Montana Annuity as Consideration for Transfer of Securities

Description

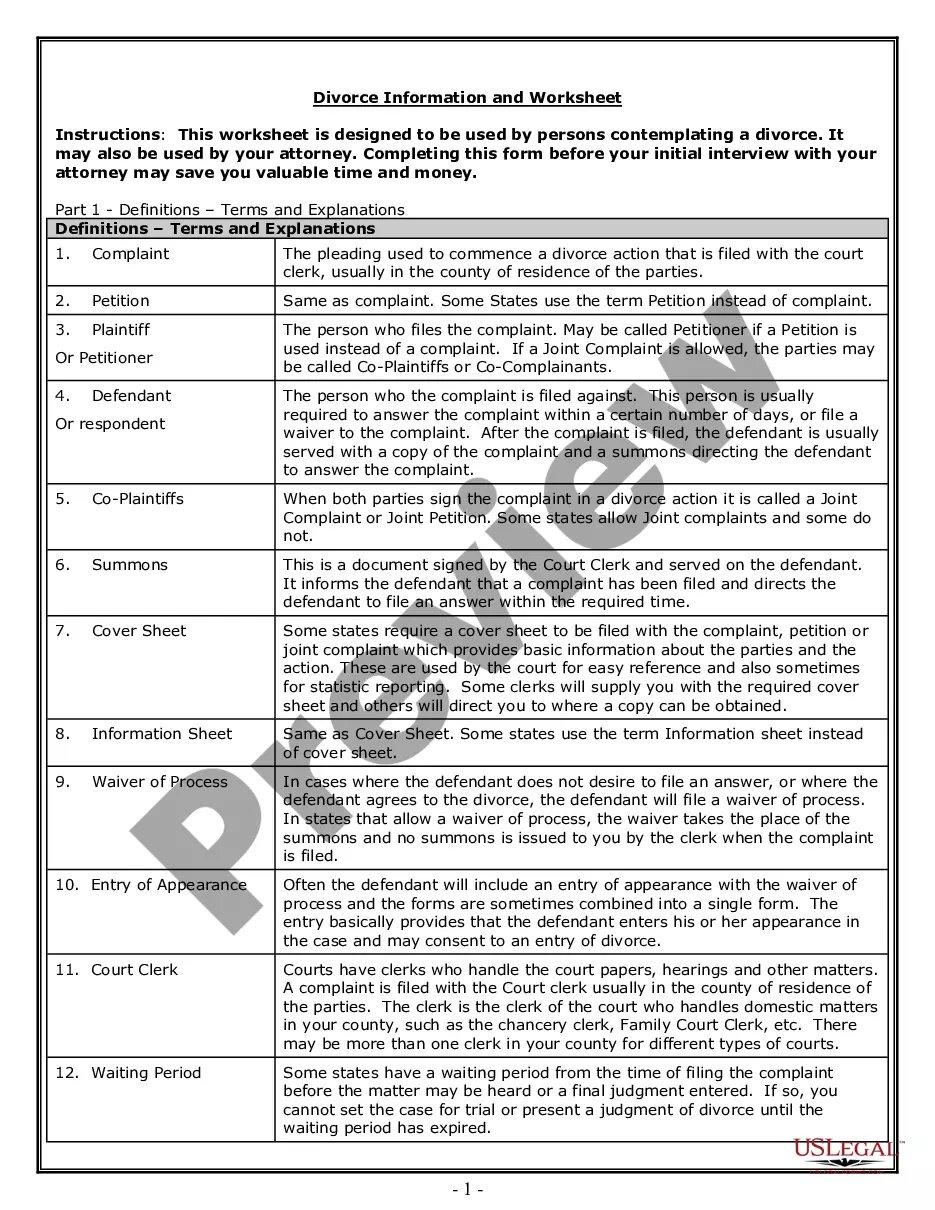

How to fill out Annuity As Consideration For Transfer Of Securities?

Have you found yourself in a situation where you require documents for either business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but discovering ones you can trust is not straightforward.

US Legal Forms offers a vast array of template forms, including the Montana Annuity as Consideration for Transfer of Securities, which are designed to comply with federal and state regulations.

Once you find the correct form, click on Purchase now.

Choose the payment plan you prefer, fill in the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Montana Annuity as Consideration for Transfer of Securities template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and verify that it is for the correct city/state.

- Utilize the Review feature to evaluate the form.

- Check the description to ensure that you have selected the appropriate form.

- If the form is not what you are looking for, use the Lookup field to find the form that fits your needs.

Form popularity

FAQ

In the case of annuities, you can surrender your existing contract for another annuity with a different insurance company without fear of IRS penalties or restrictions.

In the case of annuities, you can surrender your existing contract for another annuity with a different insurance company without fear of IRS penalties or restrictions.

You can change annuity brokers, but changing annuities can be costly.

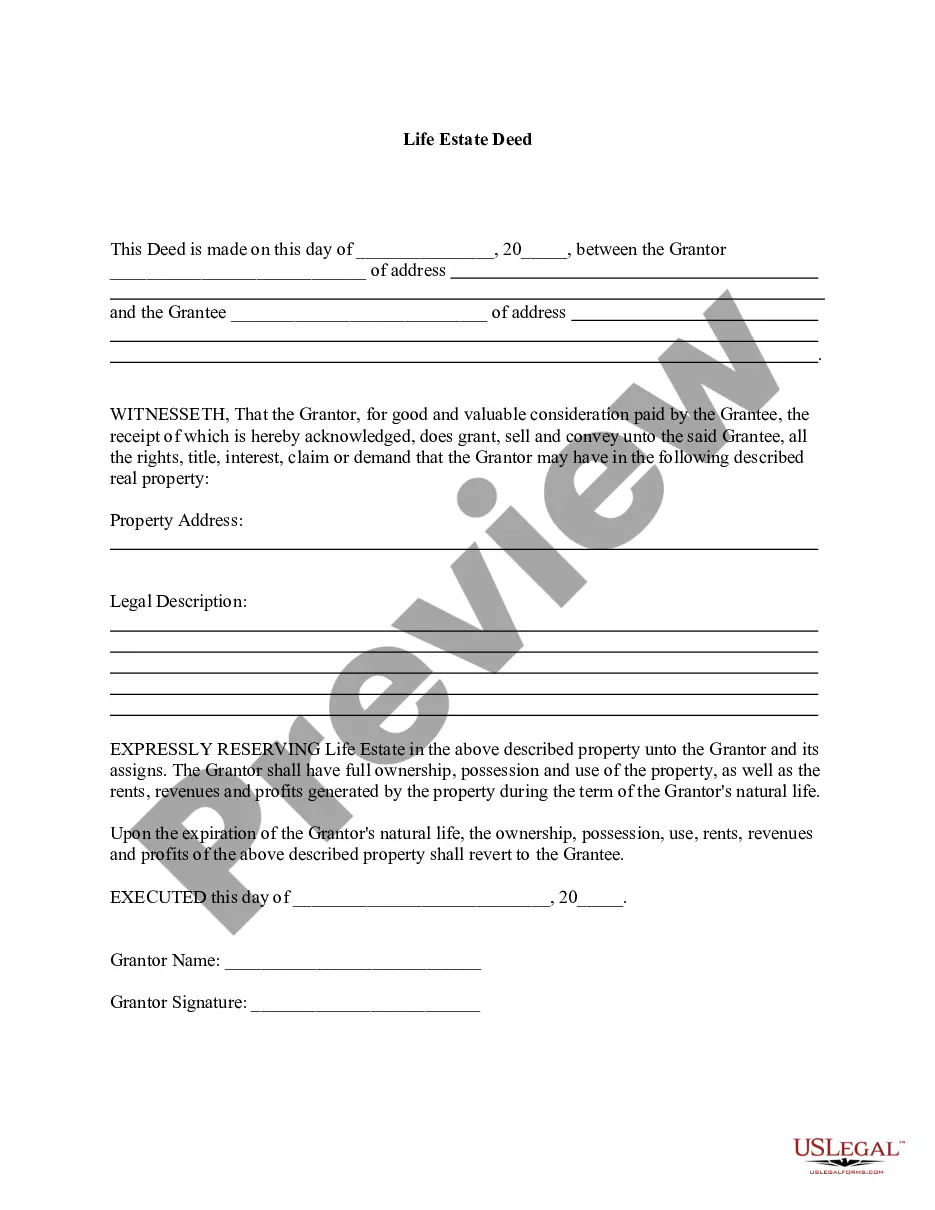

An annuity consideration or premium is the money an individual pays to an insurance company to fund an annuity or receive a stream of annuity payments. An annuity consideration may be made as a lump sum or as a series of payments, often referred to as contributions.

Contact your annuity company and let your account manager know you want to change the owner of your contract. The annuity company will send you a change of ownership form. Fill out the change of ownership form for your annuity.

A 1035 transfer is a tax-free transfer from one insurance company annuity to another. You don't pay taxes or penalties if you transfer the funds this way.

If you outlive the annuity's terms, you and the provider simply part ways. If you die before the annuity's term runs out, the contract isn't canceled, as with a lifetime annuity, but can be passed to heirs. Your heirs may receive a lump-sum payout of the annuity's value rather than continuing to receive your benefits.

Annuities outside of an IRA structure can be transferred as a nontaxable event by using the IRS approved 1035 transfer rule. Annuities within an IRA can transfer directly to another IRA with an annuity carrier, and not create any tax consequences as well.

Yes, you can roll over or exchange a fixed annuity for a new annuity. Check to make sure that surrender charges don't apply, however. Typically, a minimum deposit of at least $5,000 will be required.