Montana Revocable Trust for House

Description

How to fill out Revocable Trust For House?

You can allocate time on the web seeking to locate the valid document template that suits the federal and state requirements you need.

US Legal Forms offers a substantial array of valid forms that can be examined by experts.

It's easy to download or print the Montana Revocable Trust for House from our services.

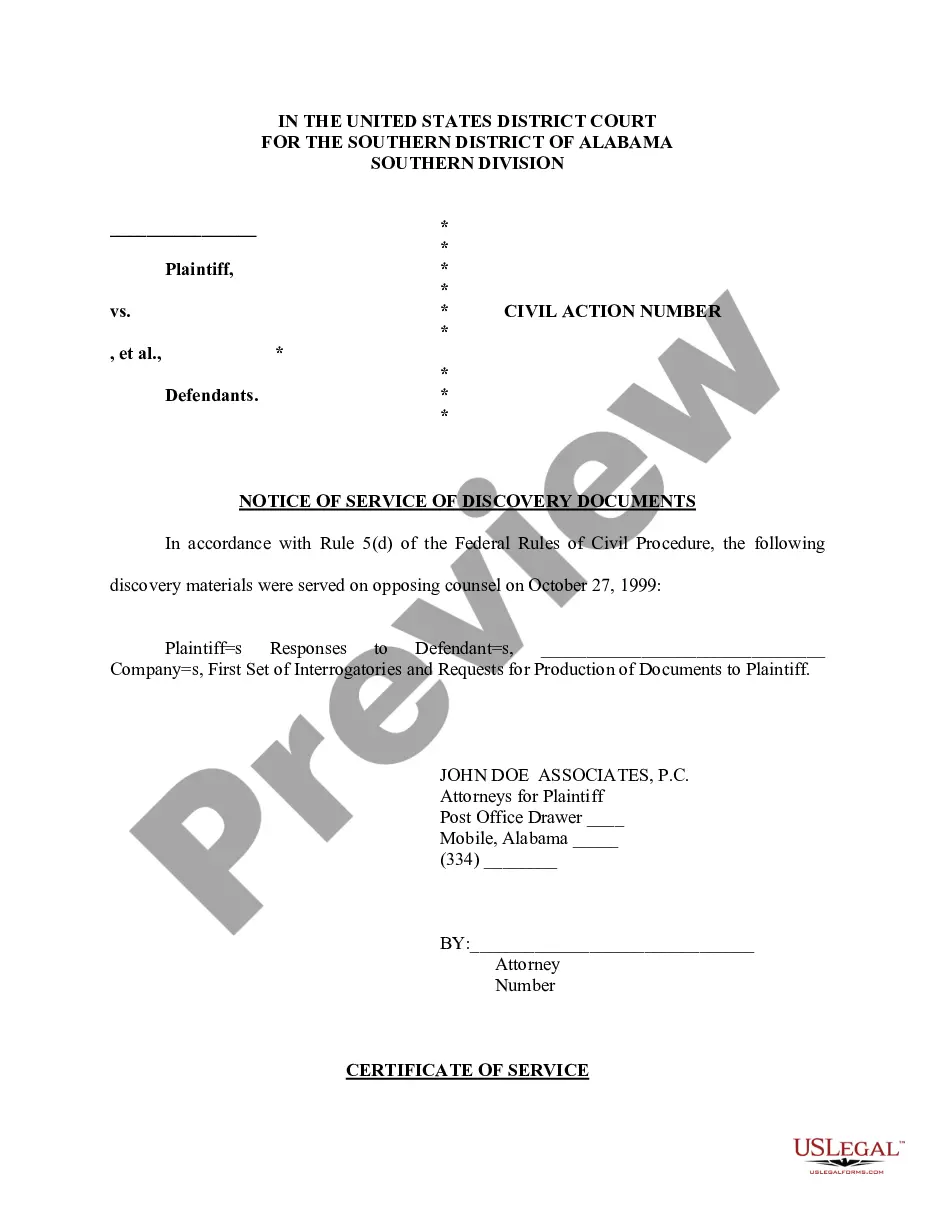

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Montana Revocable Trust for House.

- Each valid document template you buy is yours permanently.

- To obtain another copy of the purchased form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form description to confirm you have picked the right form.

Form popularity

FAQ

The primary downfall of maintaining a trust, particularly a Montana Revocable Trust for House, is the responsibility it places on the trustee. The trustee must manage the assets wisely and adhere to the trust's terms, all while navigating legal obligations. If the trustee fails to act in the best interests of the beneficiaries, it can lead to lawsuits or financial loss. As a result, choosing a trustworthy and responsible person for this role is paramount.

One disadvantage of a family trust, such as a Montana Revocable Trust for House, is the potential for family disputes over asset distribution. Trusts can sometimes breed tension among family members if there are misunderstandings regarding the terms. Transparency in the trust's structure and clear communication among family members can help mitigate these issues. However, it's crucial to weigh the emotional aspects alongside the financial advantages.

For tax purposes, a Montana Revocable Trust for House is typically treated like an individual in the eyes of the IRS. This means that the income generated by the trust must be reported on the grantor's personal tax return. It’s essential to maintain accurate records and understand the reporting requirements. Working with a tax professional can provide clarity and help ensure compliance with tax laws.

To establish a trust in Montana, you typically need to create a trust document that outlines the terms clearly. While the Montana Revocable Trust for House can be set up without a lawyer, consulting a legal expert ensures compliance with state laws. Once the document is ready, sign it in front of a notary. If you are dealing with real estate, ensure the property is transferred into the trust properly to ensure that it operates as intended.

Deciding whether to place assets in a trust is a significant choice. A Montana Revocable Trust for House can offer your parents greater control over their assets during their lifetime, and allow for easier management after their passing. It can help avoid probate, which simplifies the transfer of their home and other properties. This arrangement can also provide peace of mind, knowing that their wishes will be honored.

While using a Montana Revocable Trust for House offers many benefits, there are also disadvantages to consider. For example, transferring your home into the trust can incur costs, such as potential attorney fees and recording fees. Moreover, some homeowners may face complications with their mortgage lender if they do not inform them of the transfer. It's essential to weigh these factors against the advantages to ensure it aligns with your estate planning goals.

One of the biggest mistakes parents make when establishing a Montana Revocable Trust for House is failing to properly fund the trust. If assets are not transferred into the trust, they remain part of the parents' estate, which can lead to complications during probate. Additionally, parents often forget to review and update the trust as their circumstances change. Keeping the trust current ensures it effectively serves its intended purpose.

While a Montana Revocable Trust for House offers various advantages, there are downsides to consider. A notable drawback is that a revocable trust does not provide asset protection from creditors, which means that your home could still be at risk. Additionally, setting up and managing a trust may involve time and costs, so it's important to evaluate these factors when deciding.

Placing your house in a Montana Revocable Trust for House can offer significant benefits. This action can simplify the transfer of assets to your beneficiaries, avoiding probate, which often takes time and incurs costs. Additionally, it can provide privacy since the trust does not become part of public record, allowing your wishes to be fulfilled without unnecessary complications.

Yes, you can place a house with a mortgage into a Montana Revocable Trust for House. However, it is essential to inform your mortgage lender about the trust. The lender may require you to maintain payments and adhere to other terms of the mortgage. This strategy can ensure that your property is managed according to your wishes, even if something happens to you.