Montana Notice of Default on Promissory Note Installment

Description

How to fill out Notice Of Default On Promissory Note Installment?

If you wish to be thorough, obtain, or create approved document templates, utilize US Legal Forms, the premier collection of legal forms, which can be accessed online.

Employ the site's straightforward and user-friendly search to locate the documents you require. Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to obtain the Montana Notice of Default on Promissory Note Installment with just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Stay competitive and download and print the Montana Notice of Default on Promissory Note Installment with US Legal Forms. There are millions of professional and state-specific forms you can use for your individual business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to get the Montana Notice of Default on Promissory Note Installment.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

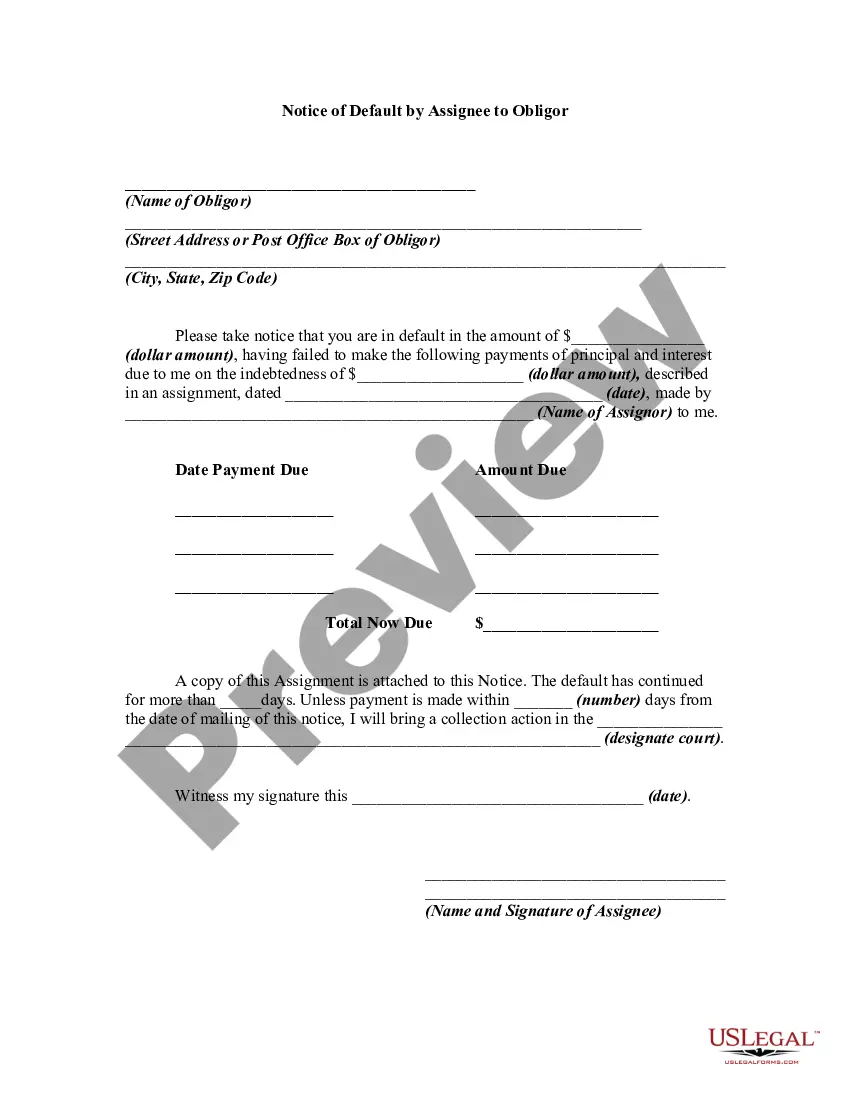

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If the form does not meet your expectations, utilize the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Acquire now button. Choose the pricing plan you prefer and enter your credentials to register an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Montana Notice of Default on Promissory Note Installment.

Form popularity

FAQ

If you default on a promissory note, the lender may initiate legal actions, including filing a claim for the amount due. The lender could also issue a Montana Notice of Default on Promissory Note Installment as part of the process, which formally indicates that you have failed to meet your obligations. This could lead to additional fees or damage to your credit rating. To avoid these consequences, it's advisable to communicate with your lender and seek a resolution.

Writing a notice of default involves clearly stating the breach of the promissory note. Be specific about the missed payments and describe how the borrower can rectify the default. Including references to the Montana Notice of Default on Promissory Note Installment will clarify that legal action may follow if the issue is not resolved promptly. Using templates from USLegalForms can simplify this process significantly.

To issue a notice of default, start by reviewing the terms outlined in the promissory note. Verify that the borrower has indeed defaulted, and then prepare a formal notification that includes pertinent details such as payment amount, due dates, and corrective actions. Mentioning the Montana Notice of Default on Promissory Note Installment can add weight to your communication. For reliable templates, USLegalForms can be a valuable resource.

When writing a letter for a defaulter, clearly state the amount due and the terms of the promissory note. Include a request for immediate payment and mention the potential consequences of not settling the debt. To ensure you comply with legal standards, consider referencing the Montana Notice of Default on Promissory Note Installment to emphasize the seriousness of the situation. For a structured approach, you can use templates available on the USLegalForms platform.

A notice of default on a promissory note is a formal document indicating that the borrower has not fulfilled their repayment obligations. It serves to inform the borrower of the default and the potential consequences that may ensue, such as legal action. Familiarizing yourself with this process can help both lenders and borrowers navigate the complexities of their agreements effectively.

Upon receiving a default notice, it is vital to review the contents carefully to understand what the lender is claiming. You have options, such as contacting the lender to discuss the situation or seeking legal advice. Taking swift action can help prevent further consequences and may lead to a resolution without legal escalation.

Receiving a notice of default is a serious matter and signals that you have failed to meet the terms of the promissory note. It’s important to take the notice seriously and respond promptly, as it may initiate a legal process. Consider contacting a legal expert who can help you navigate your options and potentially resolve the issue before it escalates.

If a borrower defaults on a promissory note, several steps may follow, starting with potential legal action by the lender. The lender may file a Montana Notice of Default on Promissory Note Installment to formally notify the borrower of the default status. This can lead to the borrower’s credit being affected, legal judgments, or even foreclosure if secured by collateral.

Writing a notice of default involves outlining the specifics of the promissory note, including the date of the original agreement and details about the default. Be clear and concise while stating the amount owed and any applicable timelines for resolution. Utilizing a template available on USLegalForms can simplify this process and ensure you cover all necessary elements.

When a borrower defaults on a promissory note, the lender should first review the terms of the agreement to confirm the default. Following this, it's essential to communicate with the borrower to understand their situation. Document all interactions and consider sending a Montana Notice of Default on Promissory Note Installment, as this formal notice can pave the way for potential remedies.