Montana Agreement to Form Partnership in Future to Conduct Business

Description

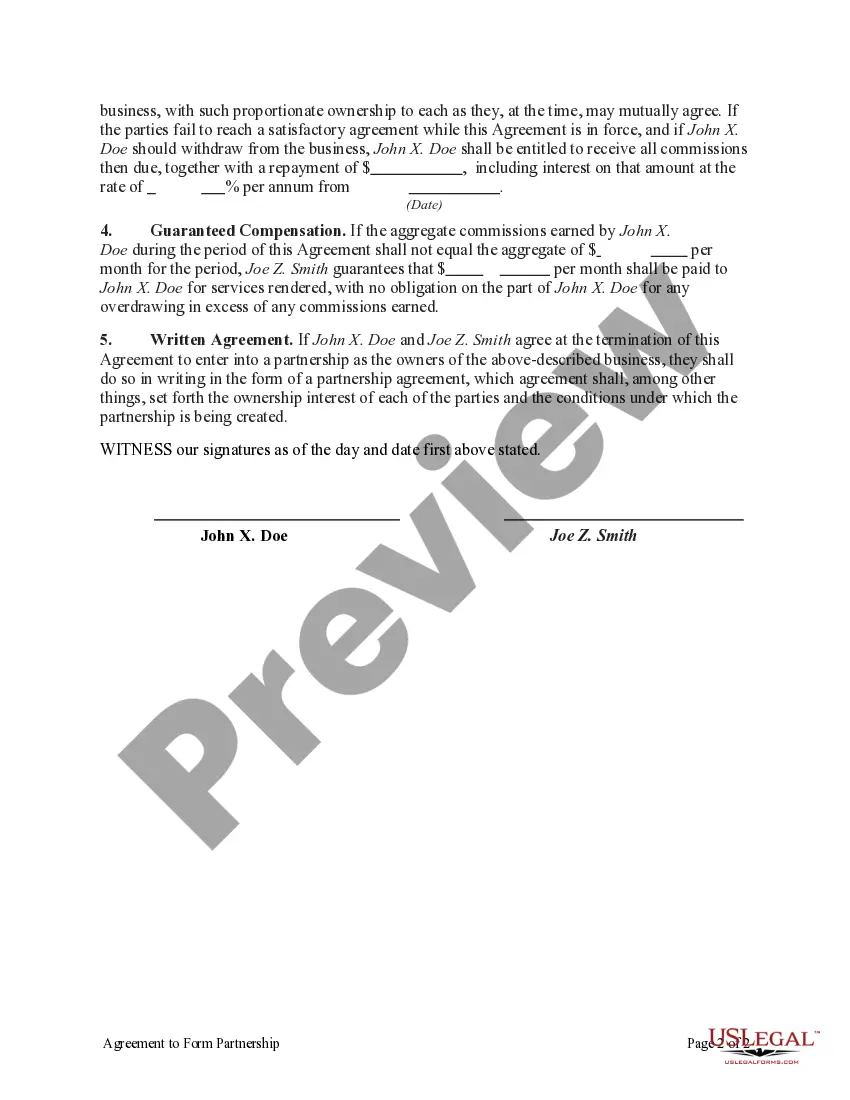

How to fill out Agreement To Form Partnership In Future To Conduct Business?

Locating the appropriate genuine document template can be quite challenging.

Of course, there are numerous designs available online, but how can you secure the genuine format you require? Utilize the US Legal Forms website.

The service offers a plethora of templates, including the Montana Agreement to Form Partnership in Future to Conduct Business, suitable for both professional and personal needs.

First, ensure you have selected the appropriate document for your city/state. You can preview the form using the Review button and check the document details to confirm it suits your needs. If the form does not satisfy your requirements, utilize the Search field to find the correct document. Once you are certain that the form is accurate, click the Get now button to obtain the document. Choose the pricing plan you prefer and provide the necessary information. Create your account and process the payment using your PayPal account or credit card. Select the download file format and retrieve the legal document template to your device. Complete, edit, print, and sign the acquired Montana Agreement to Form Partnership in Future to Conduct Business. US Legal Forms is indeed the largest collection of legal templates where you can find various document layouts. Use this service to obtain professionally crafted papers that adhere to state standards.

- All templates are vetted by specialists and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to access the Montana Agreement to Form Partnership in Future to Conduct Business.

- Utilize your account to browse the legitimate templates you have previously obtained.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

Filling out a partnership form involves detailing basic information about your business and the partners involved. Ensure you include relevant data such as names, addresses, and the specific roles of each partner. The Montana Agreement to Form Partnership in Future to Conduct Business provides a structured way to present this information, helping to avoid any miscommunications.

To write a partnership agreement sample, start with a clear layout that covers basic information about the partnership. This should include the business name, purpose, roles of partners, and terms for profit-sharing. Utilizing a Montana Agreement to Form Partnership in Future to Conduct Business template can guide you in crafting a comprehensive and effective sample.

The four types of partnerships are general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has unique features and impacts on liability and management. Understanding these differences can help you choose the right structure when drafting your Montana Agreement to Form Partnership in Future to Conduct Business.

The filing requirements for a partnership in Montana typically include submitting your Montana Agreement to Form Partnership in Future to Conduct Business to the appropriate state office. Depending on your business type, you may also need to obtain necessary licenses or permits. It's important to check local regulations as well to ensure compliance.

Filling out a partnership agreement involves gathering key information about each partner. You'll need to include details like the business name, purpose, contributions, and profit-sharing arrangements in your Montana Agreement to Form Partnership in Future to Conduct Business. Using a template can help simplify the process, ensuring you don’t miss any important details.

To form a partnership, you need at least two individuals or entities that share a common business goal. You must also prepare a Montana Agreement to Form Partnership in Future to Conduct Business that details each partner's contributions, roles, and profit sharing. Clear communication among partners is crucial to ensure everyone is on the same page from the start.

To establish a partnership, you need to complete a Montana Agreement to Form Partnership in Future to Conduct Business. This form outlines the essential terms of your partnership and ensures that all partners understand their rights and responsibilities. By using a clear and concise form, you can set a solid foundation for your future business endeavors.

Writing a simple business partnership agreement begins with identifying the names of the partners and the business structure. Next, include details such as capital contributions, profit-sharing ratios, and the duration of the partnership. Incorporating a Montana Agreement to Form Partnership in Future to Conduct Business can provide clarity and legal validity, and you can leverage Uslegalforms to access templates that help make drafting straightforward and efficient.

To create a business partnership, you and your partner should clearly define your business goals, discuss contributions, and outline each partner's responsibilities. It is essential to draft a comprehensive Montana Agreement to Form Partnership in Future to Conduct Business that details your terms and expectations. Using tools from Uslegalforms can simplify this process, ensuring all legal aspects are covered for a smooth partnership formation.

If there is no written agreement, partners may face uncertainty regarding their rights and obligations. This can lead to disputes and potential financial losses. A well-drafted Montana Agreement to Form Partnership in Future to Conduct Business can prevent such issues by detailing each partner's role and the terms of the partnership.