Montana Articles of Association

Description

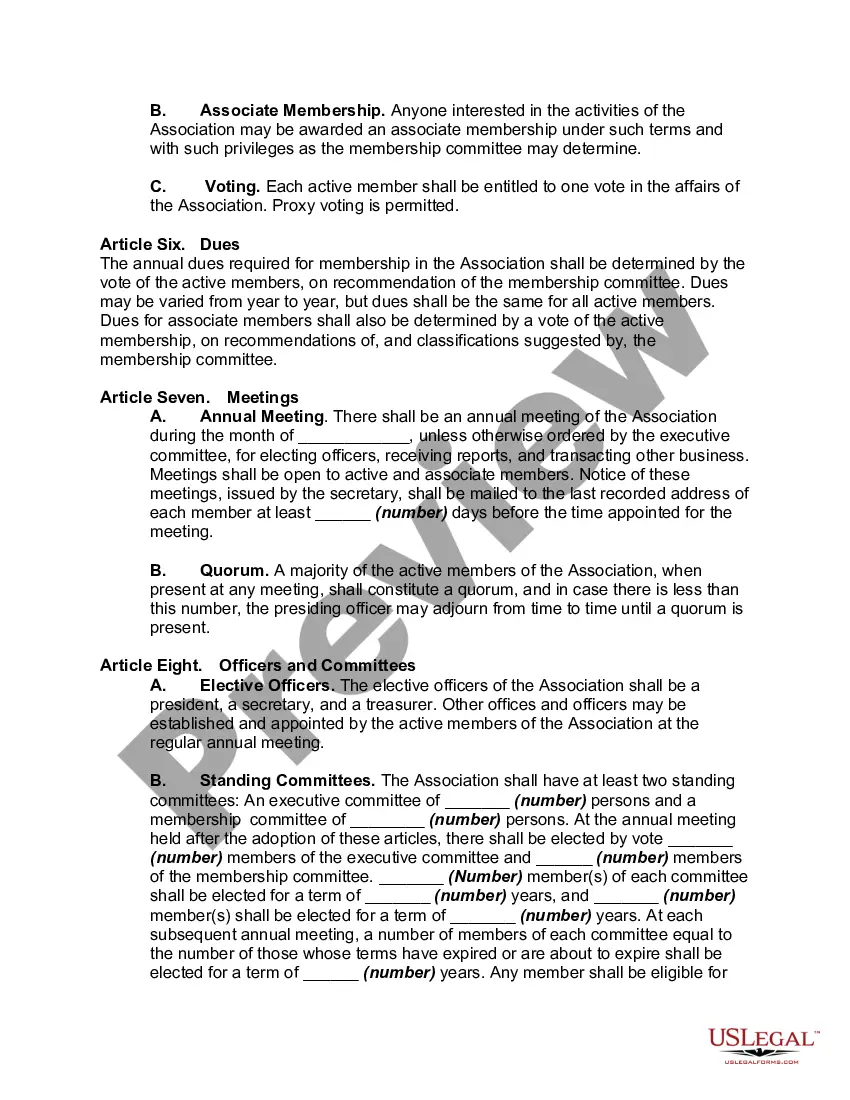

Statutes in some jurisdictions require that the constitution or articles of association, and the bylaws, be acknowledged or verified. In some jurisdictions, it is required by statute that the constitution or articles of association be recorded, particularly where the association or club owns real property or any interest in real property.

How to fill out Articles Of Association?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse assortment of legal form templates that you can obtain or create.

Using the platform, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Montana Articles of Association in moments.

If you already have an account, Log In and obtain the Montana Articles of Association from the US Legal Forms database. The Download button will be available on every form you view. You have access to all previously acquired forms from the My documents section of your profile.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Montana Articles of Association. Every form you add to your account has no expiration and is yours permanently. So, if you wish to obtain or print another copy, just visit the My documents section and click on the form you need. Access the Montana Articles of Association with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal needs and specifications.

- If you wish to use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure to select the correct form for your location.

- Click the Review button to examine the form's details.

- Read the form description to confirm you have chosen the right one.

- If the form does not meet your needs, utilize the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, verify your choice by clicking the Get now button.

- Then, choose your preferred payment method and provide your information to create an account.

Form popularity

FAQ

Choosing a Montana LLC offers several advantages, including limited liability protection for its owners. This means your personal assets are generally safe from business debts and claims. Additionally, the state has flexible management regulations, allowing you control over your business operations. By forming a Montana LLC, you also benefit from a business-friendly tax structure, making it an attractive option for many entrepreneurs.

To start an LLC in Montana, you need to file your Montana Articles of Association with the Secretary of State. Additionally, you must choose a unique name for your LLC that complies with Montana naming rules. It's also essential to designate a registered agent who can receive legal documents on behalf of the LLC. Lastly, obtaining an Employer Identification Number (EIN) may be necessary for tax purposes.

Yes, it's mandatory to have a Registered Agent for your LLC in Montana. This agent acts as your business's official point of contact for legal documents and communications. Having a Registered Agent ensures that your Montana Articles of Association remain compliant with state regulations. This role is crucial for maintaining transparency and reliability in your business operations.

Filing an annual report in Montana is a straightforward process. You can submit your report online through the Montana Secretary of State's website, or you may opt for a paper filing. Ensure that your Montana Articles of Association are current before you file, as this will facilitate a smoother process. Additionally, using platforms like uslegalforms can help simplify your filing experience.

The Articles of Organization in Montana remain effective until the LLC is dissolved or terminated. This means your business can operate under the established Articles as long as you stay in compliance with state regulations. If you decide to make significant changes to your business structure or name, you may need to update your Articles. For ongoing compliance and updates, uslegalforms can provide guidance to keep your Montana Articles of Association current.

To register an assumed name in Montana, also known as a 'DBA' (Doing Business As), you must file a registration application with the county in which your business operates. The application includes the desired name and relevant business details. After processing the application, you can legally conduct business under that assumed name. For assistance, uslegalforms provides valuable resources to navigate the registration process effectively.

Yes, all LLCs in Montana must have Articles of Organization, as it is the primary document required for formation. This legal paperwork officially establishes your business entity in the state. Without filing these Articles, your LLC cannot operate legally. Utilizing services from uslegalforms can streamline this process and ensure compliance with all requirements related to your Montana Articles of Association.

To form an LLC in Montana, you need to file Articles of Organization with the Secretary of State. This document includes basic information about your business, such as its name and registered agent. Additionally, obtaining an Employer Identification Number (EIN) from the IRS is crucial for tax purposes. By ensuring all these elements are in place, you set a solid foundation for your Montana Articles of Association.

Yes, you need Articles of Organization to formally establish your LLC in Montana. Filing this document is a critical step to gaining legal recognition for your business. Moreover, when you prepare your Articles of Organization, consider the insights from Montana Articles of Association to ensure that you meet all state requirements effectively.

No, an LLC does not use articles of association, but it does file Articles of Organization. This document serves as the founding paperwork for your LLC, outlining its basic information. For many business owners, understanding how Montana Articles of Association differ from LLC requirements is essential for meeting legal standards.