Montana Auditor Agreement - Self-Employed Independent Contractor

Description

How to fill out Auditor Agreement - Self-Employed Independent Contractor?

You might spend hours online trying to find the legal document template that satisfies the state and federal requirements you need.

US Legal Forms offers a plethora of legal forms that can be reviewed by professionals.

You can easily download or print the Montana Auditor Agreement - Self-Employed Independent Contractor from the service.

If available, use the Examine option to look through the document template as well. If you wish to find another version of the form, use the Search field to locate the template that meets your needs and requirements. Once you have found the template you desire, click Get now to proceed. Select the pricing plan you want, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Find the format of the document and download it to your device. Make edits to the document if necessary. You may complete, modify, sign, and print the Montana Auditor Agreement - Self-Employed Independent Contractor. Obtain and print numerous document templates using the US Legal Forms site, which provides the largest selection of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you already have a US Legal Forms account, you may sign in and click the Obtain option.

- Next, you can complete, modify, print, or sign the Montana Auditor Agreement - Self-Employed Independent Contractor.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of the acquired form, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town of your choice.

- Review the form details to confirm you have chosen the right form.

Form popularity

FAQ

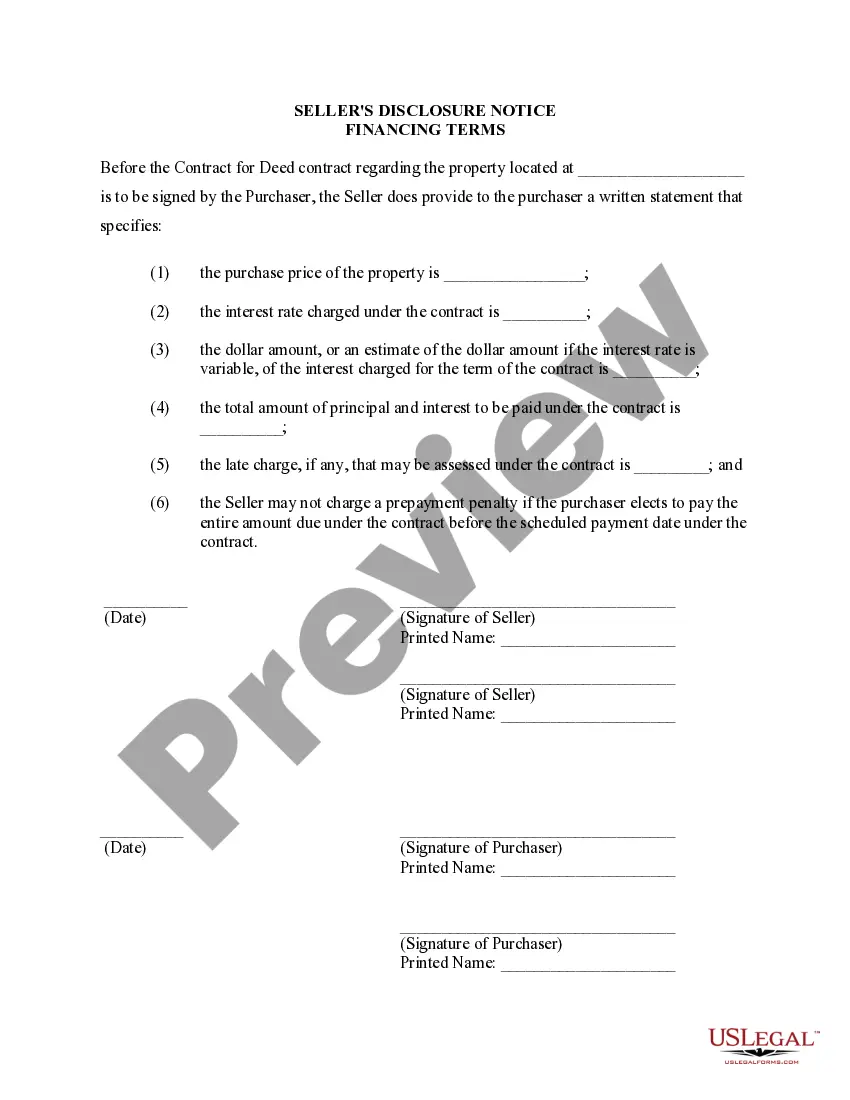

Writing a contract as a self-employed independent contractor involves several key steps. First, clearly define the services you will provide as outlined in the Montana Auditor Agreement - Self-Employed Independent Contractor. Next, outline payment terms, including rates and schedules. Finally, include termination clauses, confidentiality agreements, and any other essential terms. Utilizing platforms like USLegalForms can simplify this process, providing templates and guidance that ensure your contract meets legal standards.

Creating an independent contractor agreement begins with defining the scope of work, which outlines the tasks the contractor will perform. Next, include payment terms, specifying the rate and schedule for compensation. It’s also essential to clarify the relationship, noting that the agreement is a Montana Auditor Agreement - Self-Employed Independent Contractor. Lastly, consider using a platform like US Legal Forms to ensure you have a comprehensive and legally sound agreement.

Filling out an independent contractor agreement is straightforward if you follow a clear structure. Start by entering the names and contact information of both parties, and then define the scope of work, payment terms, and deadlines. Lastly, ensure that both parties sign the agreement to make it legally binding. Using a reliable source like US Legal Forms can simplify this process, especially when focusing on a Montana Auditor Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor form requires you to provide accurate and relevant information about the contractor and the services to be performed. Include their personal details, business information, and any relevant identification numbers. Ensure that the form reflects all discussed terms to maintain clarity. For added convenience, check out the US Legal Forms platform for step-by-step guidance and templates aligned with your Montana Auditor Agreement - Self-Employed Independent Contractor needs.

Writing an independent contractor agreement involves outlining the terms of the working relationship between you and the contractor. Start by including essential details such as the scope of work, payment terms, and duration of the engagement. Be clear and direct in your wording to avoid misunderstandings. You can use the US Legal Forms platform to find templates, specifically tailored for a Montana Auditor Agreement - Self-Employed Independent Contractor.

To register as an independent contractor in Montana, you need to complete the application process through the Montana Department of Labor and Industry. It involves filling out the necessary forms and submitting proof of your business activities. Don't forget that registering is essential for receiving benefits and maintaining compliance. Once registered, you can easily manage your Montana Auditor Agreement - Self-Employed Independent Contractor status.

Yes, independent contractors can be audited, especially if their income reports show inconsistencies. When you operate under a Montana Auditor Agreement - Self-Employed Independent Contractor, it’s crucial to maintain accurate records to avoid potential issues. Audits serve to ensure compliance with tax regulations and validate your income claims. By using a reliable platform like US Legal Forms, you can find tools and resources to help you efficiently manage your agreements and support your self-employment.