Montana Insurance Organizer

Description

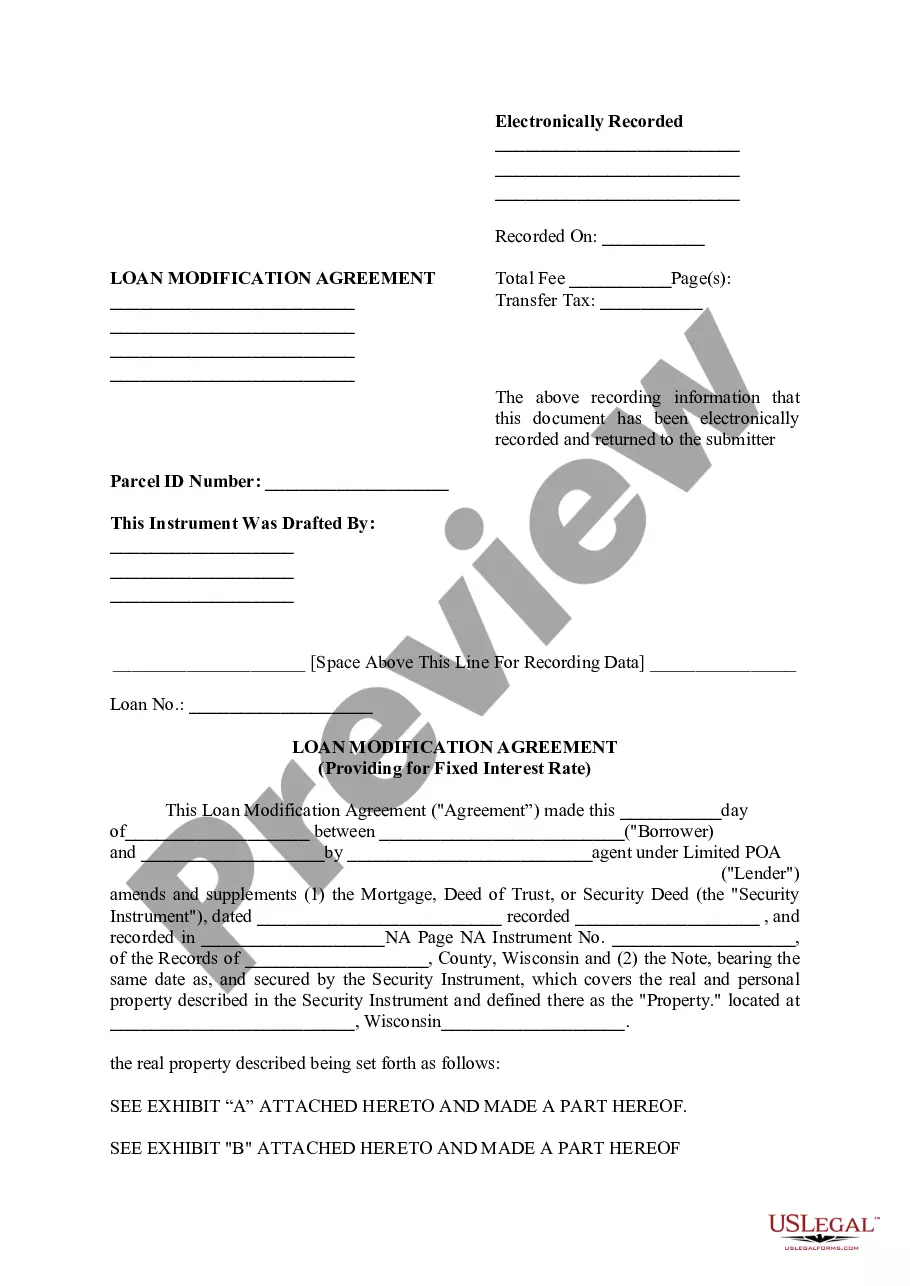

How to fill out Insurance Organizer?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a range of legal document samples that you can download or print.

Through the website, you can access a vast array of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of documents like the Montana Insurance Organizer in just a few moments.

If you have an account, Log In and download the Montana Insurance Organizer from your US Legal Forms collection. The Download button will be displayed on every form you view. You can access all previously obtained forms in the My documents section of your profile.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit it as needed, and print and sign the downloaded Montana Insurance Organizer.

Every template you add to your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply return to the My documents section and click on the form you need. Access the Montana Insurance Organizer using US Legal Forms, the most extensive collection of legal document templates. Utilize a plethora of professional and state-specific templates that cater to your business or personal requirements.

- Ensure you have selected the correct form for your locality.

- Click the Review option to examine the form's details.

- Check the form description to confirm you have chosen the right one.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, select the payment plan you prefer and provide your credentials to sign up for an account.

Form popularity

FAQ

Filing a complaint with the insurance commissioner in Montana is a straightforward process. Start by gathering all relevant documentation, including your policy and any correspondence with the insurance company. You can file your complaint online, via mail, or by phone. Using a Montana Insurance Organizer can help you keep all your documents easily accessible during this process.

Does Montana allow the use of digital insurance cards? Montana held out longer than many states, but law enforcement will now accept proof of coverage on your mobile device. Just make sure your insurance company offers digital insurance cards.

There is no SR22 insurance requirement in Montana!

Contrary to popular belief, car insurance typically follows the car not the driver. If you let someone else drive your car and they get in an accident, your insurance company would likely be responsible for paying the claim, depending on the coverages in your policy.

Like most states, insurance follows the carnot the driverin Montana. This means that you buy insurance for a particular vehicle, not necessarily a particular driver. If your vehicle is insured and another driver borrows your car, they will be covered under your car insurance policy.

Car insurance usually follows the car in Montana. The types of car insurance that follow the car in Montana are bodily injury liability, personal injury liability, collision, and comprehensive. You're required to carry bodily injury liability and property damage liability in Montana.

Montana law requires drivers to carry a minimum amount of liability insurance. Penalties for not having insurance can be severe. You can't afford not to have insurance.

If you have a serious driving violation in Montana, such as a DUI, you need to have SR-22 insurance. This policy costs more than a standard car insurance policy.

All car owners in Montana are required by law to carry the following minimum levels of insurance: Bodily injury: $25,000 per person and $50,000 per accident. Property damage: $20,000 per accident. Uninsured/underinsured motorist: $25,000 per person and $50,000 per accident

The cost of an SR22 varies between insurance companies. An individual can expect to spend an average of $300 to $800, depending on factors such as personal driving history, age, driving experience, marital status, and place of residence. Insurance companies that do offer SR22 coverage tend to do so at a high cost.