Guam Direction For Payment of Royalty to Trustee by Royalty Owners

Description

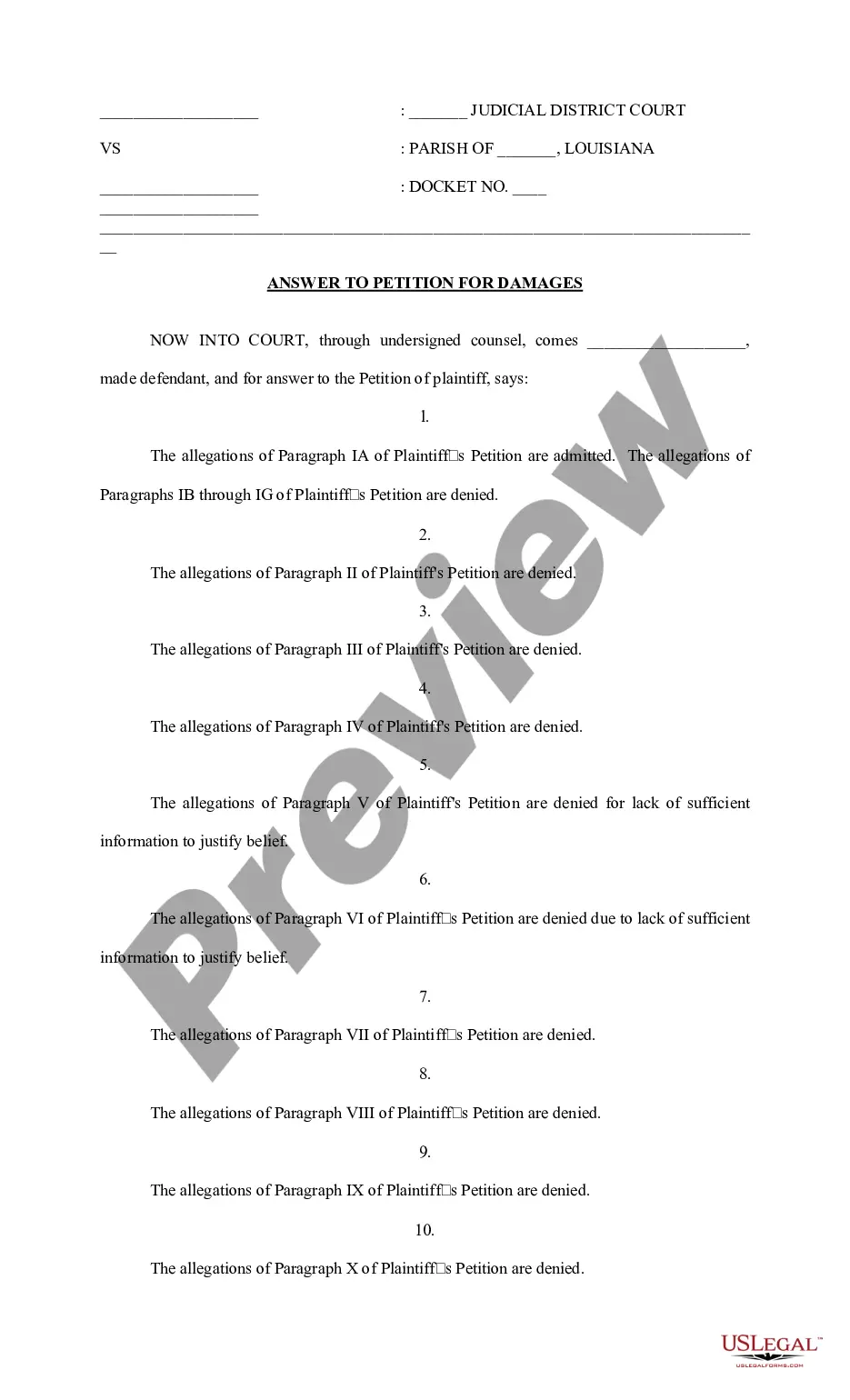

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

If you want to full, acquire, or printing authorized record layouts, use US Legal Forms, the biggest assortment of authorized types, which can be found on-line. Take advantage of the site`s simple and easy practical lookup to get the files you need. Different layouts for organization and specific reasons are categorized by categories and states, or key phrases. Use US Legal Forms to get the Guam Direction For Payment of Royalty to Trustee by Royalty Owners in a number of mouse clicks.

In case you are currently a US Legal Forms consumer, log in to the account and click on the Acquire button to find the Guam Direction For Payment of Royalty to Trustee by Royalty Owners. You can also accessibility types you earlier delivered electronically within the My Forms tab of your own account.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for your correct city/country.

- Step 2. Utilize the Review solution to look through the form`s content. Never forget about to read the information.

- Step 3. In case you are not happy with all the kind, utilize the Lookup discipline towards the top of the monitor to get other versions from the authorized kind web template.

- Step 4. After you have identified the shape you need, click the Buy now button. Opt for the pricing prepare you like and include your credentials to register for the account.

- Step 5. Process the purchase. You can utilize your charge card or PayPal account to finish the purchase.

- Step 6. Pick the structure from the authorized kind and acquire it on your gadget.

- Step 7. Comprehensive, revise and printing or sign the Guam Direction For Payment of Royalty to Trustee by Royalty Owners.

Each authorized record web template you purchase is your own for a long time. You might have acces to every single kind you delivered electronically within your acccount. Click the My Forms area and choose a kind to printing or acquire yet again.

Remain competitive and acquire, and printing the Guam Direction For Payment of Royalty to Trustee by Royalty Owners with US Legal Forms. There are many expert and condition-distinct types you can utilize for the organization or specific needs.

Form popularity

FAQ

An FFI generally means a foreign entity that is a financial institution. Foreign person. A foreign person includes a nonresident alien individual and certain foreign entities that are not U.S. persons (entities that are beneficial owners should complete Form W-8BEN-E rather than this Form W-8BEN).

Chapter 3 withholding under sections 1441-1443 generally applies a 30% statutory rate of withholding to payments of FDAP income or gains from U.S. sources but only if they are not effectively connected with a U.S. trade or business made to a payee that is a foreign person. Tax Withholding Types | Internal Revenue Service irs.gov ? individuals ? international-taxpayers irs.gov ? individuals ? international-taxpayers

The term Chapter 4 status means, with respect to a person, the person's status as a U.S. person, a specified U.S. person, a foreign individual, a participating FFI, a deemed-compliant FFI, a Model 1 FFI, an exempt beneficial owner, a nonparticipating FFI, a territory financial institution, a QI branch of a U.S. ...

8 forms are used by foreign persons or business entities to claim exempt status from certain withholdings. There are five 8 forms: 8BEN, 8BENE, 8ECI, 8EXP, and 8IMY. Form 8IMY is used by intermediaries that receive withholding payments on behalf of a foreigner or as a flowthrough entity.

Non-US individuals who receive certain types of income from US sources?such as interest, dividends, rents, royalties, and certain other types of income?need to fill out the W-8 BEN. The form is used to claim any applicable tax treaty benefits and to verify that the individual is not a US resident for tax purposes. W-8 BEN Tax Form: What It Is & Who Needs To File One | Stripe stripe.com ? resources ? more ? w-8-ben-tax-form stripe.com ? resources ? more ? w-8-ben-tax-form

Chapter 4 withholding requires a withholding agent to withhold 30% on withholdable payments made to an entity that is an FFI unless the withholding agent is able to treat the FFI as a participating FFI, deemed-compliant FFI, or exempt beneficial owner.

Chapter 4 Status (FATCA Status) This means the business is an Active Non-Financial Foreign Entity. If none of the other categories fit, Active NFFE is the best option. Your FATCA (Foreign Account Tax Compliance Act) status will determine which parts of the W8BEN-E form you fill out later. How to Fill Out & File Form W-8BEN-E - Tipalti tipalti.com ? ... tipalti.com ? ...

How Do I Fill Out Form W-8BEN? Part I ? Identification of Beneficial Owner: Line 1: Enter your name as the beneficial owner. ... Line 2: Enter your country of citizenship. ... Line 3: Enter your permanent residence/mailing address. ... Line 4: Enter your mailing address, if different. Form W-8BEN : Definition, Purpose and Instructions - Tipalti tipalti.com ? ... tipalti.com ? ...