Montana Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

Discovering the right legal papers template can be a have a problem. Of course, there are plenty of themes available on the net, but how do you get the legal kind you want? Use the US Legal Forms web site. The support provides thousands of themes, for example the Montana Sample Letter regarding Information for Foreclosures and Bankruptcies, that can be used for company and personal requirements. Each of the varieties are checked out by pros and meet state and federal demands.

If you are currently authorized, log in for your accounts and then click the Acquire switch to find the Montana Sample Letter regarding Information for Foreclosures and Bankruptcies. Utilize your accounts to look through the legal varieties you have ordered in the past. Proceed to the My Forms tab of your accounts and obtain one more copy in the papers you want.

If you are a fresh consumer of US Legal Forms, here are easy recommendations that you should comply with:

- First, make sure you have chosen the right kind to your area/region. You are able to look through the form making use of the Preview switch and read the form information to guarantee this is the right one for you.

- When the kind fails to meet your requirements, take advantage of the Seach field to obtain the proper kind.

- When you are sure that the form is proper, click the Buy now switch to find the kind.

- Opt for the prices prepare you would like and enter the necessary details. Create your accounts and pay for your order with your PayPal accounts or charge card.

- Choose the document file format and acquire the legal papers template for your product.

- Full, edit and produce and sign the obtained Montana Sample Letter regarding Information for Foreclosures and Bankruptcies.

US Legal Forms is the most significant catalogue of legal varieties that you can find a variety of papers themes. Use the service to acquire professionally-produced papers that comply with express demands.

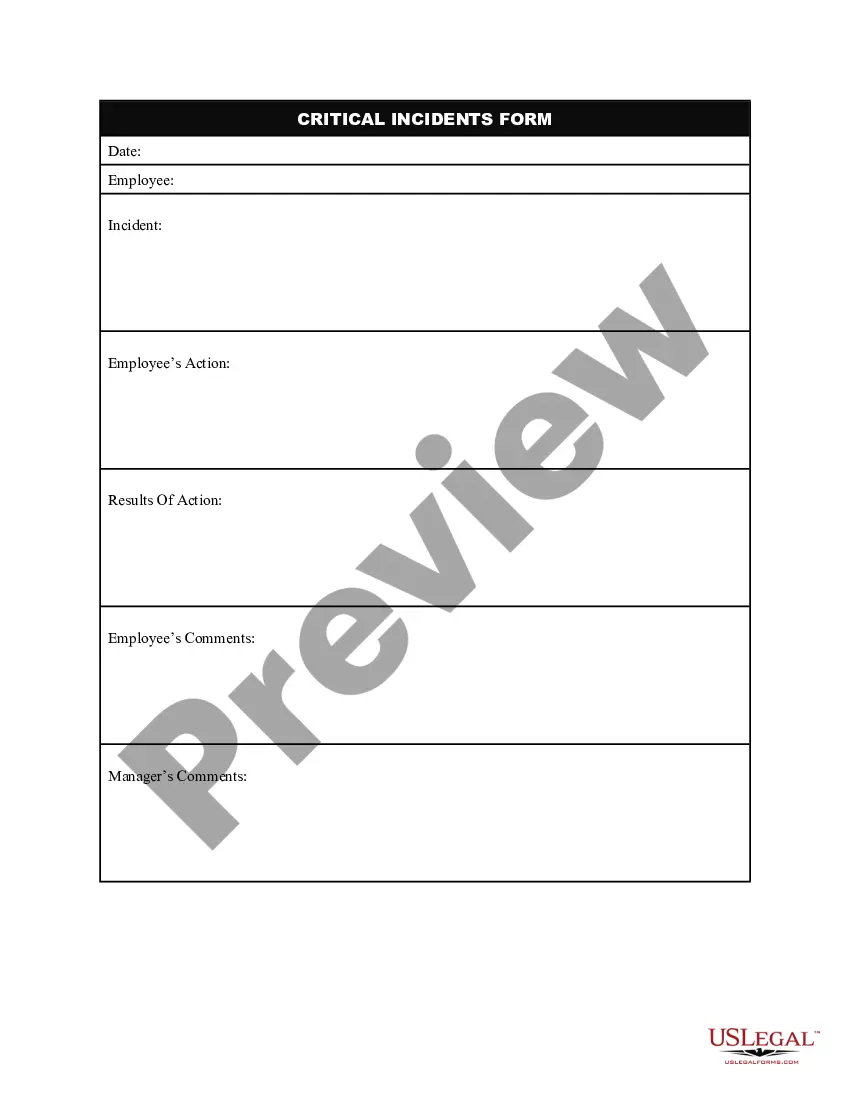

Form popularity

FAQ

A few potential ways to stop a foreclosure and keep your home include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. Working out a loss mitigation option, like a loan modification, will also stop a foreclosure.

Technically speaking, a notice of default is not a foreclosure. Instead, it serves as notice that you are behind in your payments and that your property may be sold as a result of foreclosure if you don't act soon.

The significant impacts for homeowners include the loss of Down Payment, Mortgage Loan Payments, and of the Equity in the home. Through foreclosure, homeowners lose the down payment made at the time of purchase and the mortgage loan payments they made during the ownership of their home.

A foreclosure is simply the closing of a Home Loan by paying off the entire amount borrowed in one lump sum amount. It is part of the regular Home Loan process and allows you to pay off the borrowed amount before the EMI schedule. You can opt for a foreclosure even after having made a few EMI payments.

When a homeowner stops paying on a loan used to purchase a home, the home is deemed to be in foreclosure. What this ultimately means is that the ownership of the home switches from the homeowner to the bank or lender that provided the loan.

A foreclosure is simply the closing of a Home Loan by paying off the entire amount borrowed in one lump sum amount. It is part of the regular Home Loan process and allows you to pay off the borrowed amount before the EMI schedule. You can opt for a foreclosure even after having made a few EMI payments.

The state of Montana allows 150 days before your home can be fully foreclosed on, but that means that you will be notified by the bank after one missed payment. You must make recompense with the bank or they will take your home, claim it and eventually sell it.

Foreclosure is a process that begins when a borrower fails to make their mortgage payments. When a home is foreclosed upon, the lender typically repossesses and attempts to sell the house. This happens because mortgage loans are secured by real estate, meaning your home is used as collateral.