Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Declaration of Gift Over Several Year Period

Description

How to fill out Declaration Of Gift Over Several Year Period?

Selecting the appropriate legal document template can be a challenge. Of course, there are numerous templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website. The service offers thousands of templates, including the Montana Declaration of Gift Over Several Year Period, which can be utilized for both business and personal purposes. All the forms are verified by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the Montana Declaration of Gift Over Several Year Period. Use your account to review the legal forms you have previously obtained. Navigate to the My documents tab in your account to access another copy of the document you need.

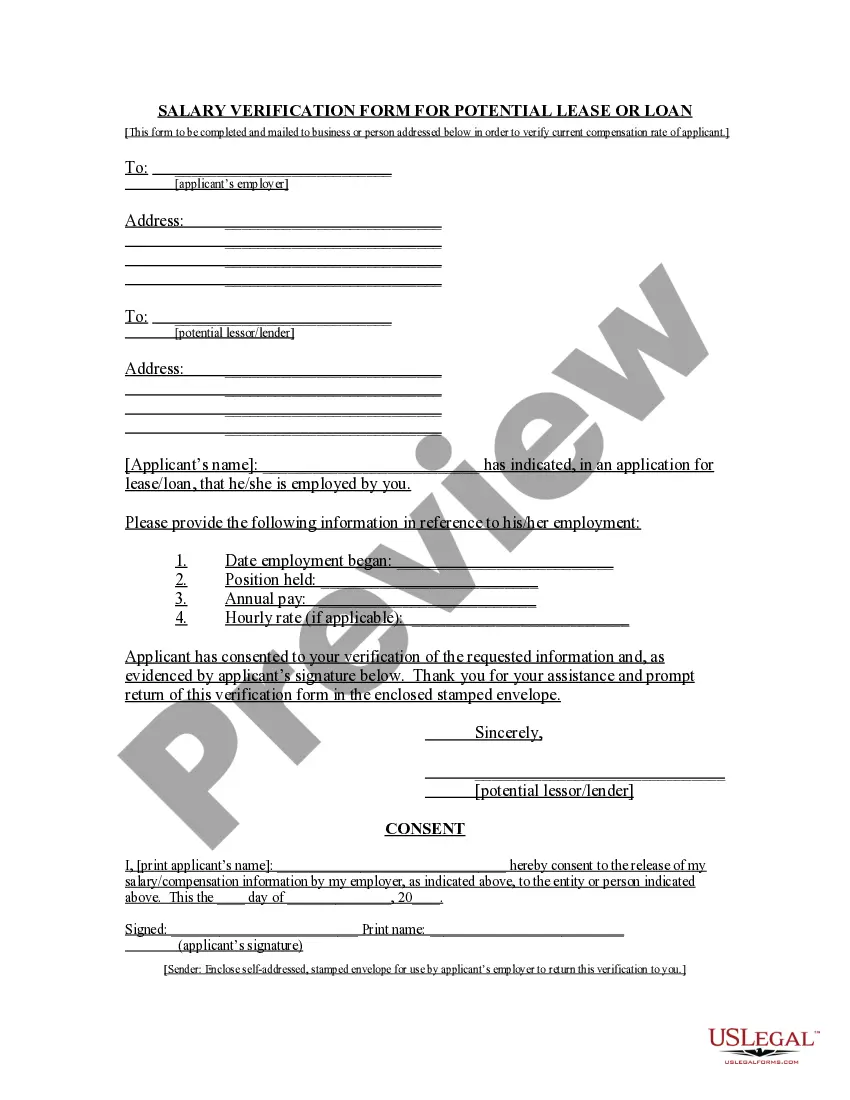

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/state. You can examine the form using the Review option and read the form description to confirm it is the right one for you. If the form does not meet your needs, use the Search field to find the appropriate template.

Utilize the service to download professionally crafted documents that conform to state regulations.

- Once you are confident that the form is suitable, click on the Acquire now button to obtain the form.

- Choose the pricing plan you prefer and provide the necessary information.

- Create your account and complete the purchase using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, print, and sign the obtained Montana Declaration of Gift Over Several Year Period.

- US Legal Forms is the largest repository of legal documents where you can find a variety of paper templates.

Form popularity

FAQ

Yes, there is a statute of limitations on gift tax, typically three years from the date the gift tax return is filed. This timeframe allows the IRS to assess any additional taxes owed before it becomes too late. It is important to accurately document gifts using tools like the Montana Declaration of Gift Over Several Year Period to ensure compliance and transparency. If you have questions about gift taxes, consider exploring resources on the US Legal Forms platform for guidance.

The tax loophole for inherited property in Montana often involves taking advantage of the Montana Declaration of Gift Over Several Year Period. This arrangement enables individuals to transfer property over time, allowing them to utilize gift exclusions effectively and avoid hefty taxes on inherited assets. It's a powerful tool that can help preserve the value of your estate while providing for your loved ones. Look into resources like uslegalforms to navigate this process effectively.

Montana does not impose an inheritance tax, making it an attractive state for estate planning. However, it is essential to understand how the Montana Declaration of Gift Over Several Year Period can help in estate transfer. This methodology allows you to manage your gifts smartly, ensuring your property benefits your heirs without unnecessary tax burdens. Stay informed about the regulations to maximize your estate's value.

Yes, you can gift more than $3,000 per year under the Montana Declaration of Gift Over Several Year Period. However, any amount exceeding this threshold may require careful planning to avoid potential tax implications. Spreading gifts over several years can be an effective strategy for larger amounts, allowing you to effectively transfer wealth without incurring heavy taxes. Consider consulting with uslegalforms for detailed guidance tailored to your situation.

The Duttons successfully avoided the inheritance tax by leveraging the Montana Declaration of Gift Over Several Year Period. This legal strategy allows individuals to make significant gifts spread over multiple years, which can help minimize tax liabilities. By utilizing this approach, they effectively reduced the taxable estate, ensuring a smoother transfer of wealth. You can also explore this option to secure a tax-efficient legacy for your loved ones.

Yes, Form 709 can be filed electronically through certain tax software platforms or by a tax professional. Filing electronically streamlines the process and can reduce the potential for errors that occur with paper forms. If you’re managing your giving strategy with the Montana Declaration of Gift Over Several Year Period, electronic filing can help you keep track of your gifts more efficiently.

Reporting a lifetime gift tax exemption involves filling out Form 709, where you declare your gifts over the years. This form is crucial for accurately tracking your exemptions and ensuring proper tax compliance. Using the Montana Declaration of Gift Over Several Year Period can assist in organizing your gifts and simplifying the reporting process.

The annual gift exclusion amount can change year to year, allowing you to gift a specific sum to individuals without triggering gift tax. For 2023, the exclusion is $17,000 per recipient, which can significantly impact your financial planning. Utilizing the Montana Declaration of Gift Over Several Year Period can help you plan your gifts efficiently to ensure compliance and maximize your benefits.

To avoid Montana inheritance tax on property, consider strategies such as gifting your property during your lifetime or utilizing trusts. Gifting can allow you to make use of your lifetime gift exemption, while a trust can help manage your assets effectively. Engaging with the Montana Declaration of Gift Over Several Year Period can further support your planning efforts and help you avoid unintended tax consequences.

To report your lifetime gift exemption, you must complete Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return. This form records your gifts and indicates if you are using your lifetime exemption, which allows you to gift larger amounts over time without incurring tax. The Montana Declaration of Gift Over Several Year Period may also be relevant, as it assists in tracking your gifts and ensures you stay compliant with tax regulations.