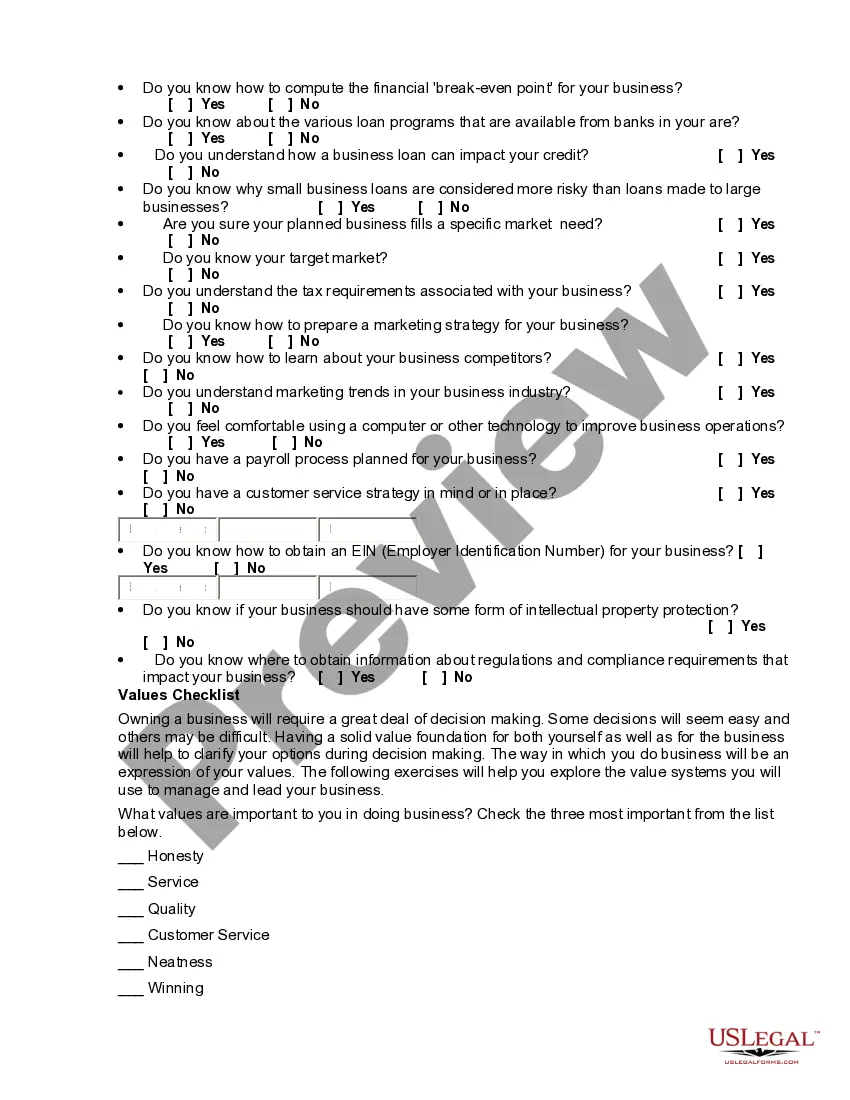

Are you ready to start a business? This assessment tool is designed to help you better understand your readiness for starting a small business. It will prompt you with questions and assist you in evaluating skills, characteristics and experience, as they relate to your being prepared for starting a business.

Montana Personal Strengths and Weaknesses - Owning a Small Business

Description

How to fill out Personal Strengths And Weaknesses - Owning A Small Business?

Locating the correct sanctioned document template can be challenging.

Of course, there are numerous designs accessible online, but how do you discover the sanctioned form you need.

Visit the US Legal Forms website. The platform offers thousands of templates, including the Montana Personal Strengths and Weaknesses - Operating a Small Business, which you can utilize for both business and personal purposes.

First, confirm you have selected the correct form for your specific area. You can review the form using the Review button and read the form details to ensure it is suitable for you.

- All forms are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download option to access the Montana Personal Strengths and Weaknesses - Operating a Small Business.

- Use your account to browse through the legal forms you have previously acquired.

- Navigate to the My documents section of your account and obtain another copy of the document you desire.

- If you are a new user of US Legal Forms, follow these simple instructions.

Form popularity

FAQ

The tax rate for small businesses in Montana varies based on revenue and business structure. Generally, corporations face a flat tax rate, while pass-through entities, like LLCs, are taxed at personal income tax rates. Therefore, thoroughly assessing Montana's personal strengths and weaknesses - owning a small business can ensure your tax strategy aligns with your goals.

Do You Have To Have A Business License To Sell On Etsy? As a result, Etsy does not require sellers to have a business license, and suggests you contact a professional if you have questions.

Montana does not have a standard state business license and, because there is no state sales tax, businesses are not required to have a seller's permit. However, there are hundreds of state licenses that businesses in certain professions must have.

Montana does not have a standard state business license and, because there is no state sales tax, businesses are not required to have a seller's permit. However, there are hundreds of state licenses that businesses in certain professions must have.

How to Start a Business in MontanaChoose a Business Idea. Take some time to explore and research ideas for your business.Decide on a Legal Structure.Choose a Name.Create Your Business Entity.Apply for Licenses and Permits.Pick a Business Location and Check Zoning.Report and File Taxes.Obtain Insurance.More items...

Domestic and foreign corporations are required to register and file an Annual Report with the Secretary of State's Office. There are several types of corporations; some operate for profit and others are not for profit.

If you plan to start a sole proprietorship and you are not planning to do business under your own name, you must Register an Assumed Business Name with the Secretary of State's Office. Otherwise, no registration is required. You must obtain any necessary state and local business licenses.

Montana topped the list in a new report that ranks best states for starting a new small business. The state's first-place ranking was based on a handful of factors including consumer spending, labor costs and climate by The Blueprint, an off-shoot of the investment advice publication The Motley Fool.

Any business that physically operates from a residential property will need to have a background check. Home-based businesses will have to submit the Home Occupation Additional Info form with their business license application.

To register your Montana LLC, you'll need to file the Articles of Organization with the Montana Secretary of State. You can apply online. Read our Form an LLC in Montana guide for details. Or use a professional service like ZenBusiness or to form your LLC for you.