Montana Telephone Systems Service Contract - Self-Employed

Description

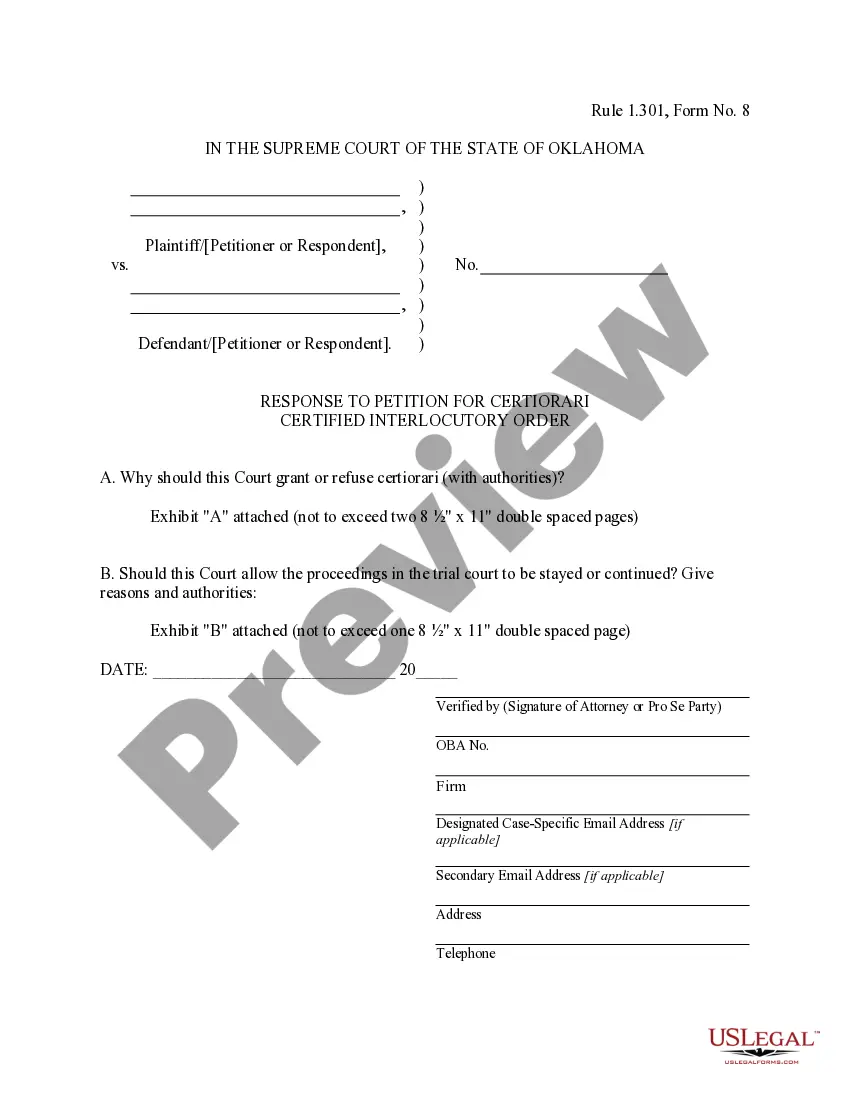

How to fill out Telephone Systems Service Contract - Self-Employed?

If you wish to finalize, obtain, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online. Take advantage of the site’s user-friendly and efficient search to locate the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Montana Telephone Systems Service Agreement - Self-Employed in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Montana Telephone Systems Service Agreement - Self-Employed. You can also access forms you previously saved in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of the legal form template. Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to register for the account. Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction. Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Montana Telephone Systems Service Agreement - Self-Employed.

- Every legal document template you purchase is yours permanently.

- You will have access to every form you saved in your account.

- Select the My documents section and choose a form to print or download again.

- Be proactive and download, and print the Montana Telephone Systems Service Agreement - Self-Employed with US Legal Forms.

- There are millions of professional and state-specific forms you can use for your business or personal needs.

Form popularity

FAQ

To become an independent contractor in Montana, start by researching the specific requirements for your industry. You must register your business with the state and obtain any necessary licenses. Joining platforms like uslegalforms can help you navigate the legal documents required, such as a Montana Telephone Systems Service Contract - Self-Employed, which is crucial for establishing trust and clarity with your clients. Finally, focus on building a network to attract clients and showcase your skills.

Establishing yourself as an independent contractor involves several important steps. First, you need to create a business plan that defines your services and target market. Next, register your business with the state of Montana, and obtain any required licenses. Utilizing a Montana Telephone Systems Service Contract - Self-Employed can help you formalize your agreements with clients, ensuring clarity and professionalism in your services.

To be an independent contractor, you need to have a clear understanding of your business structure and responsibilities. You must obtain the necessary licenses and permits specific to your trade in Montana. Additionally, you should have a solid contract, such as a Montana Telephone Systems Service Contract - Self-Employed, that outlines your services and payment terms. Establishing good financial practices, including tracking your income and expenses, is also essential.

To file taxes for your LLC in Montana, you will need to gather essential documents such as your income statements, expense records, and any relevant tax forms. If you operate under a Montana Telephone Systems Service Contract - Self-Employed, ensure you also include self-employment income and expenses. You might consider using a tax filing service like US Legal Forms to simplify the process and ensure accuracy. Proper filing helps you maintain compliance and avoid unnecessary issues.

After taxes, the amount you keep from a $100,000 income can vary based on your deductions, credits, and self-employment tax obligations. Typically, after federal and state taxes, you might expect to retain around $70,000 to $80,000 from your income under a Montana Telephone Systems Service Contract - Self-Employed. Using tax estimation tools can provide a more accurate figure tailored to your situation. Planning ahead can help you maximize your earnings.

No, the self-employment tax is not 30%. The standard rate is 15.3%, which covers Social Security and Medicare contributions. If you work under a Montana Telephone Systems Service Contract - Self-Employed, it's crucial to know that this tax rate can feel high, but it supports your future benefits. Always verify current tax rates to ensure you are budgeting correctly.

The self-employment tax rate is currently 15.3%, which includes both Social Security and Medicare taxes. For individuals operating under a Montana Telephone Systems Service Contract - Self-Employed, this rate applies to your net earnings. Understanding how this tax works allows you to plan your finances better. Consulting with a tax professional can provide clarity on how much you might owe.

Self-employment taxes are triggered when your net earnings from self-employment exceed a certain threshold, which is typically $400. If you earn this amount or more through your Montana Telephone Systems Service Contract - Self-Employed, you must report it on your tax return. Additionally, income from freelance work, side businesses, or contract work can also trigger these taxes. Being proactive about tax responsibilities helps you avoid penalties.

To be an independent contractor in Montana, you need a clear business plan and the necessary permits to operate legally. Additionally, understanding the Montana Telephone Systems Service Contract - Self-Employed is crucial for compliance. You should also prepare a portfolio of your work and establish a network of potential clients. Lastly, consider utilizing platforms like uslegalforms to access essential legal documents and resources.

The basic requirement of being an independent contractor is to provide services to clients under a contractual agreement. Your work should be performed independently, and you should have control over how you complete tasks. As you navigate your role, ensure that you meet the standards outlined in the Montana Telephone Systems Service Contract - Self-Employed. This will help establish your credibility and professionalism.