Montana Runner Agreement - Self-Employed Independent Contractor

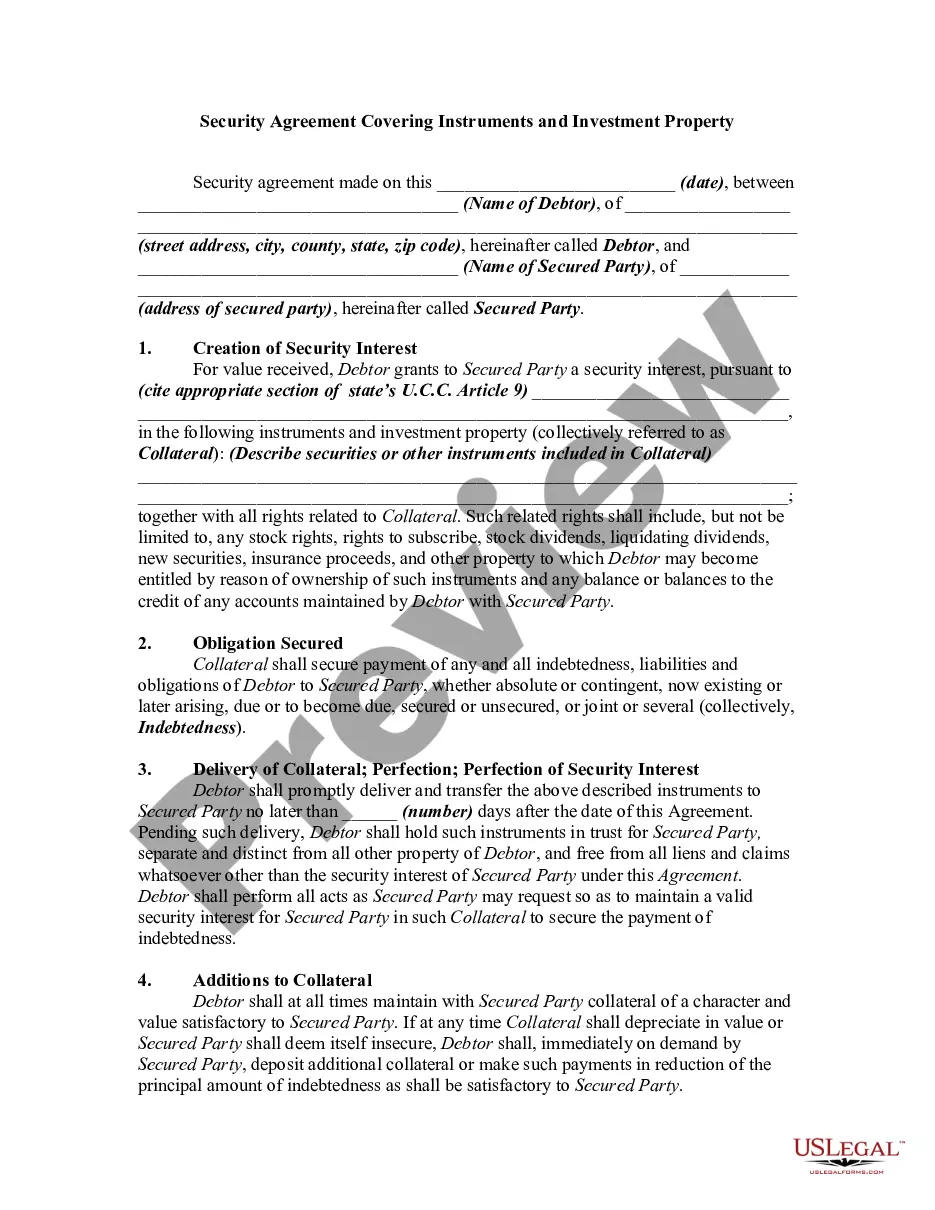

Description

How to fill out Runner Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal document templates for you to download or print.

By using the website, you can locate thousands of templates for business and personal purposes, organized by type, claims, or keywords. You can easily find the most recent versions of documents like the Montana Runner Agreement - Self-Employed Independent Contractor within moments.

If you're a member, Log In to access the Montana Runner Agreement - Self-Employed Independent Contractor from your US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded documents in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the document onto your device. Make amendments. Complete, edit, print, and sign the downloaded Montana Runner Agreement - Self-Employed Independent Contractor.

- Ensure you have selected the appropriate document for your area/region.

- Click the Review button to examine the content of the form.

- Check the form outline to confirm that you have selected the correct document.

- If the document does not meet your needs, use the Search field at the top of the page to find one that does.

- Once you are satisfied with the document, confirm your selection by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

The 2-year rule refers to how long independent contractors should retain their records, including agreements and invoices. This period is critical for tax purposes and ensures you have documentation in case of audits or disputes. By utilizing the Montana Runner Agreement - Self-Employed Independent Contractor, you establish a clear record of your agreements, which can help you maintain compliance during this timeframe.

In general, independent contractors who are sole proprietors are to be reported to the EDD.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Self Employed, Contractors, and other individuals may qualify for Pandemic Unemployment Assistance (PUA). The user-friendly application can be accessed by going to mtpua.mt.gov and clicking on Apply for Pandemic Unemployment Assistance or by clicking on the blue button below.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

To perform contractor work in the state of Montana, you will need to obtain a business license to do so. Furthermore, you will need to acquire the proper permits and additional paperwork to bid or perform contractor work in the state of Montana.

What is an independent contractor? (b) is engaged in an independently established trade, occupation, profession or business. Additionally, an independent contractor must obtain either an independent contractor exemption certificate or self-elected coverage under a Montana workers' compensation insurance policy.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.