Statutory Guidelines [Appendix A(3) IRC 130] regarding certain personal injury liability assignments.

Montana Certain Personal Injury Liability Assignments IRS Code 130

Description

How to fill out Certain Personal Injury Liability Assignments IRS Code 130?

If you want to total, download, or print legitimate file templates, use US Legal Forms, the most important selection of legitimate kinds, that can be found on-line. Take advantage of the site`s simple and handy search to get the files you want. Numerous templates for organization and personal uses are sorted by categories and suggests, or keywords and phrases. Use US Legal Forms to get the Montana Certain Personal Injury Liability Assignments IRS Code 130 in just a handful of mouse clicks.

Should you be currently a US Legal Forms customer, log in to the bank account and click on the Acquire button to find the Montana Certain Personal Injury Liability Assignments IRS Code 130. Also you can gain access to kinds you earlier downloaded from the My Forms tab of your own bank account.

If you work with US Legal Forms initially, follow the instructions below:

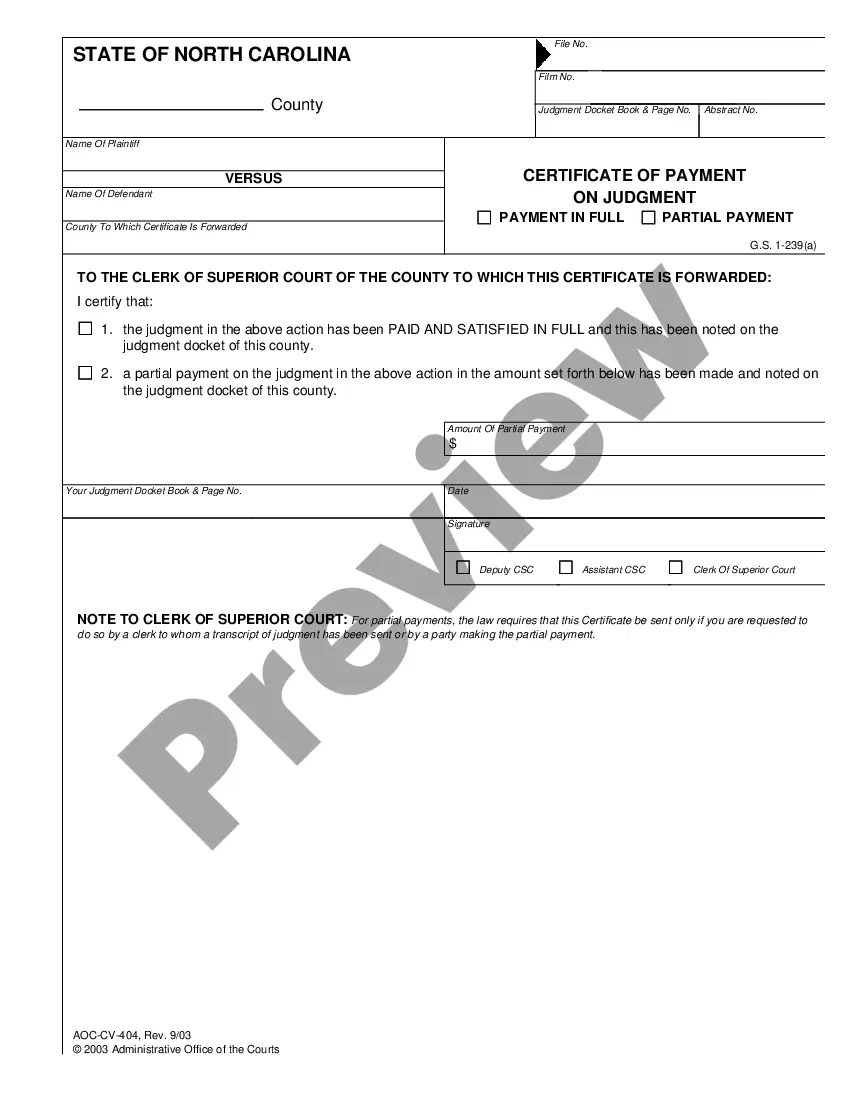

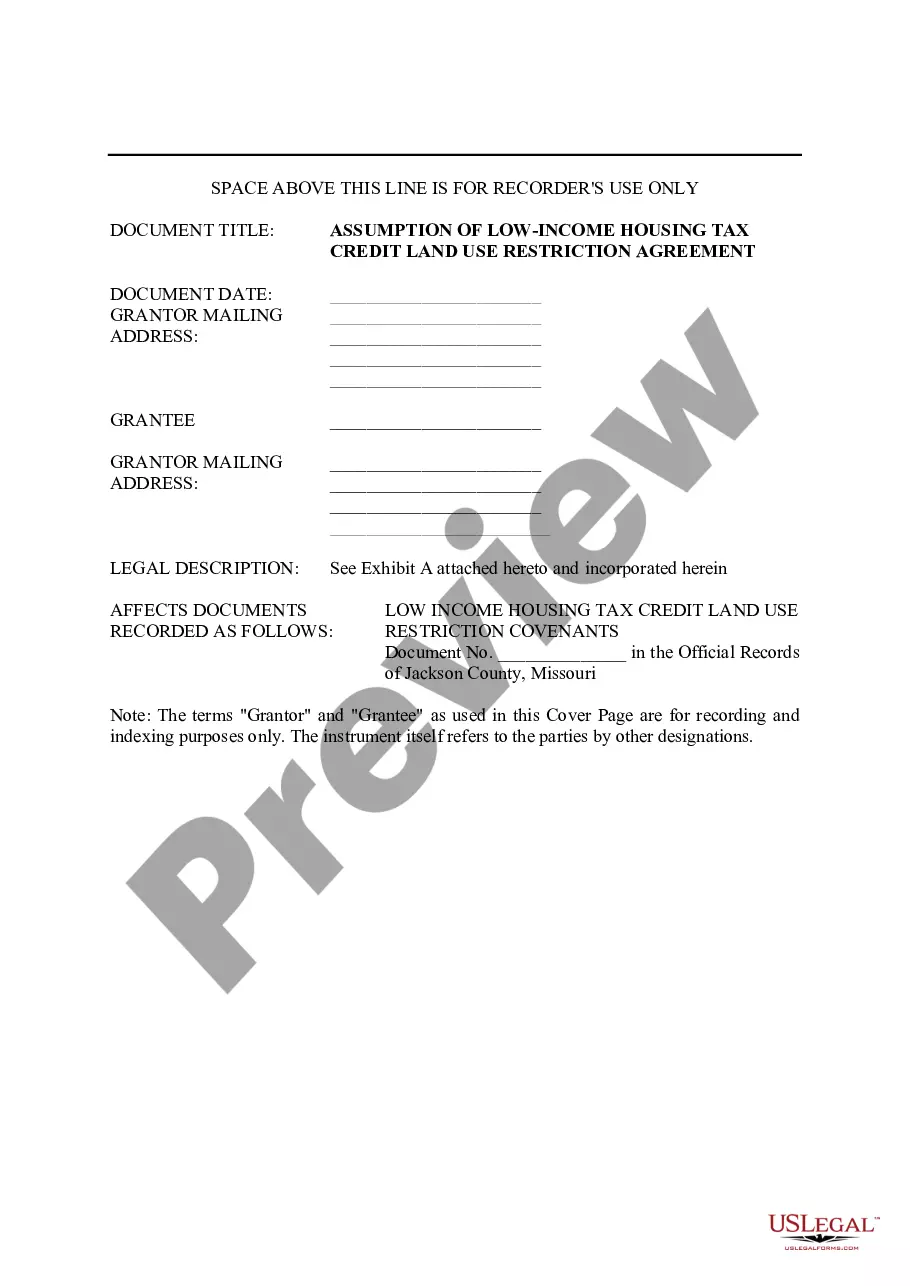

- Step 1. Be sure you have selected the form for that proper metropolis/country.

- Step 2. Utilize the Preview option to examine the form`s information. Never forget to learn the outline.

- Step 3. Should you be not happy together with the form, use the Research field near the top of the display to discover other versions from the legitimate form design.

- Step 4. Once you have discovered the form you want, click on the Purchase now button. Opt for the prices strategy you prefer and add your accreditations to sign up on an bank account.

- Step 5. Process the purchase. You may use your Мisa or Ьastercard or PayPal bank account to finish the purchase.

- Step 6. Find the file format from the legitimate form and download it in your device.

- Step 7. Full, modify and print or sign the Montana Certain Personal Injury Liability Assignments IRS Code 130.

Every single legitimate file design you buy is your own property eternally. You have acces to every form you downloaded in your acccount. Select the My Forms area and decide on a form to print or download once again.

Compete and download, and print the Montana Certain Personal Injury Liability Assignments IRS Code 130 with US Legal Forms. There are millions of professional and state-distinct kinds you can utilize for your organization or personal needs.

Form popularity

FAQ

The IRS allows settlements won in a personal injury case to be excluded from gross income when filing taxes. This tax-free status applies to both lump sum and periodic payments.

Any amount received for agreeing to a qualified assignment shall not be included in gross income to the extent that such amount does not exceed the aggregate cost of any qualified funding assets.

Key Takeaways. Income excluded from the IRS's calculation of your income tax includes life insurance death benefit proceeds, child support, welfare, and municipal bond income. The exclusion rule is generally, if your "income" cannot be used as or to acquire food or shelter, it's not taxable.

Damages received to compensate for economic loss, for example lost wages, business income and benefits, are not excludable form gross income unless a personal physical injury caused such loss.

Section 130(c) defines a qualified assignment as any assignment of liability to make periodic payments as damages (whether by suit or agreement) on account of personal injury or sickness (in a case involving physical injury or sickness) provided, among other conditions, the periodic payments are fixed and determinable ...

Income tax exemption: Structured settlement payments?including growth?are 100% income tax-free. While lump sum cash settlements are income tax-free for physical injury cases, growth on funds placed in a traditional investment may be taxable.

Inheritances, gifts, cash rebates, alimony payments (for divorce decrees finalized after 2018), child support payments, most healthcare benefits, welfare payments, and money that is reimbursed from qualifying adoptions are deemed nontaxable by the IRS.

Rev. Rul. 85-97 - The entire amount received by an individual in settlement of a suit for personal injuries sustained in an accident, including the portion of the amount allocable to the claim for lost wages, is excludable from the individual's gross income.