Montana Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

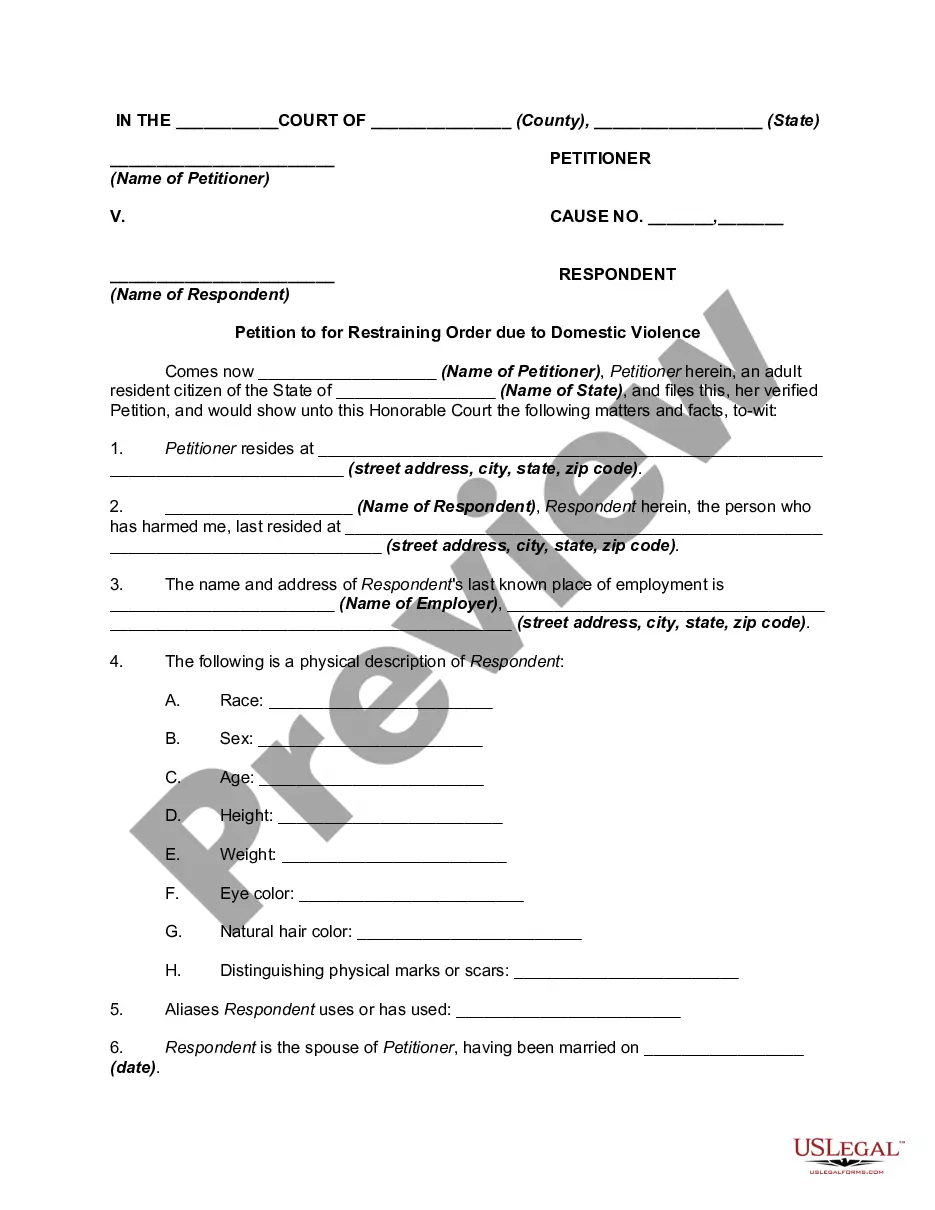

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Have you been inside a position the place you need documents for either organization or individual purposes nearly every day? There are tons of lawful record templates accessible on the Internet, but finding types you can depend on isn`t easy. US Legal Forms delivers a huge number of develop templates, much like the Montana Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, that happen to be created in order to meet federal and state demands.

In case you are previously informed about US Legal Forms website and get a merchant account, merely log in. Afterward, you can acquire the Montana Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse web template.

If you do not provide an bank account and need to begin to use US Legal Forms, adopt these measures:

- Find the develop you want and ensure it is for the appropriate city/region.

- Make use of the Preview button to examine the shape.

- Look at the outline to ensure that you have chosen the appropriate develop.

- When the develop isn`t what you are looking for, take advantage of the Research discipline to get the develop that meets your needs and demands.

- If you find the appropriate develop, click on Purchase now.

- Pick the prices strategy you want, fill out the specified information and facts to generate your money, and purchase your order using your PayPal or Visa or Mastercard.

- Select a practical paper formatting and acquire your duplicate.

Get all the record templates you might have purchased in the My Forms food list. You can aquire a additional duplicate of Montana Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse any time, if needed. Just select the necessary develop to acquire or print out the record web template.

Use US Legal Forms, the most substantial selection of lawful varieties, to conserve efforts and stay away from mistakes. The assistance delivers skillfully produced lawful record templates which you can use for a range of purposes. Make a merchant account on US Legal Forms and commence producing your lifestyle easier.

Form popularity

FAQ

RESIDUARY TRUST. Unlike the Marital Trust, the Residuary Trust can provide for substantial flexibility and give broader discretion to the Trustee. This trust may be structured as a single trust for the benefit of all your descendants or separate trusts for each of your children (and such child's descendants).

Even with the increased lifetime exemption amount for 2023, over $2 million would be subject to estate taxes. Those assets could be gifted to you tax-free using the unlimited marital deduction; however, the value of your taxable estate would also be increased by the value of the assets gifted to you. Understanding the Unlimited Marital Deduction | Los Angeles Estate ... schomerlawgroup.com ? estate-planning-2 schomerlawgroup.com ? estate-planning-2

An example of when a marital trust might be used is when a couple has children from a previous marriage and wants to pass all property to the surviving spouse upon death, but also provide for their individual children.

In order to qualify the trust instrument must provide that at least one trustee be a United States citizen or domestic corporation, and that any distribution from the trust principal be subject to the United States trustee's right to withhold the estate tax due on the distribution.

The unlimited marital deduction is a provision in the U.S. Federal Estate and Gift Tax Law that allows an individual to transfer an unrestricted amount of assets to their spouse at any time, including at the death of the transferor, free from tax. What Is Unlimited Marital Deduction? How It Works and Taxation Investopedia ? terms ? unlimited-m... Investopedia ? terms ? unlimited-m...

Formula Marital Deduction Bequests There are three basic formula clauses that normally are used: (1) pecuniary marital deduction; (2) pecuniary unified credit; and (3) fractional residuary marital reduction. Numerous variations and refinements can be applied to each. Chapter 6 Use of the Marital Deduction in Estate Planning National Timber Tax ? publications ? Cha... National Timber Tax ? publications ? Cha... PDF

The marital deduction is determinable from the overall gross estate. The total value of the assets passed on to the spouse is subtracted from that amount, giving us the marital deduction. This interspousal transfer can occur during the couple's lifetime or after one spouse's death, ing to a will.

The only potential disadvantages in general are two sub-trusts instead of one at the death of the first spouse and the requirement to file a 706 death tax return to elect QTIP treatment over the assets being funded to the QTIP Marital Trust. Married Joint Trust Marital Deduction Planning in California geigerlawoffice.com ? blog ? married-joint-t... geigerlawoffice.com ? blog ? married-joint-t...