Montana Accounting Agreement - Self-Employed Independent Contractor

Description

How to fill out Accounting Agreement - Self-Employed Independent Contractor?

Are you currently in a location where you require documents for either professional or personal activities almost every day? There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Montana Accounting Agreement - Self-Employed Independent Contractor, which are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Montana Accounting Agreement - Self-Employed Independent Contractor template.

You can find all the document templates you have purchased in the My documents section. You can acquire another copy of the Montana Accounting Agreement - Self-Employed Independent Contractor at any time. Simply click on the required form to download or print the template.

Utilize US Legal Forms, the most comprehensive collection of legal documents, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- Obtain the form you need and ensure it is suitable for your specific city or county.

- Utilize the Review option to examine the document.

- Verify the details to confirm you have selected the correct form.

- If the document is not what you are looking for, use the Lookup field to find a form that matches your needs and requirements.

- Once you find the correct form, click Purchase now.

- Choose your preferred pricing plan, fill in the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

To perform contractor work in the state of Montana, you will need to obtain a business license to do so. Furthermore, you will need to acquire the proper permits and additional paperwork to bid or perform contractor work in the state of Montana.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Montana law requires construction contractors with employees, corporations or manager-managed limited liability companies in the construction industry to register, which is the same as a license.

General contractors, including handymen, are not required to hold a license to work in Montana. However, if you have employees, you will be required to register with the Department of Labor and Industry, Contractor Registration Unit. To register, you must show proof of workers' compensation insurance.

A worker must be:Engaged in their own independently established business, occupation, trade, or profession. Covered under a self-elected workers' compensation insurance policy or obtain an Independent Contractor Exemption Certificate (ICEC).

The fee for a contractor registration application is $70, and the independent contractor registration fee is $125. Neither of these registrations requires work experience or a written exam.

Independent contractor's licensesFirst, prove you independently own a business.Get a Montana Tax Identification Number with the Montana Department of Revenue.Then fill out an independent contractor exemption certification.Fill out and mail in the application form.

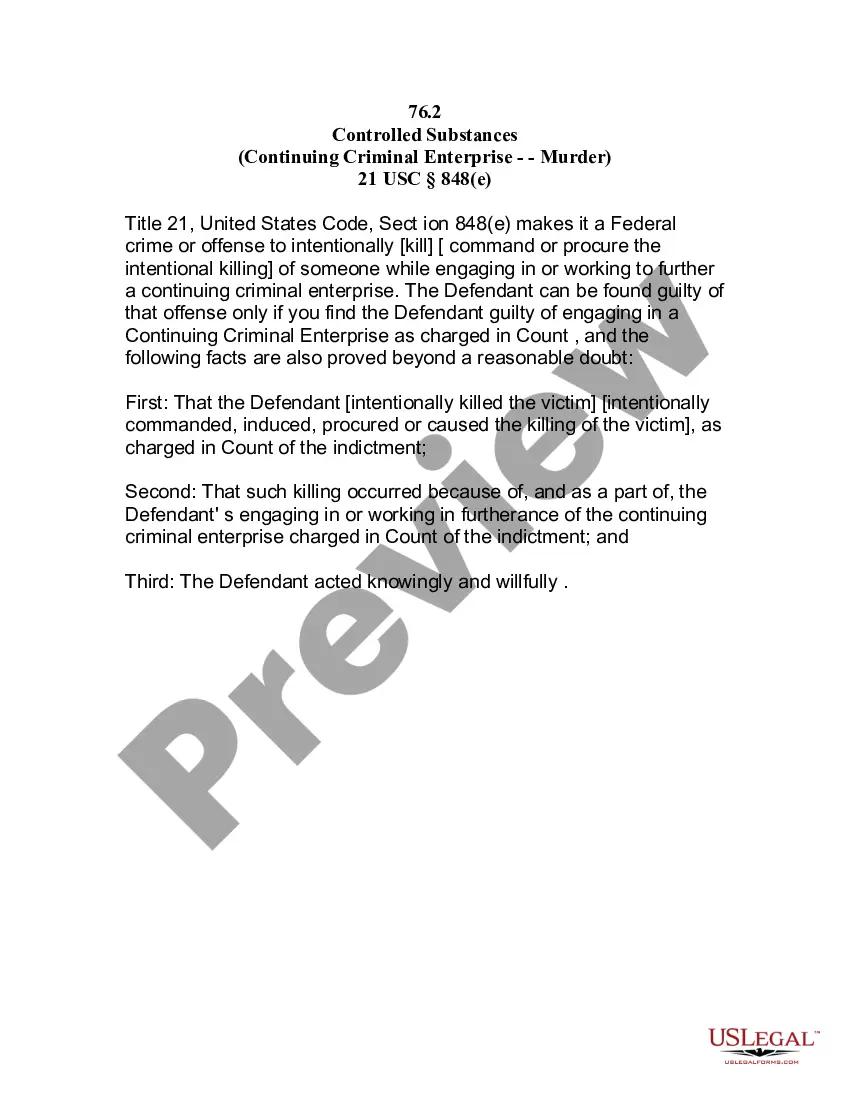

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?