Montana Security Agreement regarding Member Interests in Limited Liability Company

Description

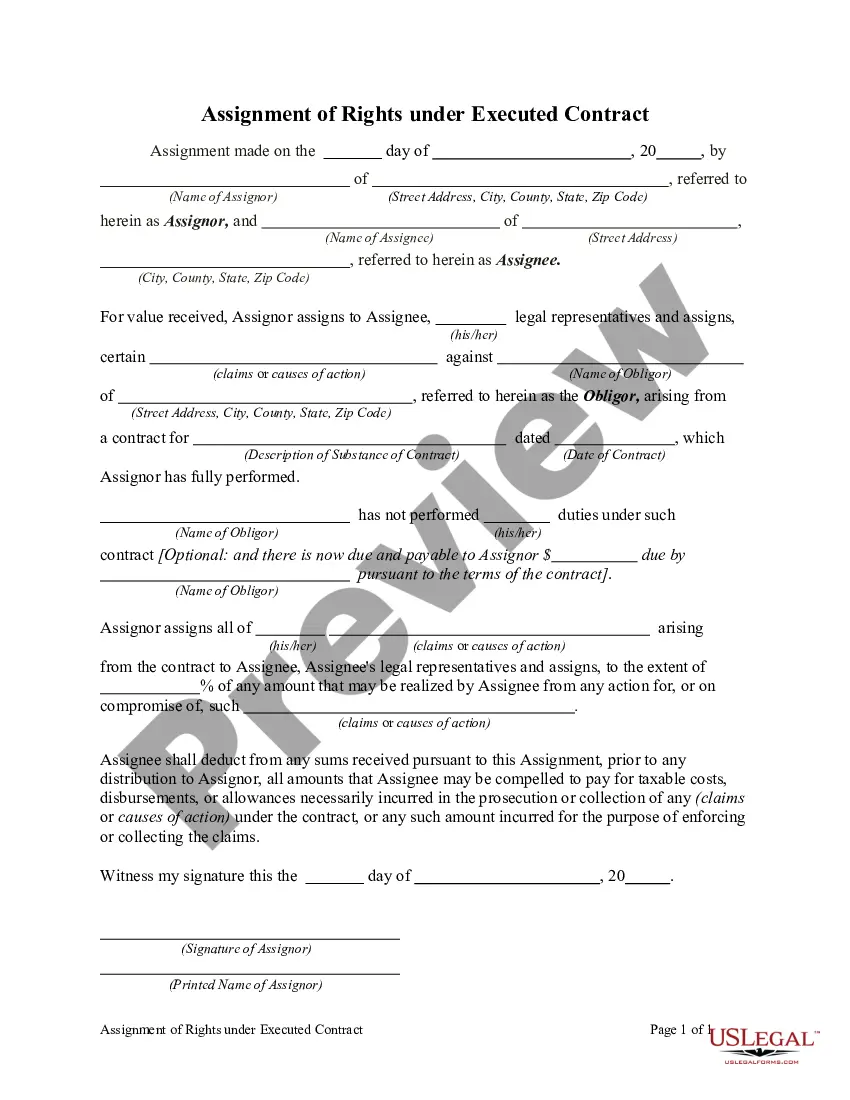

How to fill out Security Agreement Regarding Member Interests In Limited Liability Company?

If you wish to finish, obtain, or print out legal document templates, utilize US Legal Forms, the premier assortment of legal forms that are available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

A variety of templates for business and personal use are categorized by groups and states, or keywords.

Step 4. Once you have found the form you need, select the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for the account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the Montana Security Agreement related to Member Interests in Limited Liability Company within a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to retrieve the Montana Security Agreement regarding Member Interests in Limited Liability Company.

- You can also access forms you previously obtained within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate area/region.

- Step 2. Utilize the Preview feature to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find other versions of the legal form format.

Form popularity

FAQ

Those LLC members who operate the business owe the fiduciary duties of loyalty and reasonable care to the non-managing LLC owners. Depending upon your state, LLC members may be able to revise, broaden, or eliminate these fiduciary duties by contract or under the conditions of their LLC operating agreement.

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities. There is no maximum number of members. Most states also permit single-member LLCs, those having only one owner.

5 steps for maintaining personal asset protection and avoiding piercing the corporate veilUndertaking necessary formalities.Documenting your business actions.Don't comingle business and personal assets.Ensure adequate business capitalization.Make your corporate or LLC status known.

The main advantage to an LLC is in the name: limited liability protection. Owners' personal assets can be protected from business debts and lawsuits against the business when an owner uses an LLC to do business. An LLC can have one owner (known as a member) or many members.

LLC Flexibility The hallmark of LLCs is their flexibility. LLCs offer the protection of its members not being personally liable for debts or obligations. There are no restrictions on the number of persons or types of entities which can own membership interests in an LLC.

Limited liability is a form of legal protection for shareholders and owners that prevents individuals from being held personally responsible for their company's debts or financial losses.

Excerpt from The LLC Handbook. The term member refers to the individual(s) or entity(ies) holding a membership interest in a limited liability company. The members are the owners of an LLC, like shareholders are the owners of a corporation. Members do not own the LLC's property.

What Is Limited Liability Protection? Limited liability protection means that if your company incurs legal liability, personal assets stay protected. The extent and nature of that protection varies from state to state, so you want to be sure to speak with an attorney to make sure that you get it right.

What Type of Liability Protection Do You Get With an LLC? The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

The members of an LLC can decide how to operate the various aspects of the business by forming an operating agreement. An operating agreement is not required for an LLC to exist, and if there is one, it need not be in writing. LLC members should protect their interests by creating a written operating agreement.