Montana Adjustments in the event of reorganization or changes in the capital structure

Description

How to fill out Adjustments In The Event Of Reorganization Or Changes In The Capital Structure?

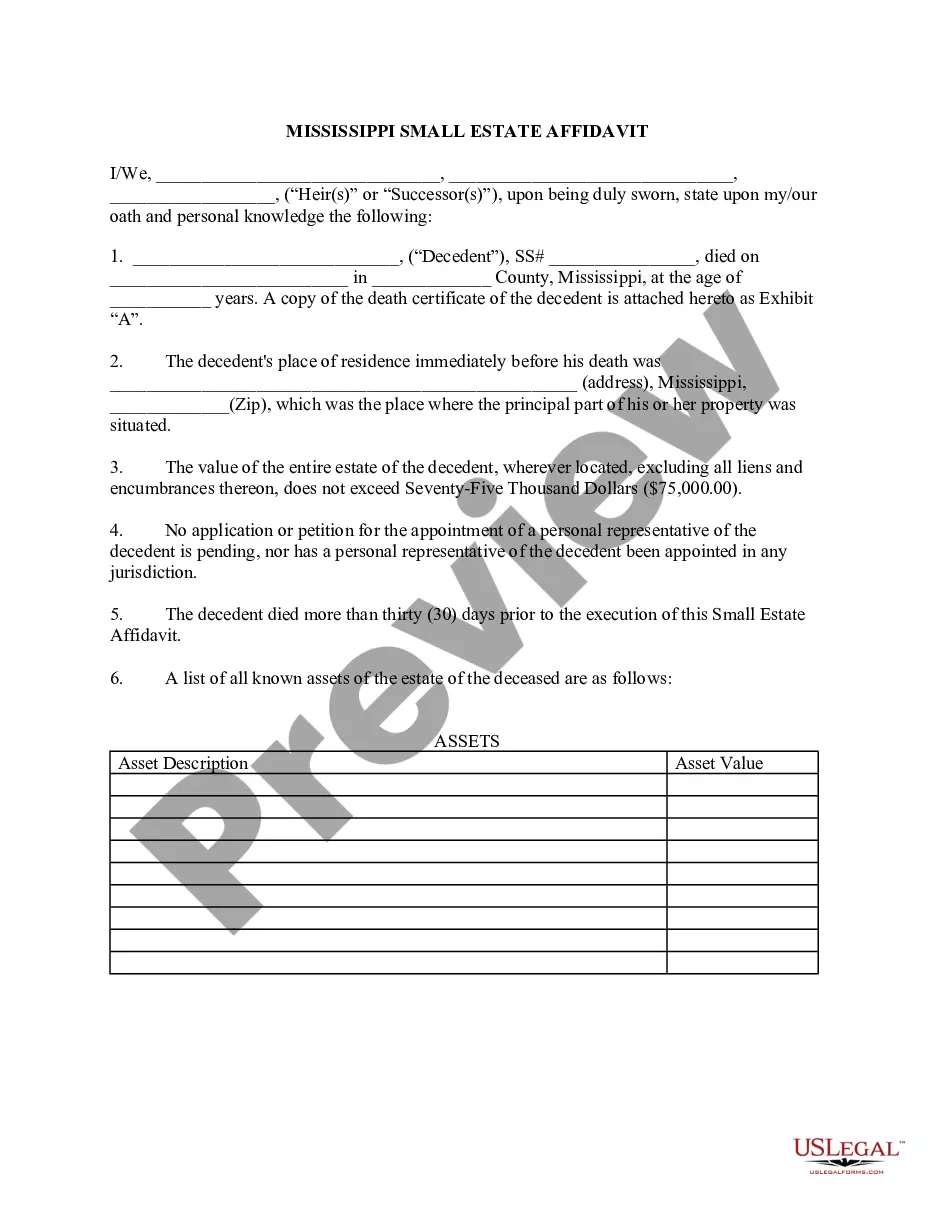

Finding the right legitimate record design might be a have difficulties. Needless to say, there are a variety of themes accessible on the Internet, but how do you obtain the legitimate kind you want? Make use of the US Legal Forms internet site. The service offers 1000s of themes, including the Montana Adjustments in the event of reorganization or changes in the capital structure, which you can use for company and private needs. All the varieties are checked by specialists and satisfy federal and state needs.

In case you are presently authorized, log in for your bank account and click on the Down load button to obtain the Montana Adjustments in the event of reorganization or changes in the capital structure. Use your bank account to look through the legitimate varieties you have acquired in the past. Go to the My Forms tab of your own bank account and obtain an additional copy from the record you want.

In case you are a fresh consumer of US Legal Forms, listed here are straightforward guidelines that you can stick to:

- Initial, ensure you have selected the appropriate kind to your metropolis/region. You can look over the form using the Review button and read the form description to make certain it will be the right one for you.

- When the kind fails to satisfy your requirements, make use of the Seach discipline to obtain the appropriate kind.

- Once you are sure that the form is suitable, click the Buy now button to obtain the kind.

- Pick the rates prepare you would like and type in the needed information and facts. Create your bank account and pay for your order with your PayPal bank account or credit card.

- Choose the file file format and down load the legitimate record design for your system.

- Total, change and print and signal the received Montana Adjustments in the event of reorganization or changes in the capital structure.

US Legal Forms is the greatest local library of legitimate varieties where you can find various record themes. Make use of the service to down load skillfully-produced papers that stick to status needs.

Form popularity

FAQ

The Schedule K-1 is a standard IRS form that is issued annually to report activity from investments in partnership interests. The K-1 will report your share of any taxable items for the calendar year for investments that you hold membership interest in.

Who Gets an IRS Schedule K-1? Among those likely to receive a Schedule K-1 are: S corporation shareholders. Partners in limited liability corporations (LLCs), limited liability partnerships (LLPs), or other business partnerships.

Montana Schedule K-1 is provided to you by the S corporation or partnership to show your share of the income, gains, losses, deductions, and other items from the entity that you need to complete your Montana income tax return.

Schedule K-1 provides information to help you figure your stock basis at the end of each corporate tax year. The basis of your stock (generally, its cost) is adjusted annually as follows and, except as noted, in the order listed. In addition, basis may be adjusted under other provisions of the Internal Revenue Code.

Schedule K-1 is an Internal Revenue Service (IRS) tax form issued annually for an investment in a partnership. The purpose of the Schedule K-1 is to report each partner's share of the partnership's earnings, losses, deductions, and credits.