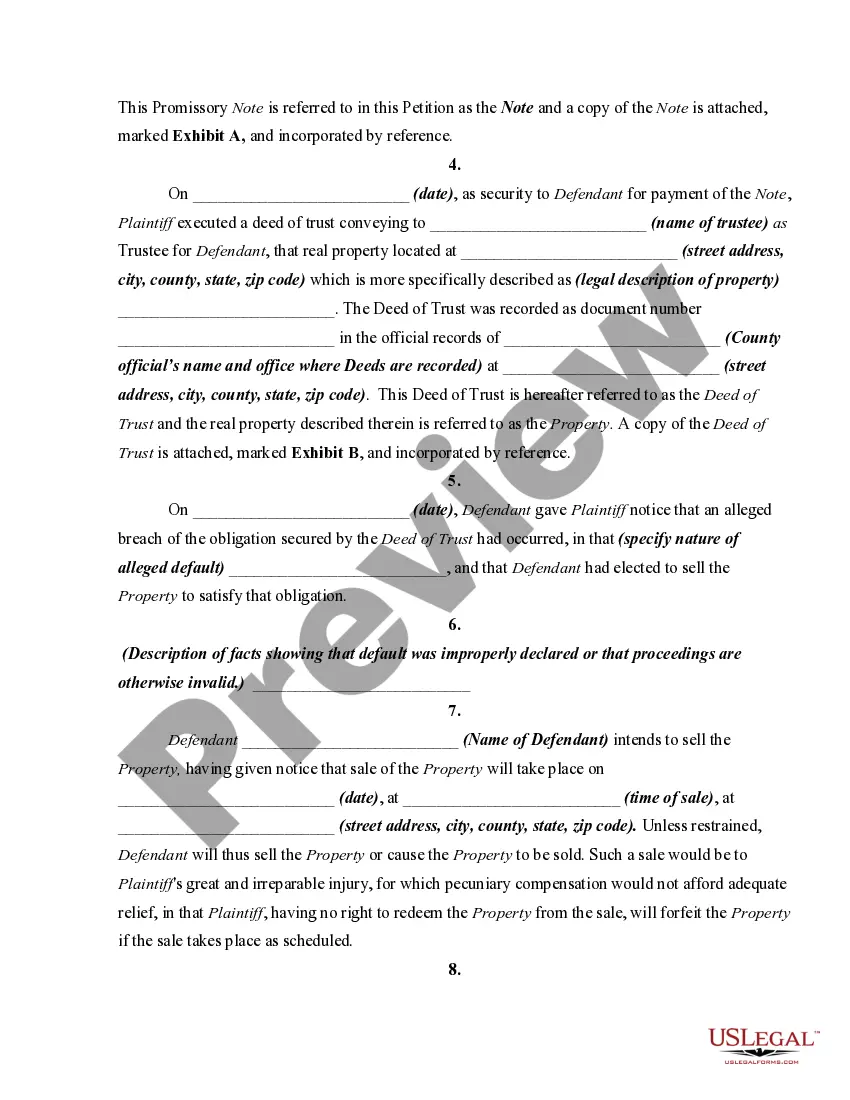

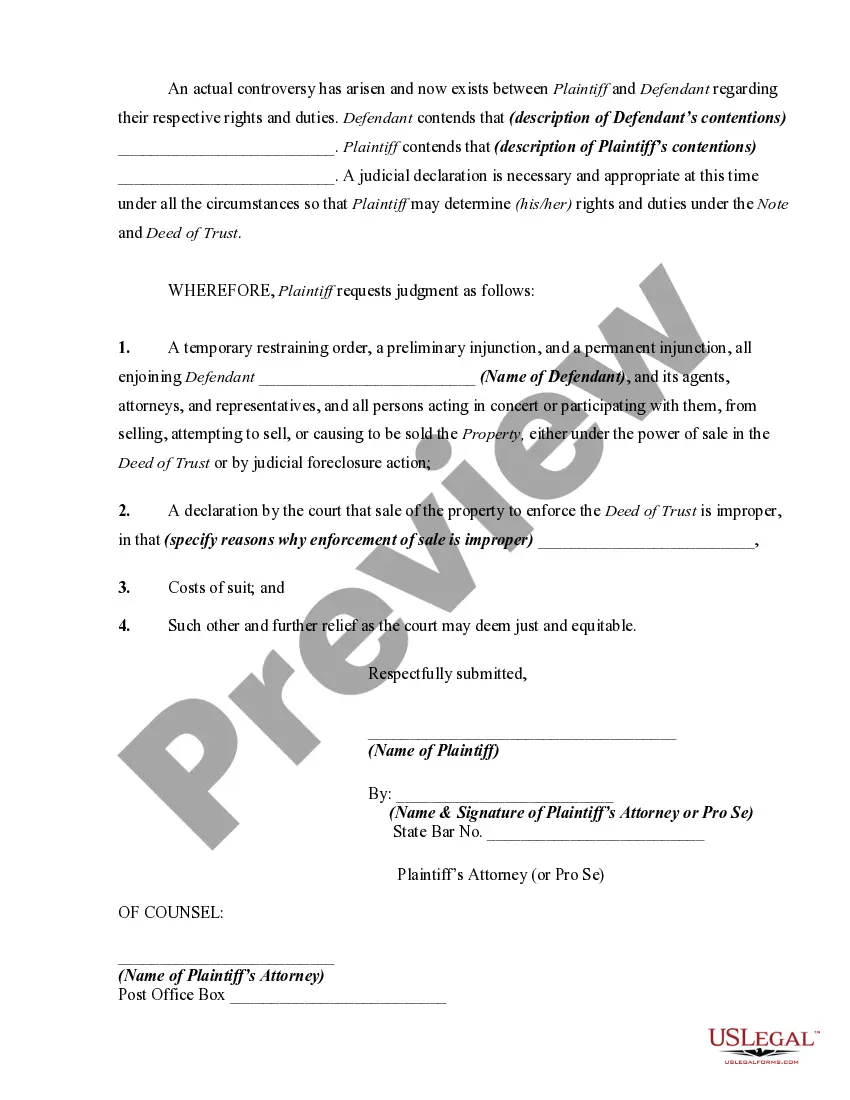

The courts have inherent power to restrain the sale of mortgaged premises in foreclosure proceedings, but are reluctant to exercise such power except where it is shown that particular circumstances, extrinsic to the instrument, would render its enforcement in this manner inequitable and work irreparable injury, and that complainant has no adequate remedy at law. Furthermore, a party must show a probable right of recovery in order to obtain a temporary injunction of a foreclosure action.

Montana Petition or Complaint to Enjoin Nonjudicial Foreclosure Sale and for Declaratory Relief

Description

How to fill out Petition Or Complaint To Enjoin Nonjudicial Foreclosure Sale And For Declaratory Relief?

It is possible to commit hrs online trying to find the legitimate record web template that fits the federal and state needs you will need. US Legal Forms supplies a huge number of legitimate types that are analyzed by professionals. It is simple to acquire or printing the Montana Petition or Complaint to Enjoin Nonjudicial Foreclosure Sale and for Declaratory Relief from the assistance.

If you already have a US Legal Forms bank account, you are able to log in and click the Obtain button. Next, you are able to complete, revise, printing, or indication the Montana Petition or Complaint to Enjoin Nonjudicial Foreclosure Sale and for Declaratory Relief. Every legitimate record web template you purchase is your own permanently. To get an additional version for any obtained develop, visit the My Forms tab and click the corresponding button.

If you use the US Legal Forms web site initially, stick to the straightforward guidelines listed below:

- Initially, make certain you have selected the right record web template for that county/town of your choosing. Look at the develop description to ensure you have picked the appropriate develop. If available, make use of the Preview button to look from the record web template as well.

- In order to find an additional variation of your develop, make use of the Look for area to discover the web template that meets your needs and needs.

- When you have found the web template you want, click Acquire now to continue.

- Find the pricing prepare you want, key in your references, and register for a free account on US Legal Forms.

- Comprehensive the deal. You can utilize your credit card or PayPal bank account to purchase the legitimate develop.

- Find the structure of your record and acquire it for your system.

- Make alterations for your record if possible. It is possible to complete, revise and indication and printing Montana Petition or Complaint to Enjoin Nonjudicial Foreclosure Sale and for Declaratory Relief.

Obtain and printing a huge number of record themes using the US Legal Forms Internet site, that offers the biggest assortment of legitimate types. Use specialist and status-certain themes to deal with your small business or person requirements.

Form popularity

FAQ

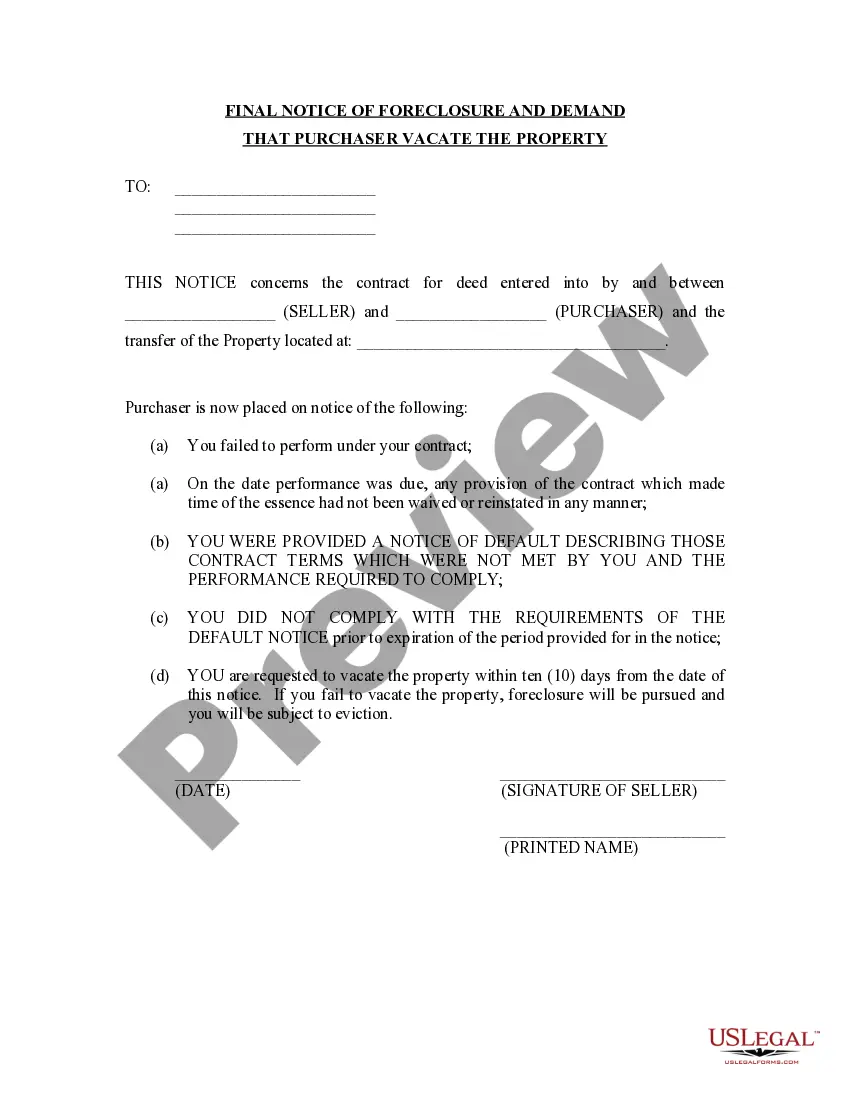

A deed in lieu of foreclosure is a contract between a lender and a borrower where the borrower transfers property to the lender. In turn, the lender waives the borrower's mortgage debt and does not pursue foreclosure.

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.

A Deed in Lieu does not clear second (or even third) mortgages, and therefore will not allow the lender to take clear title to the property. (These are sometimes referred to as junior liens.) And if the Deed in Lieu is accepted, the secondary lender may come after you for the deficiency.

Reinstating the Loan Texas law allows the borrower to block a nonjudicial foreclosure sale by "reinstating" the loan (paying the overdue amount) within 20 days after the lender serves the notice of default by mail.

The state of Montana allows 150 days before your home can be fully foreclosed on, but that means that you will be notified by the bank after one missed payment. You must make recompense with the bank or they will take your home, claim it and eventually sell it.

Redemption means paying off the loan, plus interest and costs, to get your property back after the foreclosure sale. In Montana, there is no right of redemption after a non-judicial foreclosure sale. However, if your lender forecloses judicially, you have 1 year after the sale to redeem your property.

Generally, homeowners using short sales or deeds in lieu are required to pay tax on the amount of the forgiven debt?but not if they qualify for the Qualified Principal Residence Indebtedness (QPRI) exclusion. The QPRI exclusion was set to expire on January 1, 2021, but was extended to January 1, 2026.