Montana Sample Letter for Exemption of Ad Valorem Taxes

Description

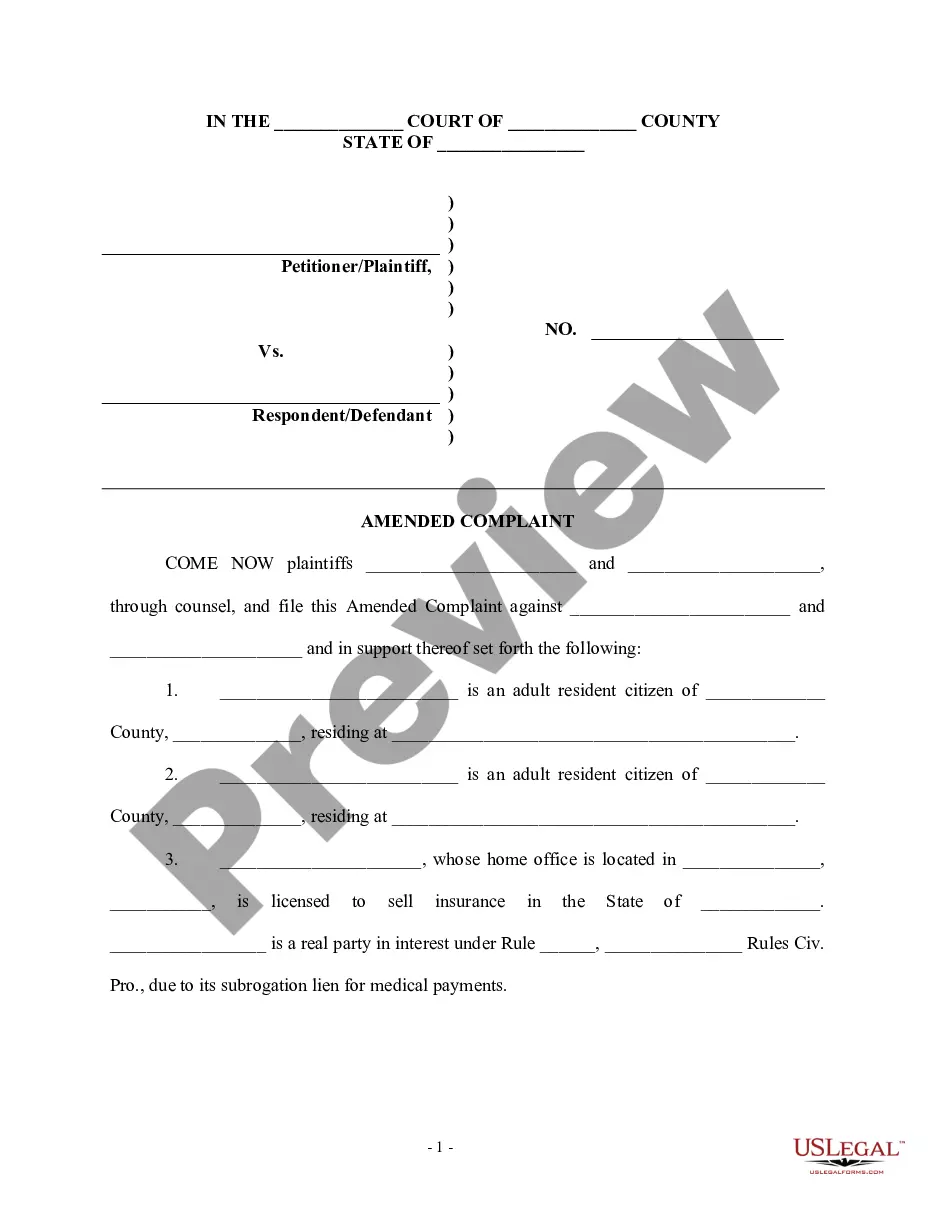

How to fill out Sample Letter For Exemption Of Ad Valorem Taxes?

If you have to complete, down load, or printing legitimate papers web templates, use US Legal Forms, the biggest selection of legitimate kinds, that can be found on the web. Take advantage of the site`s simple and convenient research to obtain the papers you will need. Various web templates for company and personal reasons are categorized by groups and claims, or search phrases. Use US Legal Forms to obtain the Montana Sample Letter for Exemption of Ad Valorem Taxes within a couple of mouse clicks.

If you are currently a US Legal Forms customer, log in in your account and click on the Acquire key to find the Montana Sample Letter for Exemption of Ad Valorem Taxes. You can even accessibility kinds you previously delivered electronically inside the My Forms tab of your account.

If you are using US Legal Forms initially, refer to the instructions beneath:

- Step 1. Make sure you have selected the form for that right area/country.

- Step 2. Utilize the Review option to examine the form`s content. Do not overlook to read the information.

- Step 3. If you are unsatisfied together with the type, take advantage of the Search area towards the top of the display screen to find other models of the legitimate type web template.

- Step 4. After you have identified the form you will need, click on the Get now key. Select the prices program you choose and add your accreditations to sign up to have an account.

- Step 5. Approach the deal. You may use your bank card or PayPal account to perform the deal.

- Step 6. Find the formatting of the legitimate type and down load it in your gadget.

- Step 7. Total, change and printing or sign the Montana Sample Letter for Exemption of Ad Valorem Taxes.

Each and every legitimate papers web template you purchase is the one you have for a long time. You might have acces to each type you delivered electronically in your acccount. Click the My Forms section and choose a type to printing or down load once again.

Be competitive and down load, and printing the Montana Sample Letter for Exemption of Ad Valorem Taxes with US Legal Forms. There are thousands of skilled and state-specific kinds you can use for your personal company or personal requires.

Form popularity

FAQ

Any person, firm, corporation, partnership, association, or other group who wants Real or Personal Property qualified as tax exempt must submit an application to the Department of Revenue.

For Montanans who turned 62 or older in 2021, the Elderly Homeowner/Renter Tax Credit can bring up to $1,000.

The amount of the Montana personal exemption from individual income tax is adjusted annually for inflation ( MCA 15-30-2114(6)) The personal exemption amount is: 2022 tax year: $2,710. 2021 tax year: $2,580. 2020 tax year: $2,560.

Property Tax Assistance Program (PTAP) will reduce your tax obligation if you meet the following income guidelines: $24,607 or less for a single person or $32,810 or less for a married couple (2021 FAGI).

The Montana Property Tax Rebate provides qualifying Montanans up to $675 of property tax relief on a primary residence in both 2023 and 2024. The qualifications to claim the rebate are at GetMyRebate.mt.gov.

The Property Tax Rebate is a rebate of up to $675 per year of property taxes paid on a principal residence. There is a rebate available for property taxes paid for Tax Year 2022 and another rebate available for property taxes paid for Tax Year 2023.

What Property Is Protected by the Montana Homestead Exemption? Montana has one of the more generous exemptions. You'll be able to protect up to $378,560 of equity in a residence, including your home, condominium, or any other dwelling and appurtenances.

Montana doesn't have a state sales tax, or similar. Therefore, an exemption certificate is not applicable.