Montana Resident Information Sheet

Description

How to fill out Resident Information Sheet?

It is feasible to spend hours online searching for the valid document template that satisfies the state and federal requirements you need.

US Legal Forms offers a multitude of valid forms that have been evaluated by professionals.

You can actually download or generate the Montana Resident Information Sheet from my services.

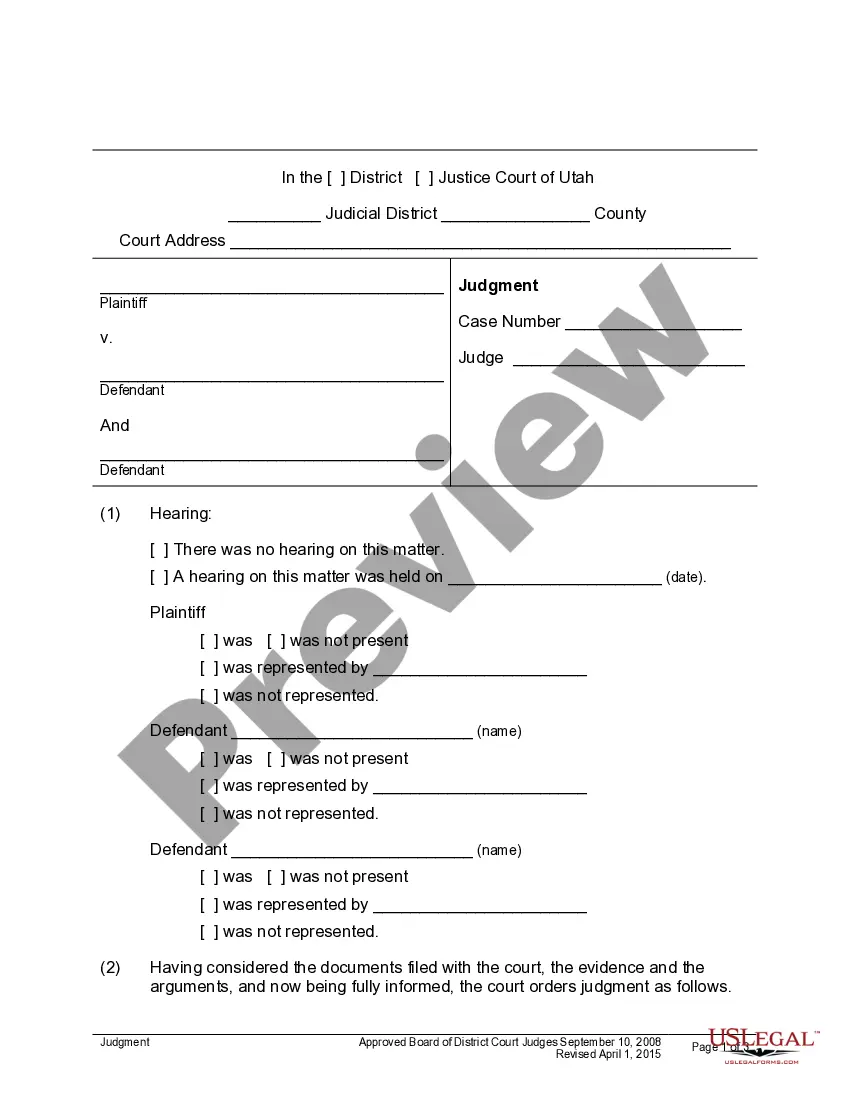

If available, utilize the Review button to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- Subsequently, you can complete, edit, produce, or sign the Montana Resident Information Sheet.

- Each valid document template you acquire is yours indefinitely.

- To retrieve an additional copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form description to confirm that you have chosen the appropriate form.

Form popularity

FAQ

The state does have a personal income tax, though, with rates ranging from 1% to 6.9%. That bottom rate is relatively low on average, but the top rate is fairly high. To offset income taxes, however, Montana offers a number of tax credits, including a credit for capital gains.

After 180 days you are considered a resident (according to Mt.gov). Note that for education purposes (such as to attend college) you must live in Montana for one full year. Live in Montana at least 120 days out of each consecutive year to keep your residency status.

You are considered a Montana resident after having lived 180 consecutive days in Montana. After establishing Montana residency, you must live in the state of Montana a minimum of 120 days a year.

You are considered a Montana resident after having lived 180 consecutive days in Montana. After establishing Montana residency, you must live in the state of Montana a minimum of 120 days a year. Your principal home must be located in Montana.

You are a Montana resident if you are domiciled or maintain a permanent place of abode in Montana. Montana taxes all of a resident's income, even if that income is earned out-of-state.

Bank statement.Certified court document.Insurance policy/card.Montana hunting/fishing license.Pay stub.Phone bill.School transcript or report card.Voter registration card.More items...

You are a Montana resident if you are domiciled or maintain a permanent place of abode in Montana. Montana taxes all of a resident's income, even if that income is earned out-of-state.

A person must be physically present in Montana for twelve or more consecutive months without an absence in excess of a total of thirty days. One must demonstrate by appropriate actions during the twelve-month period the intent to make Montana one's permanent home.

(3) Part-year residents and nonresidents compute their tax liability by multiplying the ratio of their Montana source income to income from all sources by the tax determined as if they were a resident for the entire tax year. They must complete Schedule IV, Nonresident/Part-Year Resident Tax, to determine this ratio.

Nonresident taxpayers must file a Montana income tax return if gross income attributable to state sources is equal to or greater than the return filing threshold. ( MCA 15-30-2602(1) ; ARM 42.15.