Iowa Registration Statement

Description

How to fill out Registration Statement?

Are you currently in a position where you require documentation for various business or specific purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't easy.

US Legal Forms offers thousands of form templates, such as the Iowa Registration Statement, which can be drafted to comply with federal and state regulations.

Once you locate the appropriate form, click Get now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Iowa Registration Statement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/region.

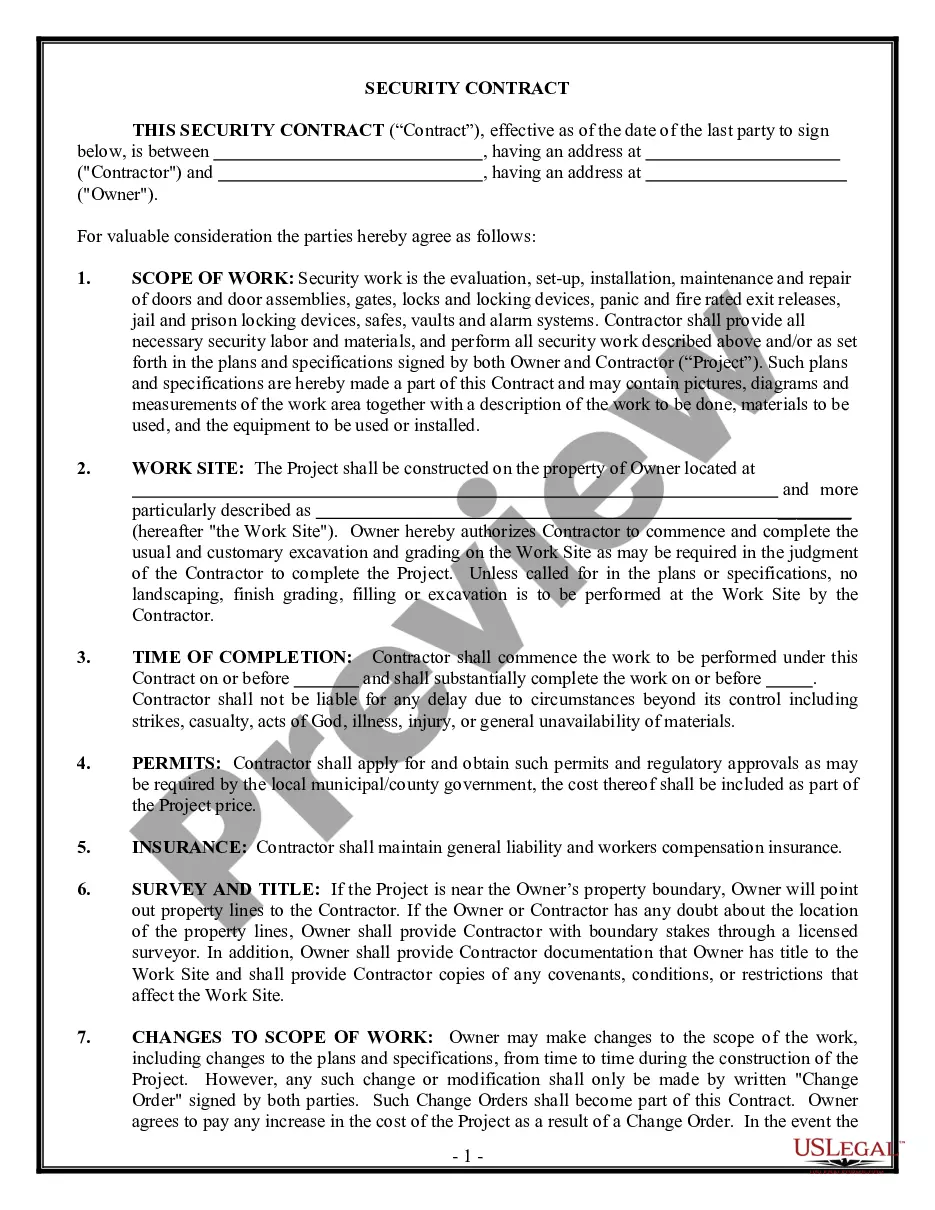

- Utilize the Preview button to examine the form.

- Read the description to confirm you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the document that fits your needs.

Form popularity

FAQ

In Iowa, your business must have a registered agent to receive and handle important legal documents on its behalf. It is possible to act as your own agent or appoint someone within the LLC to fulfill this role, provided you or the person is at least 18 and an Iowa resident.

A Biennial Report in Iowa is a regular filing that your entity must file every two years with the Secretary of State's Office. The year in which you file your Biennial Report will depend on the structure of your business entity.

If you want to start a sole proprietorship in Iowa, you will register with your county recorder's office. If you want to register as another type of business entity (example: Domestic LLC), you will register with the Iowa Secretary of State's office.

All businesses registered with the state must appoint a registered agent. The Iowa Secretary of State will reject your filing if you do not appoint one. So that the state and the general public have a reliable way to deliver to your Iowa business legal notices and other types of official mail.

Breadcrumb Go to govconnect.iowa.gov. Log in to your GovConnectIowa account. Click Register a New Business to get started. Follow the prompts on the screens to complete the business registration. Once the New Business Registration has been submitted, a confirmation number will appear on the screen.

Iowa LLC Cost. To form an LLC in Iowa, you'll start out by paying $50 to register your business with the Secretary of State. After that, you'll need to pay $30-45 dollars every two years to file your LLC's biennial report.

If an event has occurred to cause the dissolution of your Iowa LLC, you simply submit a Statement of Dissolution to the Iowa Secretary of State, Business Services Division (SOS). There is no SOS form for dissolving your Iowa LLC. The statement just needs to include the name of the company and that it is dissolved.

#1: Choose a Name For Your Iowa LLC. #2: Choose an Iowa Registered Agent. #3: File Your Iowa LLC Certificate of Organization. #4: Create Your Operating Agreement.