Wisconsin Direction For Payment of Royalty to Trustee by Royalty Owners

Description

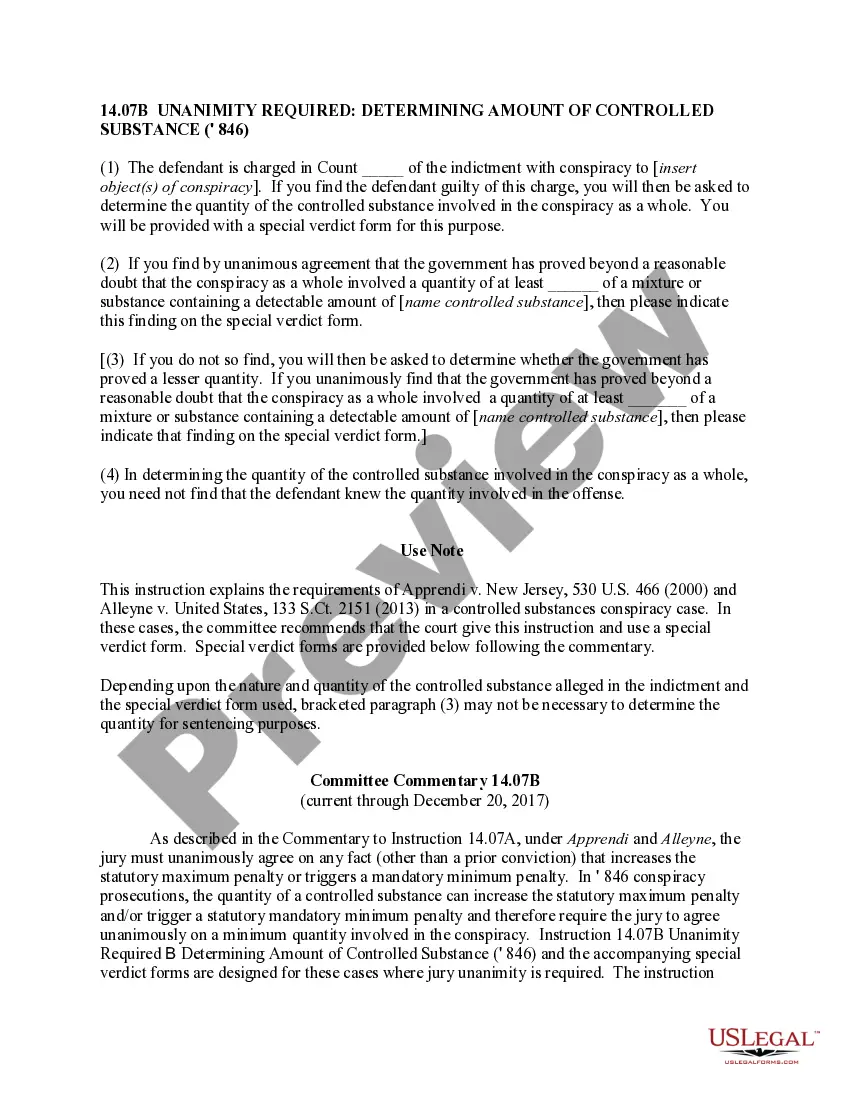

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

You are able to invest hours online looking for the legitimate document web template that fits the federal and state demands you require. US Legal Forms offers a huge number of legitimate varieties that happen to be analyzed by experts. It is simple to down load or printing the Wisconsin Direction For Payment of Royalty to Trustee by Royalty Owners from your support.

If you already possess a US Legal Forms profile, you can log in and click the Download button. Next, you can full, change, printing, or indicator the Wisconsin Direction For Payment of Royalty to Trustee by Royalty Owners. Every legitimate document web template you acquire is yours forever. To obtain one more version of any acquired develop, proceed to the My Forms tab and click the corresponding button.

Should you use the US Legal Forms website the first time, follow the basic instructions below:

- Very first, ensure that you have chosen the right document web template for your state/town of your liking. Read the develop description to make sure you have picked the right develop. If readily available, take advantage of the Review button to appear from the document web template as well.

- If you wish to discover one more model of the develop, take advantage of the Search industry to discover the web template that suits you and demands.

- When you have identified the web template you want, click on Purchase now to proceed.

- Select the rates plan you want, type in your qualifications, and register for your account on US Legal Forms.

- Full the purchase. You can use your Visa or Mastercard or PayPal profile to cover the legitimate develop.

- Select the formatting of the document and down load it for your system.

- Make adjustments for your document if possible. You are able to full, change and indicator and printing Wisconsin Direction For Payment of Royalty to Trustee by Royalty Owners.

Download and printing a huge number of document themes using the US Legal Forms website, that offers the greatest assortment of legitimate varieties. Use specialist and express-certain themes to tackle your small business or personal demands.

Form popularity

FAQ

In Wisconsin, a trust is revocable unless it specifically states it is irrevocable in the trust document. Usually a living revocable trust becomes irrevocable (not open to changes) when you die. A trust involves three parties: The settlor or grantor is you, the person who creates the trust.

Royalty income is the amount received through a licensing or rights agreement for the use of copyrighted works, influencer endorsements, intellectual property like patents, or natural resources like oil and gas properties, often including an upfront payment and ongoing earnings and payments.

Irrevocable trusts become ?active? once funded and typically avoid taxes and probate after the grantor passes away. However, if the grantor is still alive, then the trust's assets are passed to a trustee to manage, and the grantor loses the ownership of the asset, ing to Wisconsin law.

Royalty payments are tax reportable and are reported ing to the IRS instructions on the IRS Form 1099-MISC, Miscellaneous Income.

The primary difference between a will and a living trust is that assets placed in your living trust avoid probate at your death. Neither the will nor the living trust document, in and of itself, reduces estate taxes ? though both can be drafted to do this.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

(2) A trustee shall do all of the following: (a) Upon the request of a qualified beneficiary for a copy of the trust instrument, promptly furnish to the qualified beneficiary either a copy of the portions of the trust instrument relating to the interest of the qualified beneficiary or a copy of the trust instrument.

A Wisconsin living trust holds ownership of your assets while you continue to use and control them during your lifetime. After your death, the trust assets are distributed to the beneficiaries you have chosen.