Montana Collections Agreement - Self-Employed Independent Contractor

Description

How to fill out Collections Agreement - Self-Employed Independent Contractor?

If you desire to finalize, acquire, or print valid document templates, utilize US Legal Forms, the finest assortment of legal forms, that are accessible online.

Capitalize on the site's simple and straightforward search to find the documents you require. A variety of templates for commercial and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to obtain the Montana Collections Agreement - Self-Employed Independent Contractor in just a few clicks.

Every legal document format you purchase is yours permanently. You have access to every form you acquired within your account. Click on the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the Montana Collections Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are currently a US Legal Forms user, sign in to your account and click the Download button to retrieve the Montana Collections Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for your specific city/state.

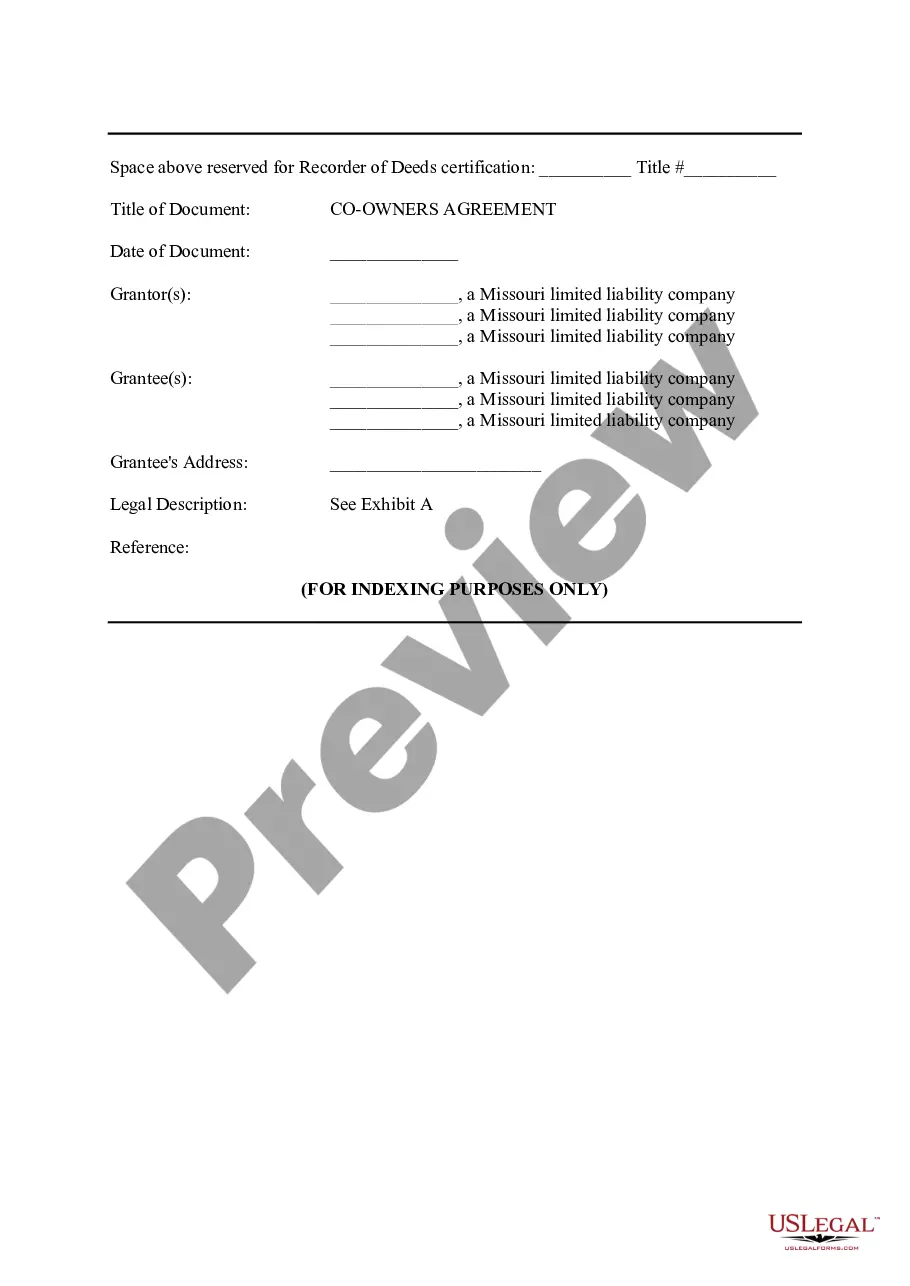

- Step 2. Use the Preview option to review the form’s content. Always remember to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other types in the legal form format.

- Step 4. Once you have located the form you need, click the Get now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Montana Collections Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Legal requirements for self-employed independent contractors include proper registration and adherence to tax obligations. They must also maintain their business licenses and comply with any local regulations. A Montana Collections Agreement can help establish clear payment terms and protect contractor rights. For comprehensive guidance, consider utilizing US Legal Forms to streamline your setup as an independent contractor.

Writing a contract as a self-employed independent contractor requires clarity and structure. Start by defining the scope of work, outlining project deliverables, and specifying payment terms. Incorporate a Montana Collections Agreement to ensure legal compliance and fair collection processes. Using US Legal Forms can simplify this process, as it provides templates tailored for independent contractors.

In Montana, anyone who qualifies as an independent contractor may need an Independent Contractor Exemption Certificate (ICEC) to perform work legally. This includes individuals and businesses that provide services without being classified as employees. If you fit this description, ensure that your Montana Collections Agreement - Self-Employed Independent Contractor aligns with the necessary legal requirements to safeguard your work.

The primary difference between an independent contractor and an employee in Montana lies in control and independence. Employees typically work under supervision and receive benefits like health insurance, while independent contractors enjoy more freedom in how they perform their work. This fundamental difference can impact tax obligations and liability, making the Montana Collections Agreement - Self-Employed Independent Contractor a vital document for clarity.

Determining whether a worker is an employee or an independent contractor relies on various factors, such as the level of control exerted by the employer and the nature of the working relationship. Key indicators include how much independence a worker has in completing tasks and whether the work is integral to the business. It's essential to clearly outline these distinctions within a Montana Collections Agreement - Self-Employed Independent Contractor to ensure compliance and protect your interests.

A basic independent contractor agreement outlines the terms of work between a contractor and a client. It typically includes details such as the scope of work, payment terms, timelines, and responsibilities of both parties. Crafting a well-defined Montana Collections Agreement - Self-Employed Independent Contractor helps protect both the contractor and the client by clarifying expectations and reducing potential misunderstandings.

In Montana, an independent contractor is a self-employed individual who provides services to clients or businesses under specific terms outlined in a contract. Unlike employees, independent contractors operate with greater autonomy and flexibility in how they complete their work. Understanding this definition is essential for creating a solid Montana Collections Agreement - Self-Employed Independent Contractor that accurately reflects your working arrangement.

Yes, it is possible for someone to be labeled an independent contractor yet function as an employee. The distinction often depends on the level of control and independence in the work relationship. If an employer controls how, when, and where the work is done, the individual may actually be classified as an employee despite the independent contractor label. Understanding these differences is crucial, especially when drafting a Montana Collections Agreement - Self-Employed Independent Contractor.

Creating an independent contractor agreement involves outlining the scope of work, payment terms, and length of the contract. Start by defining the services you will provide and include important details like deadlines and deliverables. Utilizing a Montana Collections Agreement - Self-Employed Independent Contractor template can simplify this process, ensuring you cover all necessary aspects for a professional and legally binding agreement. This saves time and helps you focus on your work.

To write an independent contractor agreement, begin with a clear title, such as 'Montana Collections Agreement - Self-Employed Independent Contractor.' Include sections for parties' information, project descriptions, payment terms, and termination conditions. Using a platform like US Legal Forms can streamline this process by providing templates and guidance to ensure you cover all necessary legal aspects.