This form is an overview of suggested inquiries for the due diligence team. The due diligence team will determine the risk of potential liability for violations committed by a company based upon the information gathered during these inquiries.

Montana Export Compliance Due Diligence Inquiries

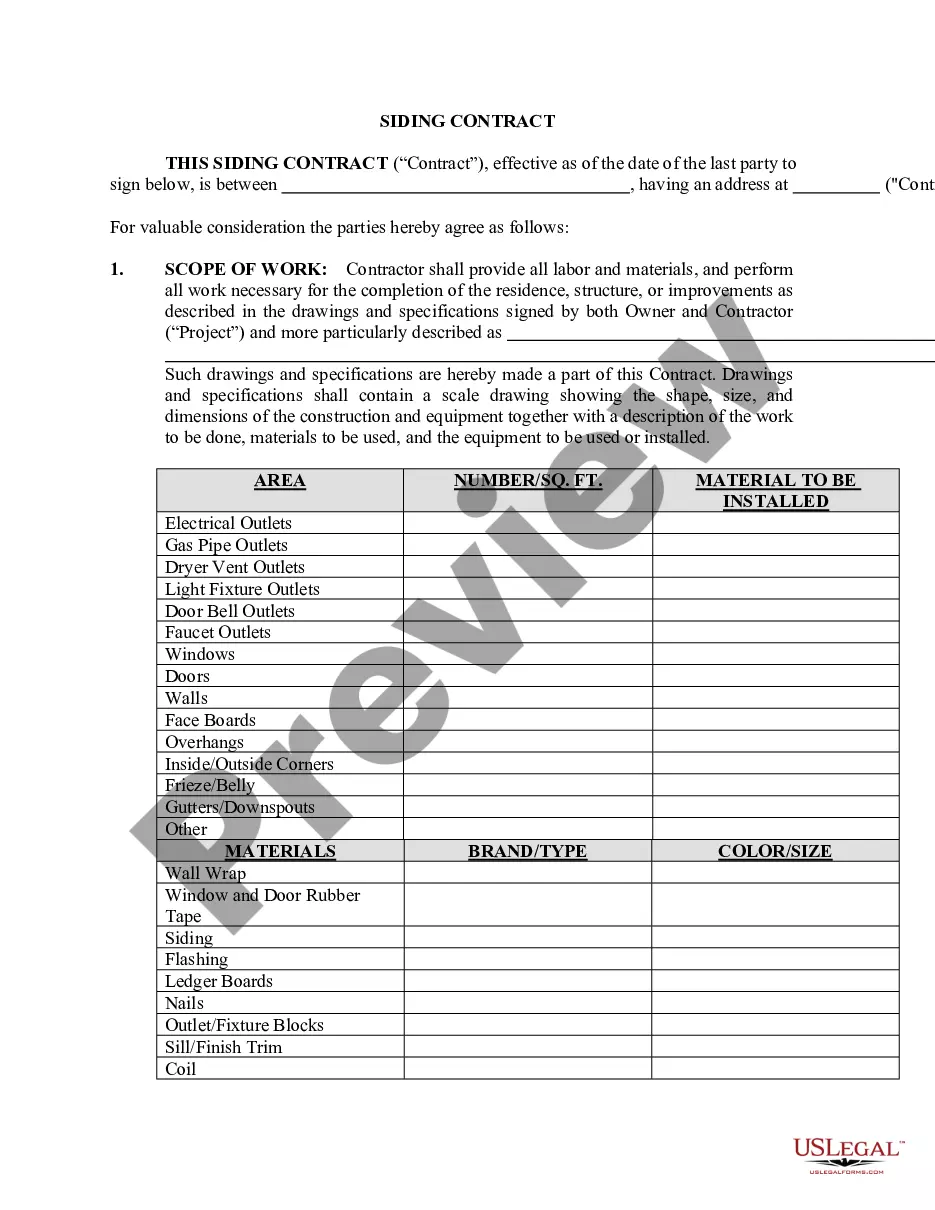

Description

How to fill out Export Compliance Due Diligence Inquiries?

If you aim to be thorough, acquire, or generate legal document templates, utilize US Legal Forms, the largest collection of legal documents accessible on the Web.

Make the most of the site's simple and convenient search to find the documents you require.

An assortment of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the necessary form, click the Get now button. Select your preferred pricing plan and input your details to create an account.

Step 5. Complete the transaction. You can use your Visa, Mastercard, or PayPal account to finalize the purchase.

- Utilize US Legal Forms to access the Montana Export Compliance Due Diligence Inquiries with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to acquire the Montana Export Compliance Due Diligence Inquiries.

- You can also retrieve documents you previously acquired within the My documents section of your account.

- If this is your first time using US Legal Forms, adhere to the steps below.

- Step 1. Confirm you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to discover alternative versions of the legal document template.

Form popularity

FAQ

Due diligence is a cornerstone of effective compliance programs, ensuring that companies stay informed about applicable regulations and their obligations. It involves continuous monitoring and reassessment to adapt to changing legal landscapes. In the context of Montana Export Compliance Due Diligence Inquiries, implementing strong due diligence practices helps organizations build a robust compliance framework. USLegalForms offers resources to support ongoing compliance efforts and simplify due diligence processes.

Due care and due diligence play vital roles in regulatory compliance by ensuring that businesses take the necessary steps to comply with legal standards. Due care demonstrates a commitment to following established procedures, while due diligence reflects thorough investigation and assessment of compliance factors. Particularly in the sphere of Montana Export Compliance Due Diligence Inquiries, both elements work together to protect companies from legal repercussions. Leveraging tools from USLegalForms can aid in achieving compliance.

The main purpose of due diligence is to ensure that businesses comply with legal and regulatory obligations. It involves a detailed examination of all relevant compliance factors to mitigate risks associated with exports. In the context of Montana Export Compliance Due Diligence Inquiries, due diligence helps organizations avoid potential legal pitfalls and fosters transparency in international trade. Engaging with experienced professionals can enhance your due diligence efforts.

The first step in export compliance determination involves identifying whether your product or service is subject to export regulations. You should assess the specific requirements related to your industry, the intended use of your goods, and the countries involved in the transaction. For those navigating Montana Export Compliance Due Diligence Inquiries, starting with a thorough review of the relevant laws is crucial. Utilizing platforms like USLegalForms can streamline your compliance process.

Understanding the export process is vital for successful Montana Export Compliance Due Diligence Inquiries. First, identify your product's export classification to ensure compliance. Next, obtain the necessary licenses for your export transactions. After that, conduct due diligence on your buyers and end-users to mitigate risks. Lastly, ensure you adhere to all shipping regulations to avoid delays and penalties. Utilizing resources from US Legal can streamline this process, helping you navigate through the essential elements with confidence.

When considering Montana Export Compliance Due Diligence Inquiries, it is essential to recognize the four types of exports: direct, indirect, tangible, and intangible exports. Direct exports involve shipping products directly to foreign buyers. Indirect exports occur through intermediaries. Tangible exports refer to physical goods, while intangible exports entail services and intellectual property. Understanding these categories is crucial for ensuring compliance and effective trade.

Responsibility for export compliance typically lies with the exporting company and its employees. Key personnel, including compliance officers, managers, and staff involved in exporting, must understand and uphold the regulations. In Montana Export Compliance Due Diligence Inquiries, it is crucial for organizations to foster a culture of compliance across all levels. This collective responsibility minimizes risks and enhances efficiency in export operations.

Due diligence is critical in maintaining export control compliance as it involves verifying the legitimacy of your trade activities. For Montana Export Compliance Due Diligence Inquiries, due diligence helps identify potential risks related to the parties and products involved. By conducting thorough investigations and assessments, you bolster your compliance processes and protect your business from legal challenges. It is an integral part of doing business responsibly.

Handling export compliance effectively requires a systematic approach. First, assess the types of goods or services you export. Next, ensure you understand the relevant regulations that apply to your trade. Utilizing a platform like US Legal Forms can streamline Montana Export Compliance Due Diligence Inquiries by providing essential documentation and guidance, ensuring your exports remain compliant.

Export compliance involves adhering to laws and regulations governing the export of goods and services. In the context of Montana Export Compliance Due Diligence Inquiries, this means understanding federal and international laws that apply to your transactions. This compliance protects your business from penalties and helps maintain good standing in international trade. Thus, being proactive in compliance can significantly enhance your reputation.