Montana Security Agreement regarding borrowing of funds and granting of security interest in assets

Description

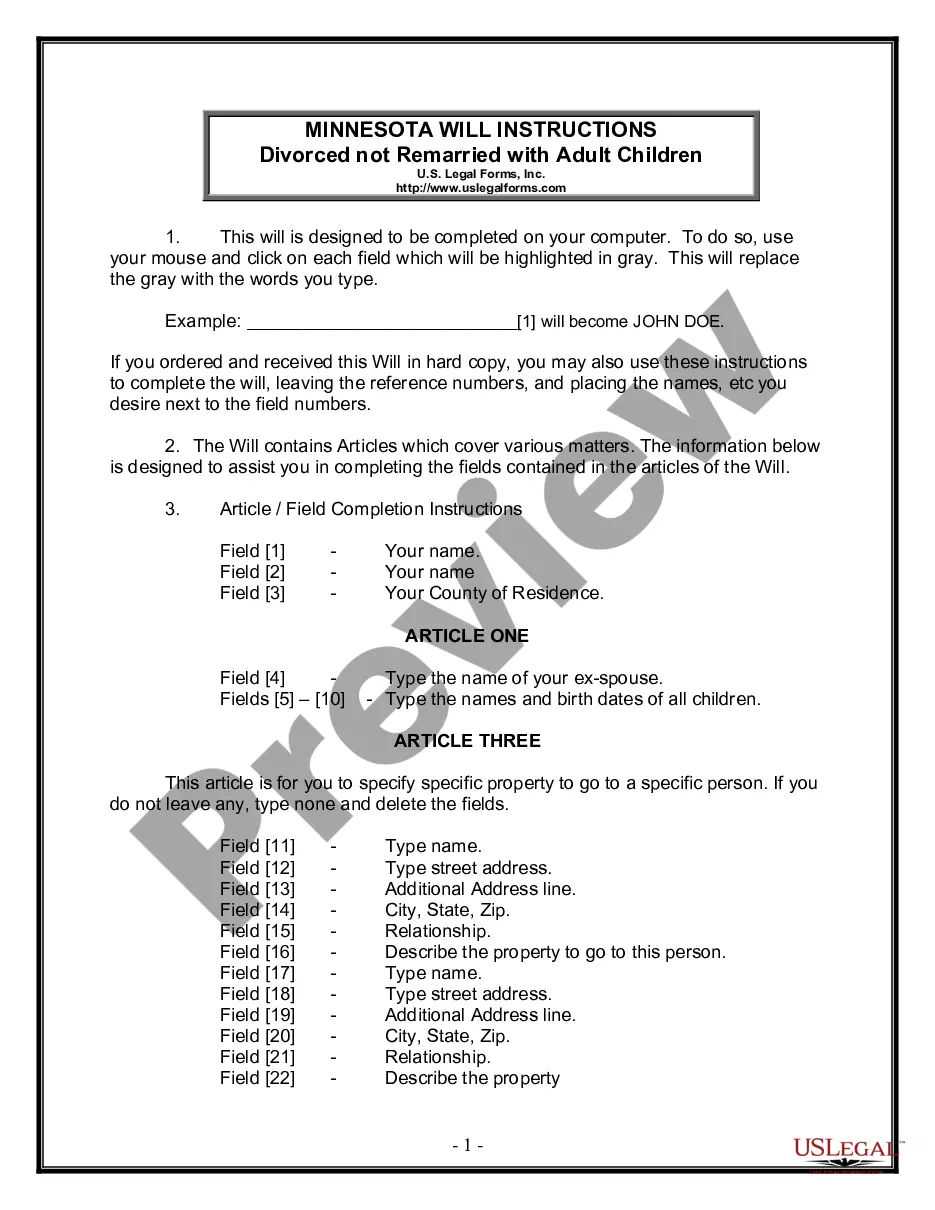

How to fill out Security Agreement Regarding Borrowing Of Funds And Granting Of Security Interest In Assets?

Discovering the right authorized record format could be a battle. Obviously, there are a lot of web templates available on the net, but how can you get the authorized kind you require? Use the US Legal Forms website. The services provides a large number of web templates, like the Montana Security Agreement regarding borrowing of funds and granting of security interest in assets, that can be used for business and private requirements. All the types are checked out by experts and meet up with federal and state demands.

When you are previously signed up, log in in your bank account and click the Down load option to find the Montana Security Agreement regarding borrowing of funds and granting of security interest in assets. Use your bank account to look from the authorized types you have purchased previously. Go to the My Forms tab of your respective bank account and obtain yet another version in the record you require.

When you are a whole new user of US Legal Forms, listed here are basic guidelines for you to stick to:

- Initial, be sure you have chosen the right kind to your metropolis/region. You can look through the form while using Review option and look at the form description to ensure it will be the best for you.

- In the event the kind does not meet up with your requirements, make use of the Seach discipline to discover the appropriate kind.

- Once you are sure that the form would work, click on the Get now option to find the kind.

- Opt for the costs program you would like and enter in the needed information and facts. Make your bank account and buy your order making use of your PayPal bank account or credit card.

- Opt for the submit format and acquire the authorized record format in your device.

- Full, modify and printing and signal the attained Montana Security Agreement regarding borrowing of funds and granting of security interest in assets.

US Legal Forms is the greatest collection of authorized types where you can discover a variety of record web templates. Use the company to acquire professionally-manufactured papers that stick to condition demands.

Form popularity

FAQ

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

Attachment of a security interest requires that the debtor have rights in the collateral, that value is given and, in most instances, that the debtor has authenticated a security agreement that describes the collateral.

Creating a security agreement Some key provisions in a security agreement include: Describing the collateral as accurately and as detailed as possible, so both the borrower and the lender agree upon the secured property. How to determine whether and when the borrower is in default under the loan.

You give the lender this right when you sign your closing forms. The document granting the security interest can be called by different names, but the most common names are "Mortgage" or "Deed of Trust."

Attachment of a security interest requires that the debtor have rights in the collateral, that value is given and, in most instances, that the debtor has authenticated a security agreement that describes the collateral.

Without both steps occurring, the lender will be unsecured. To grant a security interest in personal property, one must have a security agreement which contains (i) a statement granting the security interest and (ii) the description of the collateral.

Which of the following is NOT necessary for a security interest to attach to collateral? The debtor must authorize the filing of a financing statement. Filing an authorized financing statement is not necessary for a security interest to attach, but rather is one way to perfect a security interest.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.