Montana Statutory Notices Required for California Foreclosure Consultants

Description

How to fill out Statutory Notices Required For California Foreclosure Consultants?

Are you in a location where you require documentation for either business or personal reasons almost every day.

There are many legal document templates accessible online, but finding trustworthy ones is challenging.

US Legal Forms provides thousands of form templates, such as the Montana Statutory Notices Required for California Foreclosure Consultants, designed to comply with federal and state regulations.

Once you find the correct form, click Get now.

Choose your desired pricing plan, fill in the necessary information to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with US Legal Forms website and have an account, just Log In.

- After that, you can download the Montana Statutory Notices Required for California Foreclosure Consultants template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/region.

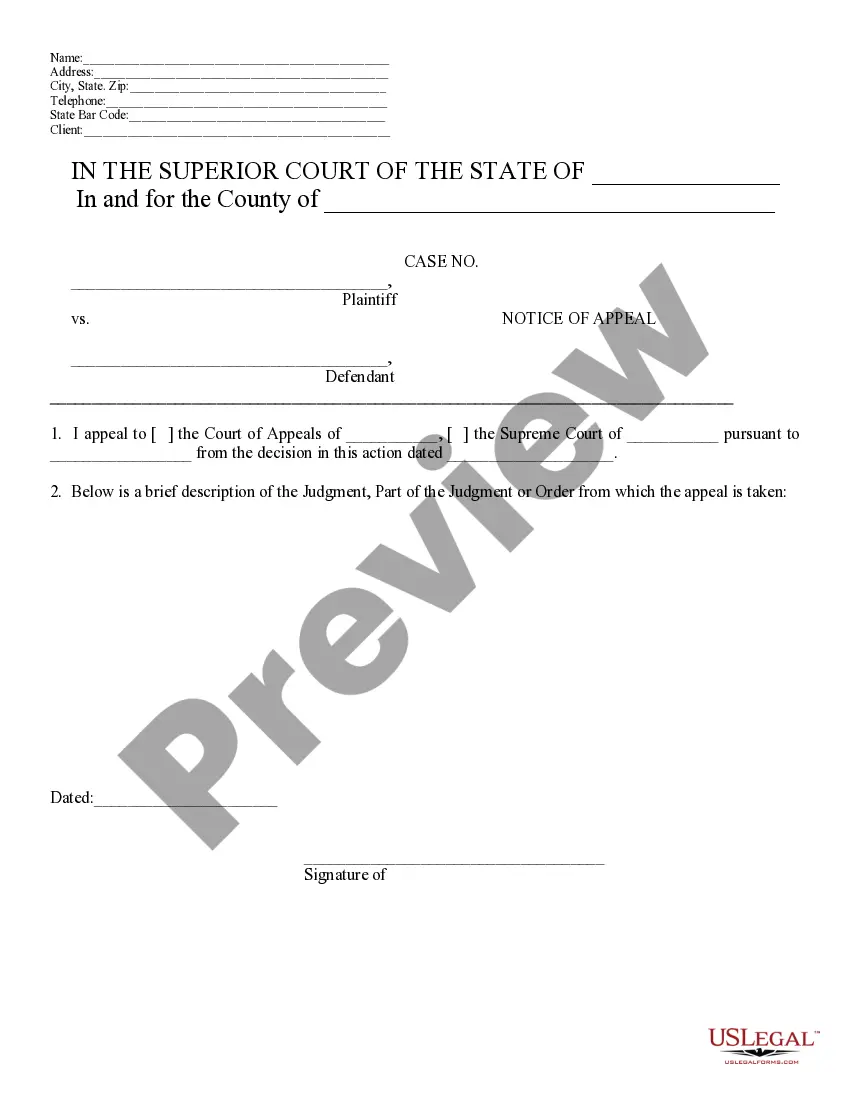

- Use the Preview button to review the form.

- Check the description to make certain you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to locate the form that meets your needs.

Form popularity

FAQ

No, Montana is not a non-judicial foreclosure state; it primarily operates under the judicial foreclosure process. This approach requires court involvement, giving borrowers an opportunity to present their case. California foreclosure consultants must stay informed about Montana statutory notices required for navigating this legal landscape effectively.

Several states require judicial foreclosure, including Montana, New York, and New Jersey, among others. In these states, the lender must go through the court system to obtain approval for foreclosure, protecting the borrower's rights. Understanding the distinctions between states is crucial for California foreclosure consultants, particularly when they deal with Montana statutory notices required for the process.

Yes, Montana is a judicial foreclosure state. This means that the lender must file a lawsuit to initiate the foreclosure process, ensuring borrowers have the opportunity to contest the foreclosure in court. The court then issues a judgment that allows the lender to proceed. California foreclosure consultants should be familiar with these Montana statutory notices required in judicial foreclosures to provide comprehensive guidance to their clients.

Foreclosure in Montana typically begins when a borrower defaults on their mortgage payments. The lender may then initiate the process by filing a Notice of Default, which is a critical Montana statutory notice required for California foreclosure consultants. This notice informs the borrower of the default and outlines steps to remedy the situation. If the issue remains unresolved, the home may be sold at a public auction, and it's essential for consultants to understand these legal requirements.

Yes, California has a statutory right of redemption, but it is limited to specific types of foreclosures, such as those initiated through the judicial process. This right allows property owners to recover their homes within a certain period post-sale. For California foreclosure consultants, understanding the nuances of the statutory right of redemption is key, especially in relation to Montana Statutory Notices Required for California Foreclosure Consultants.

In California, the statutory right of redemption applies primarily to judicial foreclosure, allowing homeowners to reclaim their property up until the property is sold at auction. However, this right does not extend to properties sold due to tax liens. California foreclosure consultants should be well-versed in these distinctions, particularly regarding Montana Statutory Notices Required for California Foreclosure Consultants.

The new law for foreclosure in California focuses on providing homeowners with options to avoid foreclosure, improving transparency in the process, and requiring lenders to perform additional outreach efforts. These changes aim to create a fair environment for homeowners facing financial hardship. California foreclosure consultants must keep up with Montana Statutory Notices Required for California Foreclosure Consultants to ensure they comply.

Statutory right of redemption allows property owners to reclaim their property after a foreclosure sale within a specified time frame. This right varies by state, and in California, it does not apply to tax sales. Knowledge of this concept is essential for California foreclosure consultants, particularly in relation to Montana Statutory Notices Required for California Foreclosure Consultants.

The 120-day delinquency rule in California mandates that lenders must wait 120 days after a borrower misses a payment before initiating foreclosure proceedings. This cooling-off period gives homeowners an opportunity to get back on track with their payments. Understanding this rule is crucial for California foreclosure consultants navigating Montana Statutory Notices Required for California Foreclosure Consultants.

In California, there is no general right of redemption for tax sales. Once a property is sold at a tax auction, the former owner loses the right to reclaim it. This is an important fact for California foreclosure consultants to understand, especially regarding Montana Statutory Notices Required for California Foreclosure Consultants, which outline procedures in more detail.