Montana Certificate of Incorporation

Description

(It is a legal document serving as a formal record of a company's formation.)"

How to fill out Certificate Of Incorporation?

Are you within a position the place you need paperwork for sometimes organization or personal purposes almost every working day? There are a variety of lawful papers templates accessible on the Internet, but getting types you can depend on is not effortless. US Legal Forms offers thousands of develop templates, like the Montana Certificate of Incorporation, that happen to be published to meet state and federal demands.

When you are previously informed about US Legal Forms site and have your account, basically log in. Next, you can acquire the Montana Certificate of Incorporation design.

Unless you come with an accounts and want to begin to use US Legal Forms, adopt these measures:

- Discover the develop you will need and make sure it is for your proper city/area.

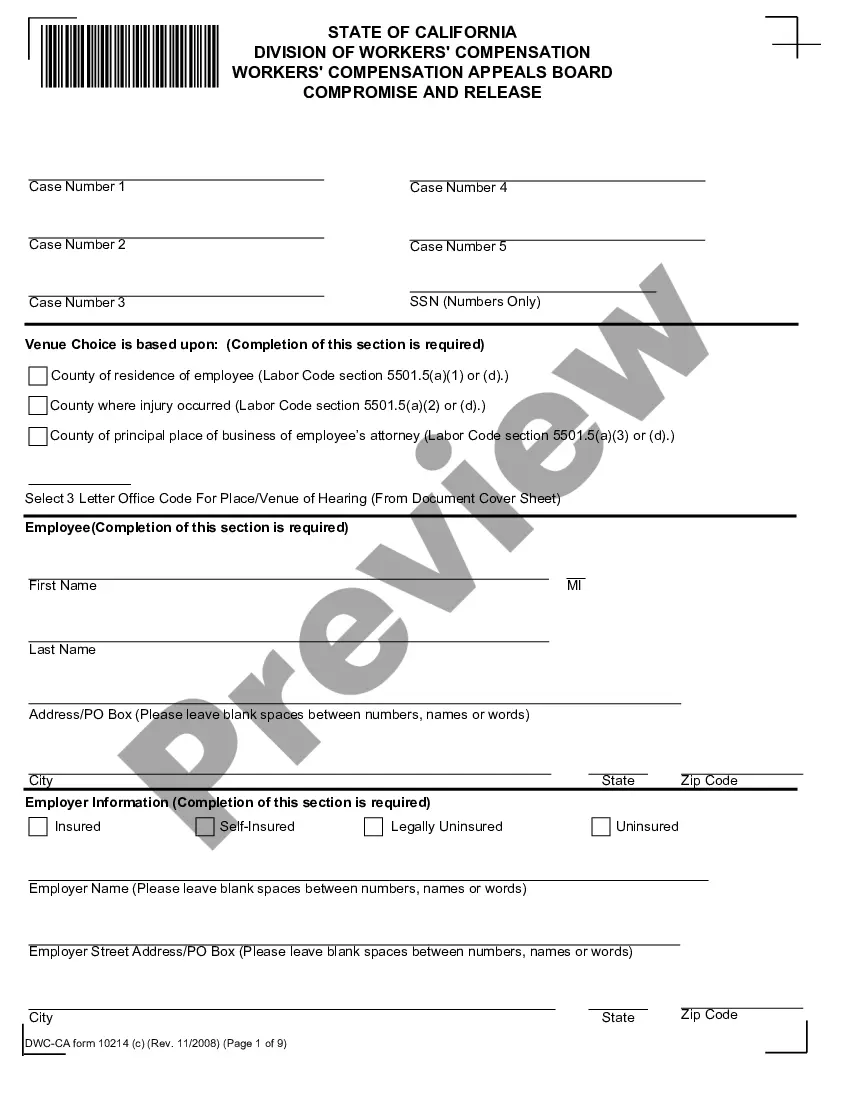

- Utilize the Review switch to analyze the shape.

- See the description to ensure that you have selected the right develop.

- When the develop is not what you`re looking for, make use of the Lookup industry to get the develop that suits you and demands.

- Once you find the proper develop, click Get now.

- Pick the pricing strategy you desire, fill in the desired details to produce your account, and pay for an order making use of your PayPal or Visa or Mastercard.

- Choose a handy data file formatting and acquire your version.

Locate all of the papers templates you may have bought in the My Forms food selection. You can aquire a additional version of Montana Certificate of Incorporation any time, if possible. Just click the necessary develop to acquire or printing the papers design.

Use US Legal Forms, by far the most comprehensive variety of lawful forms, to save time as well as prevent mistakes. The support offers expertly made lawful papers templates which you can use for a variety of purposes. Make your account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

To Register a Business with the Secretary's Office Go to the Forms section in the left side menu. Choose the applicable form. Choose Domestic forms for a Montana business. Choose Foreign forms for a business formed in another state/country that will be doing business in Montana.

A Certificate of Authority shows that you are authorized to do business in a state other than your original formation state. A Certificate of Authority is a requirement in most states. It's important to note that the name of the document can vary from state to state.

The cost to form a Montana LLC with the state is $35 to file your Articles of Organization online. If you're forming a Series LLC, you'll need to pay an additional $50 for each LLC in the series. After forming your LLC in Montana, you'll also need to pay $20 to file your annual report each year.

Starting an LLC in Montana will include the following steps: #1: Name Your Business. #2: Appoint a Registered Agent. #3: Submit Montana LLC Articles of Organization. #4: Apply for a Federal Employer Identification Number (EIN) #5: Draft an Operating Agreement.

Businesses that are incorporated in another state will typically apply for a Montana certificate of authority. Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity. Operating without a certificate of authority may result in penalties or fines.

Owners of a Montana LLC can protect their personal assets from company debts (just like a corporation), but still avoid double-taxation much like a partnership or sole-proprietorship. In addition, starting a Montana LLC won't drain your wallet.

File proper change of ownership paperwork in Montana Montana's Articles of Organization require LLCs to provide the names and addresses of their members. Thus, when you make a membership change, you have to file an Articles of Organization Amendment with the state to reflect the change.

To form a Montana corporation, you must file articles of incorporation with the Secretary of State and pay a filing fee, at which point a corporation's existence officially begins. At a minimum, the articles must include the following information: Name of the corporation. Names and addresses of incorporators.