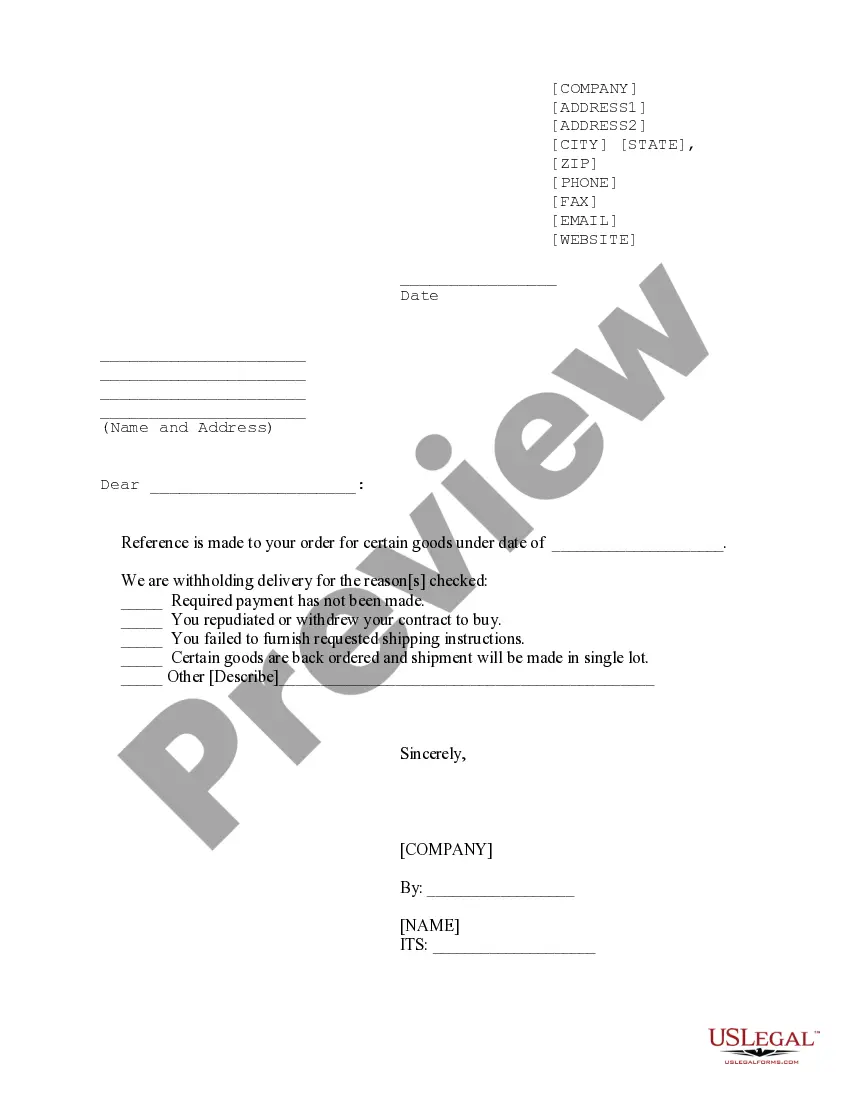

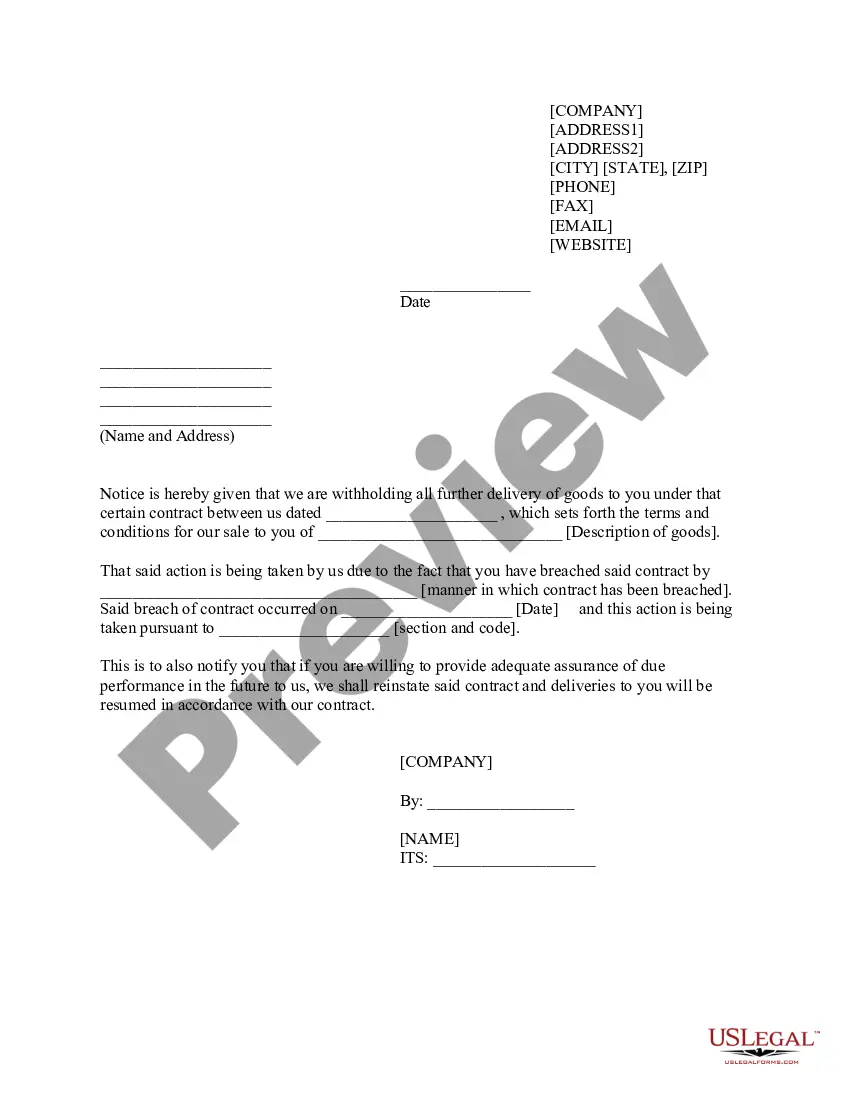

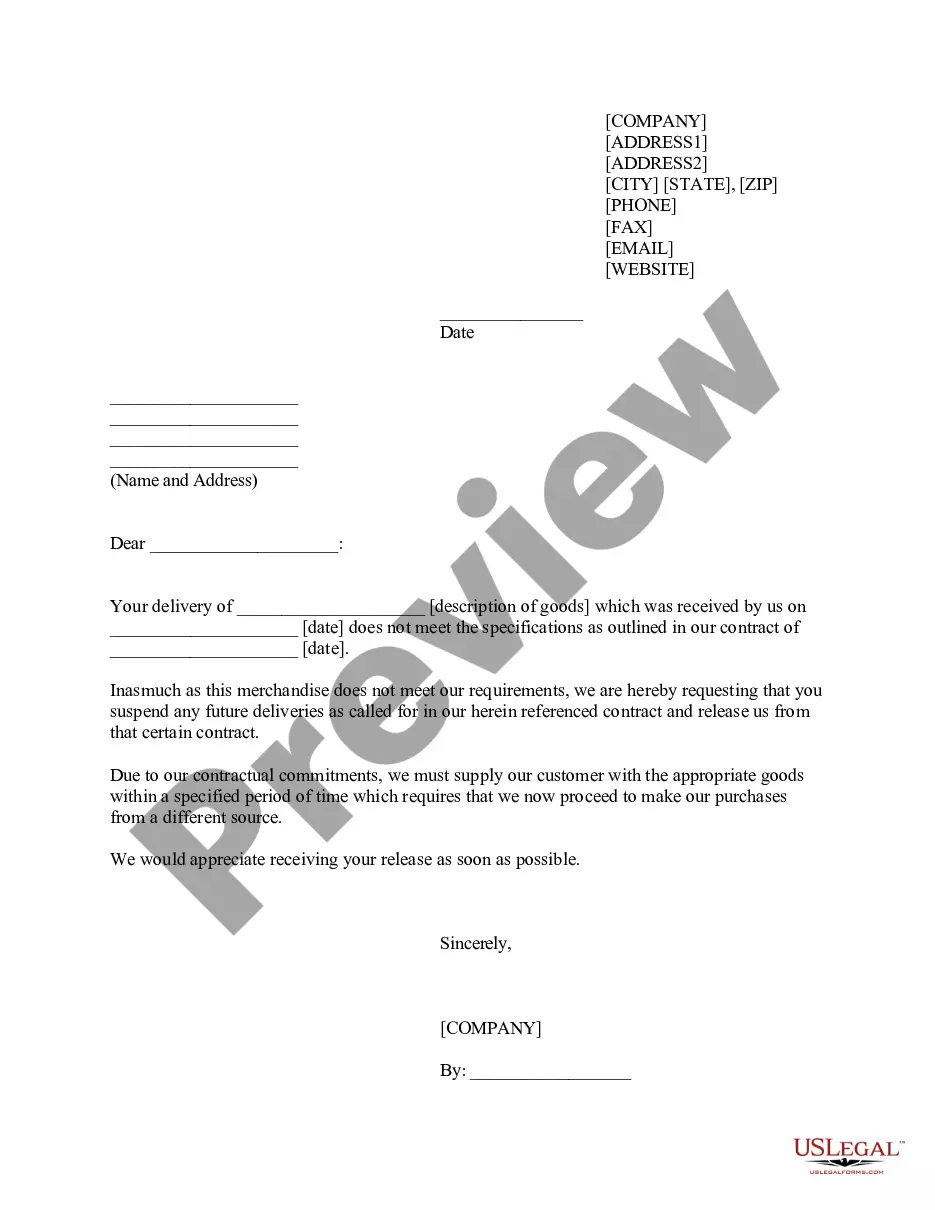

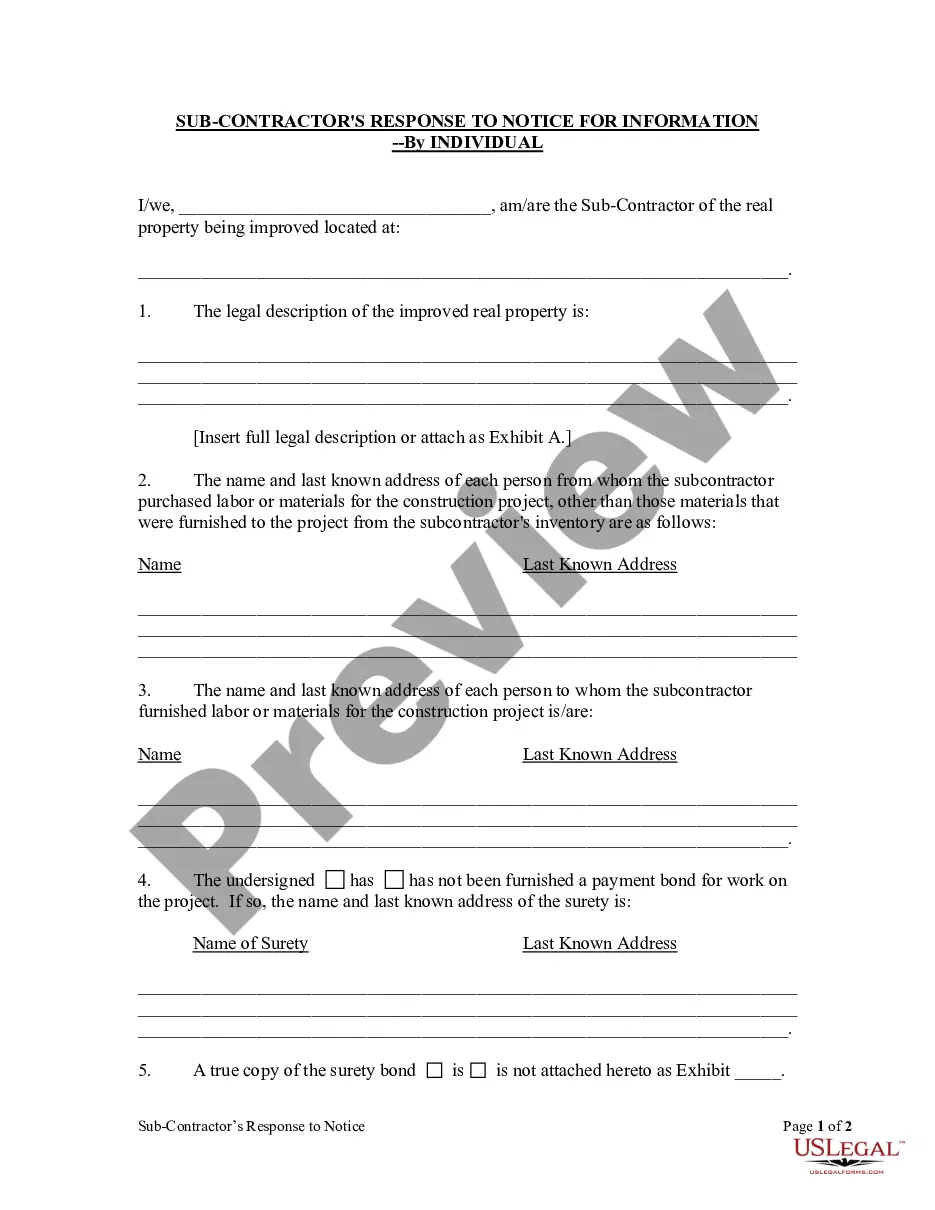

Montana Withheld Delivery Notice

Description

How to fill out Withheld Delivery Notice?

Are you situated in a position where you require documents for potential organizational or personal purposes nearly every day.

There are numerous valid document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms provides a vast array of form templates, such as the Montana Withheld Delivery Notice, which are designed to comply with state and federal regulations.

Once you acquire the correct form, click Purchase now.

Choose the subscription plan you desire, enter the necessary information to create your account, and complete your order using your PayPal or Visa or Mastercard. Obtain a suitable format and download your copy. Find all the document templates you have purchased in the My documents menu. You can download an additional copy of the Montana Withheld Delivery Notice at any time, if necessary. Simply select the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of valid forms, to save time and avoid mistakes. The service offers expertly crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Montana Withheld Delivery Notice template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is for the correct city/region.

- Utilize the Preview button to review the form.

- Examine the description to confirm that you have chosen the appropriate form.

- If the form isn’t what you’re looking for, use the Lookup section to find the form that suits your needs and requirements.

Form popularity

FAQ

Montana Employee's Withholding Allowance and Exemption Certificate (Form MW-4) A completed Form MW-4 is used by employers to determine the amount of Montana income tax to withhold from wages paid. This form allows each employee to claim allowances or an exemption to Montana wage withholding when applicable.

Montana Individual Income Tax Return (Form 2)

Montana requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the Department of Revenue. Every employer in Montana that pays wages must withhold the state tax. Nonresident employers must withhold tax from wages paid for service provided within Montana.

Definition of withhold verb (used with object), with·held, withA·holdA·ing. to hold back; restrain or check. to refrain from giving or granting: to withhold payment. to collect (taxes) at the source of income. to deduct (withholding tax) from an employee's salary or wages.

Withholding tax is income tax collected from wages when an employer pays an employee. The beginnings of withholding tax date back to 1862, when it was used to help fund the Civil War. Employees complete IRS Form W-4 to determine how much the employer should withhold from each paycheck.

Change Your WithholdingComplete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer.Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer.Make an additional or estimated tax payment to the IRS before the end of the year.29-Mar-2022

If you are a new business, register online with the Montana Department of Labor and Industry. You can also register via phone at 1-800-550-1513. If you already have a Montana UI Account Number, you can look this up online or by contacting the agency at 406-444-3834.

Montana does not recognize the federal exempt status available on the federal Form W-4. Therefore, exemption from withholding for federal purposes does not exempt you from Montana income tax withholding.