Montana Carrier Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carrier Services Contract - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can discover numerous forms for business and personal uses, organized by categories, states, or keywords. You can obtain the latest versions of documents such as the Montana Carrier Services Contract - Self-Employed Independent Contractor in just minutes.

If you already have an account, Log In to access the Montana Carrier Services Contract - Self-Employed Independent Contractor in the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents tab of your account.

Finalize the transaction. Use your credit card or PayPal account to complete the payment.

Select the format and download the document to your device. Edit. Complete, modify, print, and sign the downloaded Montana Carrier Services Contract - Self-Employed Independent Contractor.

Every template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

Access the Montana Carrier Services Contract - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates. Utilize numerous professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/region.

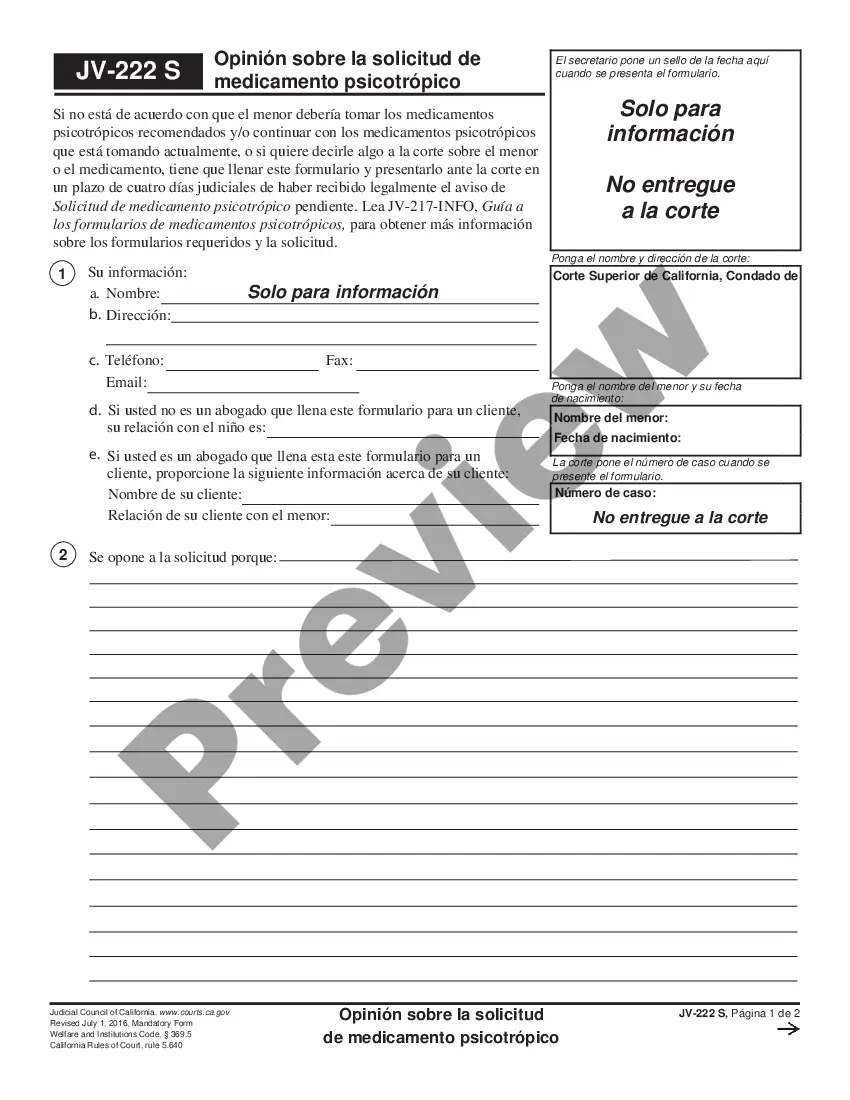

- Click on the Preview button to check the content of the form.

- Review the form summary to confirm you have chosen the appropriate document.

- If the form does not fit your needs, use the Search bar at the top of the screen to find one that does.

- Once satisfied with the document, confirm your selection by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your details to register for the account.

Form popularity

FAQ

The terms self-employed and independent contractor are often used interchangeably, but they can convey different meanings. While both indicate that you are running your own business, self-employed often emphasizes your business ownership, whereas independent contractor focuses on your working relationship with clients. Understanding the nuances can be essential when drafting a Montana Carrier Services Contract - Self-Employed Independent Contractor. Using uslegalforms can help you choose the right terminology and documentation to suit your needs.

In Montana, the primary difference lies in the level of control and oversight. Independent contractors typically maintain autonomy over their work methods and schedules, while employees usually follow the employer's directives. The Montana Carrier Services Contract - Self-Employed Independent Contractor highlights these differences, ensuring both parties understand their roles. Utilizing uslegalforms can provide you with the necessary legal framework to navigate these distinctions confidently.

Yes, an independent contractor is considered self-employed. This means that you operate your own business and have the freedom to control your work and schedule. The Montana Carrier Services Contract - Self-Employed Independent Contractor clearly outlines the responsibilities and benefits associated with this status. Partnering with a platform like uslegalforms can help clarify this distinction and provide additional resources.

The independent contractor exemption in Montana allows certain self-employed individuals to be recognized as independent contractors rather than employees. This exemption can help protect the rights of contractors while distinguishing them from traditional employees. By utilizing this exemption, those working under a Montana Carrier Services Contract - Self-Employed Independent Contractor can safeguard their status and benefits.

An independent contractor in Montana refers to an individual not classified as an employee, who provides services based on their own methods and terms. In this arrangement, independent contractors manage their own finances and often work for multiple clients. It’s crucial to understand the local laws when engaging with clients, particularly through a Montana Carrier Services Contract - Self-Employed Independent Contractor.

An independent contractor exemption allows certain workers to avoid classification as employees, which can change the level of benefits and protections afforded to them. This exemption typically allows businesses greater flexibility in managing workers while providing those workers a greater degree of independence. Understanding this exemption is essential when entering into a Montana Carrier Services Contract - Self-Employed Independent Contractor.

To get authorized as an independent contractor in the US, you typically need to register your business and obtain any necessary licenses or permits. Additionally, you should understand the requirements specific to your state, as each may have its own regulations. Using a comprehensive platform like uslegalforms can help simplify this process, especially for those seeking a Montana Carrier Services Contract - Self-Employed Independent Contractor.

The new federal rule clarifies how to classify workers as independent contractors or employees. It aims to ensure that workers receive proper rights and protections. Under this rule, individuals can more easily establish their role as a self-employed independent contractor under the Montana Carrier Services Contract.