Montana Triple Net Lease for Commercial Real Estate

Description

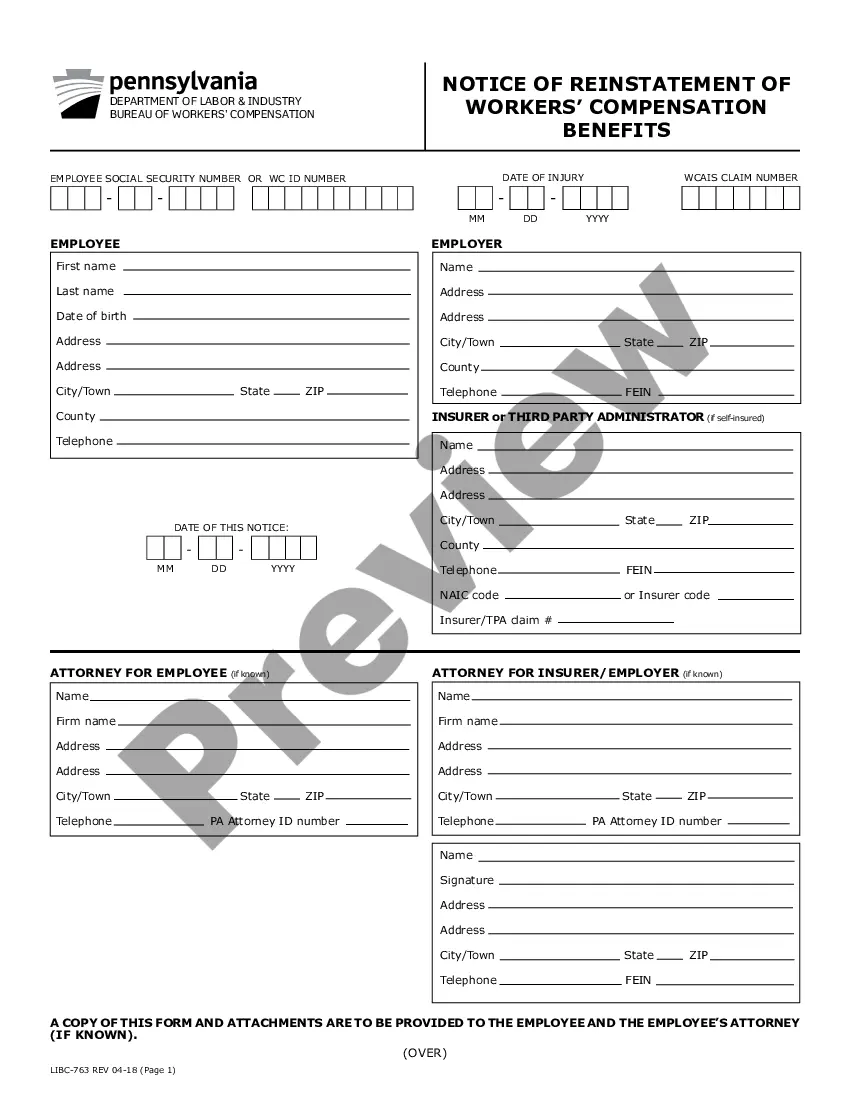

How to fill out Triple Net Lease For Commercial Real Estate?

Are you in a setting where you often need documents for either business or personal reasons nearly every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, such as the Montana Triple Net Lease for Commercial Real Estate, designed to meet both federal and state requirements.

Once you find the correct document, click Buy now.

Select the pricing plan you desire, provide the necessary information to create your account, and complete the payment via PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the template for Montana Triple Net Lease for Commercial Real Estate.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the document you need and ensure it corresponds to the correct city/region.

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the appropriate document.

- If the document doesn't match your expectations, utilize the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

To get started in a Montana Triple Net Lease for Commercial Real Estate, first, understand the basic terms and structures of these agreements. Research different types of properties that typically offer triple net leases, like retail spaces or office buildings. You can then consult resources like USLegalForms to find valuable templates and legal guidance tailored to your needs. Finally, consider your investment goals to ensure that a triple net lease aligns with your commercial real estate strategy.

In a commercial lease, a triple net lease means the tenant is responsible for three critical expenses: property taxes, insurance, and maintenance costs. This structure allows landlords to alleviate the burden of property management while providing transparency to tenants. When considering a Montana Triple Net Lease for Commercial Real Estate, understanding these responsibilities is vital for effective financial planning. This arrangement can lead to more flexible lease terms and potentially lower base rent.

Many commercial leases are structured as triple net leases, especially in the Montana Triple Net Lease for Commercial Real Estate market. This format benefits landlords, as tenants cover most property expenses, including taxes, insurance, and maintenance. Businesses often prefer this arrangement because it provides predictable rent without unexpected financial burdens. It's crucial to analyze the terms carefully before entering into such agreements.

Tenants may choose a triple net lease for several reasons, including lower base rent and greater control over property management. This arrangement allows tenants to manage costs directly, which can be appealing for businesses looking to customize their space. Additionally, a Montana Triple Net Lease for Commercial Real Estate can offer long-term stability for tenants planning to operate in a particular location.

A NNN lease, or triple net lease, is a leasing agreement where the tenant assumes responsibility for costs beyond just rent. This includes property taxes, insurance, and maintenance expenses. It's a common structure in commercial real estate, offering landlords predictable income while providing tenants control over their space in a Montana Triple Net Lease for Commercial Real Estate.

Structuring a triple net lease involves outlining responsibilities clearly in the lease document. Specify the base rent amount, due dates, and categories of costs the tenant will cover. Transparency is crucial to prevent misunderstandings, especially in a Montana Triple Net Lease for Commercial Real Estate where financial obligations can be substantial.

To calculate commercial rent in a triple net lease, first determine the base rent and then add estimated costs for property taxes, insurance, and maintenance. Knowing the square footage of the space is vital, as these costs typically apply on a per-square-foot basis. A reliable formula will help you gain a clear financial picture when considering a Montana Triple Net Lease for Commercial Real Estate.

One downside of a triple net lease is the additional financial responsibility placed on the tenant. In this arrangement, the tenant must cover taxes, insurance, and maintenance costs, which can vary significantly over time. As a result, it is essential to assess total projected expenses before entering into a Montana Triple Net Lease for Commercial Real Estate.

$12 sf nnn refers to a rental rate of twelve dollars per square foot on a triple net lease basis. This means the tenant pays the base rent along with certain additional costs such as property taxes, insurance, and maintenance. Understanding this helps potential tenants analyze their financial commitment in a Montana Triple Net Lease for Commercial Real Estate.

Writing a commercial lease involves detailing terms like rent, duration, and responsibilities. Start by defining the property and the parties involved. Then, outline the specific obligations of both the landlord and tenant. Using a trusted platform like uslegalforms can simplify the process, ensuring you create a comprehensive Montana Triple Net Lease for Commercial Real Estate.