Montana Salaried Employee Appraisal Guidelines - Employee Specific

Description

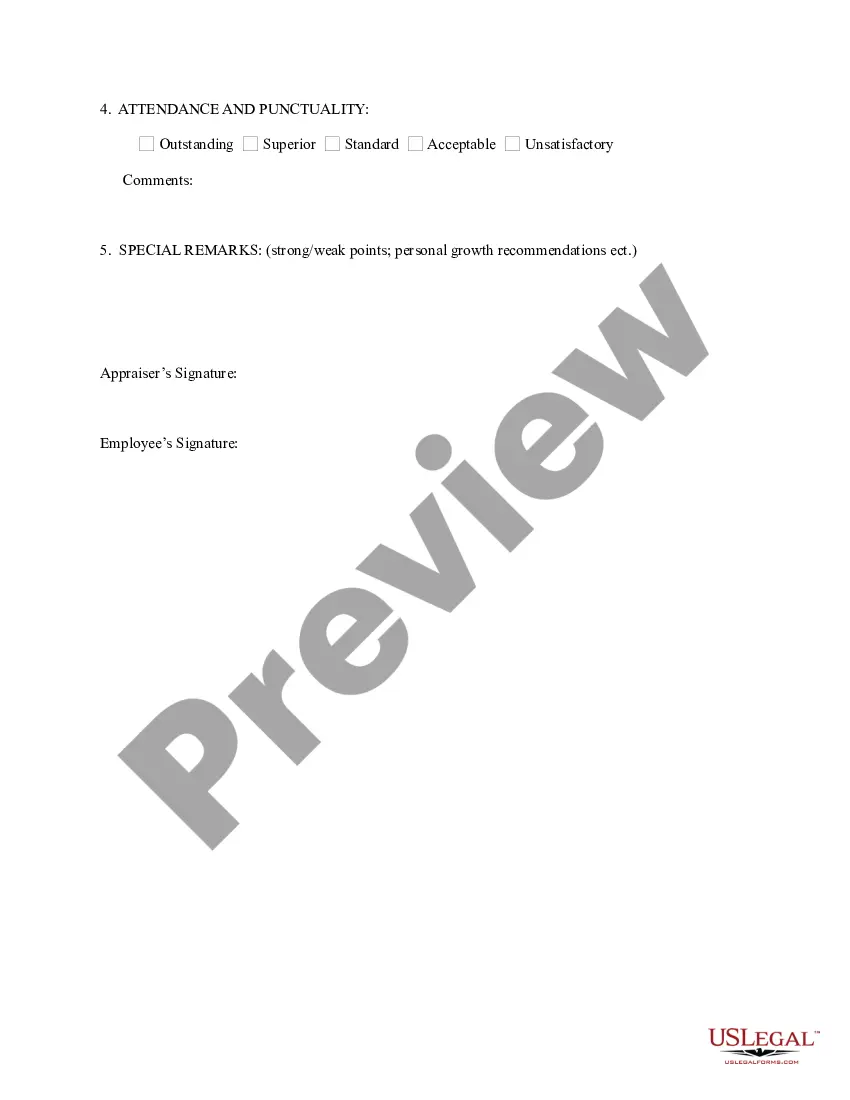

How to fill out Salaried Employee Appraisal Guidelines - Employee Specific?

You may utilize the internet to seek the legal document template that complies with both state and federal regulations you require.

US Legal Forms provides an extensive array of legal forms that are reviewed by professionals.

You can conveniently download or print the Montana Salaried Employee Appraisal Guidelines - Employee Specific from my service.

Initially, ensure that you have chosen the correct document template for the area/city of your choice. Review the document description to confirm you have selected the proper form. If available, use the Review button to preview the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Download button.

- After that, you can fill out, modify, print, or sign the Montana Salaried Employee Appraisal Guidelines - Employee Specific.

- Each legal document template you acquire is yours permanently.

- To obtain an additional copy of the purchased document, navigate to the My documents section and click the relevant button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

Montana ranked especially high in its rate of new entrepreneurs. According to U.S. Census Bureau data, the number of new business applications in the state rose 50% between January of 2020 and January of 2021.

The Fair Labor Standards Act (FLSA) doesn't include any language that prohibits employees who make more than the minimum wage from accepting tips. It does, however, guarantee that employees will make at least the federal minimum wage with direct wages and tips combined.

Montana's income tax, however, exempts any tips and gratuities that the taxpayer received while working for an employer in the food, beverage, or lodging sectors. All other tip income is still considered Montana taxable income.

No. Montana is not an at will state. In some instances, the Wrongful Discharge From Employment Act does not apply, but generally, once an employee has completed the established probationary period, the employer needs to have good cause for termination.

Montana Exempt Employees: What you need to know Montana law exempts anyone employed in a bona fide executive, administrative, professional, computer professional, or outside sales capacity from overtime pay requirements as defined by the federal Fair Labor Standards Act (FLSA) (MT Code Sec. 24.16. 211).

In Montana it is unlawful for an employer to fire you in certain circumstances, such as: You were fired because you refused to violate public policy, or reported a violation of public policy, You had finished your probationary period and your employer did not have good cause to fire you.

Under federal law and in most states, employers may pay tipped employees less than the minimum wage, as long as employees earn enough in tips to make up the difference. This is called a "tip credit." However, Montana law does not allow employers to take a tip credit.

Employers and exempt salaried supervisors or managers, however, cannot participate in a tip pool but may keep tips they receive directly from customers based on service they directly provided to the customers.

A BILL FOR AN ACT ENTITLED: "AN ACT CREATING THE MONTANA PAYCHECK TRANSPARENCY ACT PROTECTIONS; ALLOWING EMPLOYEES TO DISCUSS WAGES OR BENEFITS WITHOUT PENALTY OR RETRIBUTION FROM AN EMPLOYER; LIMITING CONDITIONS OF EMPLOPYMENT; AND PROVIDING AN EFFECTIVE DATE."