Montana Farm Hand Services Contract - Self-Employed

Description

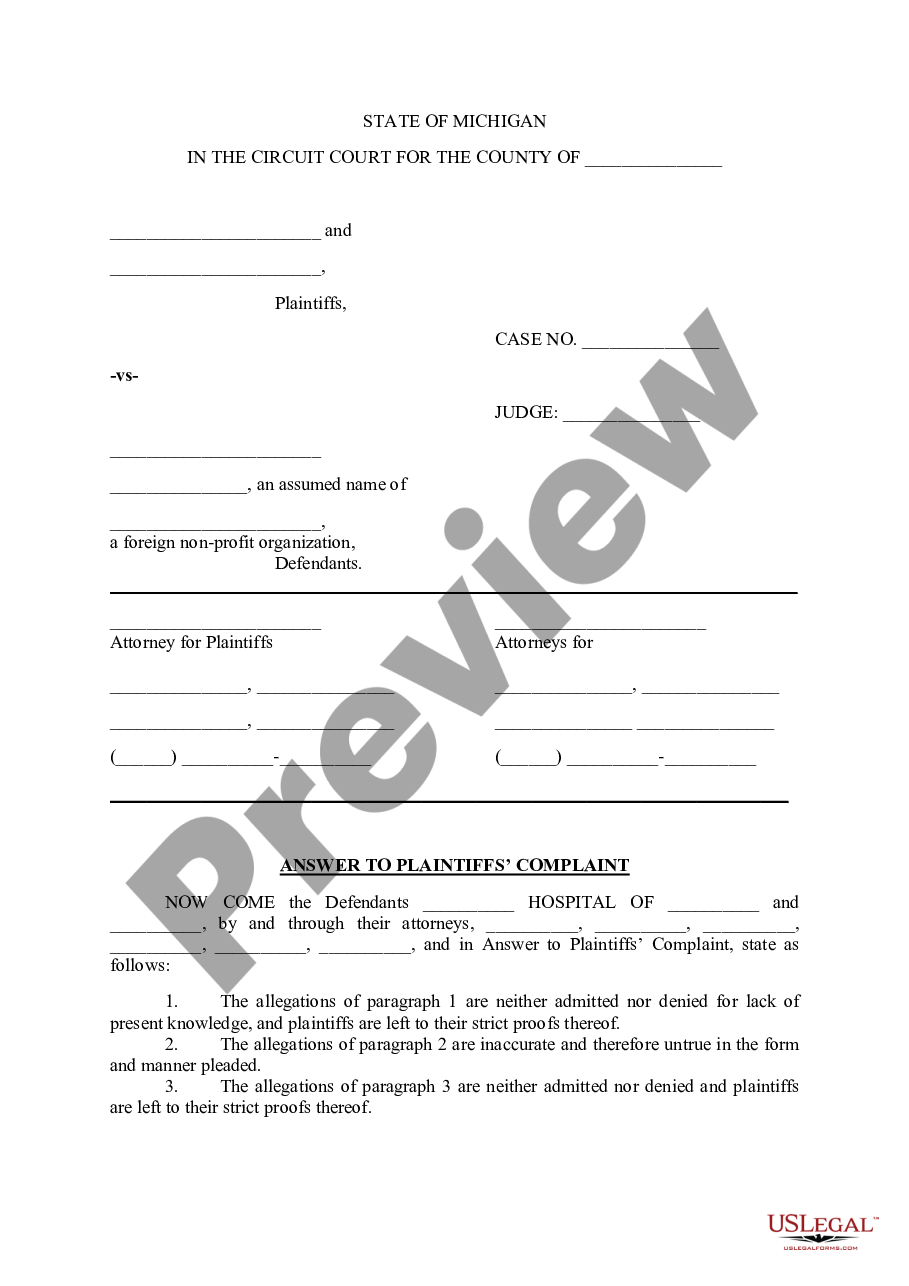

How to fill out Farm Hand Services Contract - Self-Employed?

Selecting the appropriate authorized document template can be quite a challenge. Clearly, there are numerous templates accessible online, but how do you locate the legal form you need? Use the US Legal Forms website. The service offers a vast array of templates, such as the Montana Farm Hand Services Contract - Self-Employed, which can be utilized for business and personal purposes. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Montana Farm Hand Services Contract - Self-Employed. Use your account to access the legal forms you may have purchased previously. Navigate to the My documents tab in your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure you have selected the correct form for your city/region. You can review the document using the Preview button and examine the form description to confirm it is the right one for you. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are certain that the form is suitable, click the Get now button to acquire the form. Choose the pricing plan you prefer and enter the necessary details. Create your account and pay for the order using your PayPal account or credit card. Select the document format and download the legal document template to your system. Complete, modify, print, and sign the received Montana Farm Hand Services Contract - Self-Employed. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Use the service to obtain professionally-crafted paperwork that adheres to state requirements.

Form popularity

FAQ

The self-employment tax rate in Montana is 15.3%, which consists of both Social Security and Medicare taxes. As a self-employed individual, you calculate this tax on your net earnings. When working under a Montana Farm Hand Services Contract - Self-Employed, it's vital to factor in these taxes as you budget for your annual income.

Self-employment taxes are triggered when your net earnings from self-employment reach $400 or more during the year. This includes income received from a Montana Farm Hand Services Contract - Self-Employed. Staying informed about what constitutes self-employment income will help you manage your taxes effectively.

Self-employment tax in Montana is generally calculated based on your net earnings from self-employment. This tax rate is currently 15.3%, combining Social Security and Medicare taxes. When you enter into a Montana Farm Hand Services Contract - Self-Employed, understanding this tax is crucial for your financial planning.

The amount you take home after taxes in Montana can vary based on your deductions and tax situation. However, on a gross income of $100,000, you might expect to keep around $70,000 to $75,000 after federal and state taxes. It is essential to consult a tax professional to understand your specific circumstances, especially when considering a Montana Farm Hand Services Contract - Self-Employed.

Establishing yourself as an independent contractor involves several key steps. First, identify your niche, such as Montana Farm Hand Services, and market your skills to potential clients. Additionally, create a solid Montana Farm Hand Services Contract - Self-Employed that protects your interests and defines your working relationship. Utilizing platforms like uslegalforms can help you generate these contracts effectively.

To become an independent contractor in Montana, you need to understand the requirements for self-employment. Start by registering your business with the appropriate state agencies. Next, you should create a detailed Montana Farm Hand Services Contract - Self-Employed to outline your terms of service. This document will help you clarify your responsibilities and rights as a contractor.

Amount and Duration of Unemployment Benefits in MontanaThe maximum weekly benefit amount is currently $552; the minimum amount is currently $163. You may receive benefits for a maximum of 28 weeks. (In times of very high unemployment, additional weeks of benefits may be available.)

To be eligible for this benefit program, you must a resident of Montana and meet all of the following: Unemployed, and. Worked in Montana during the past 12 months (this period may be longer in some cases), and. Earned a minimum amount of wages determined by Montana guidelines, and.

On June 27, 2021 Montana ended COVID-19 related unemployment benefits. You may still qualify for regular unemployment benefits.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.