This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Privacy and Confidentiality Policy for Credit Counseling Services

Description

How to fill out Privacy And Confidentiality Policy For Credit Counseling Services?

Locating the correct legitimate document format can be quite challenging.

Certainly, there are numerous templates accessible online, but how can you acquire the valid form you desire.

Utilize the US Legal Forms website.

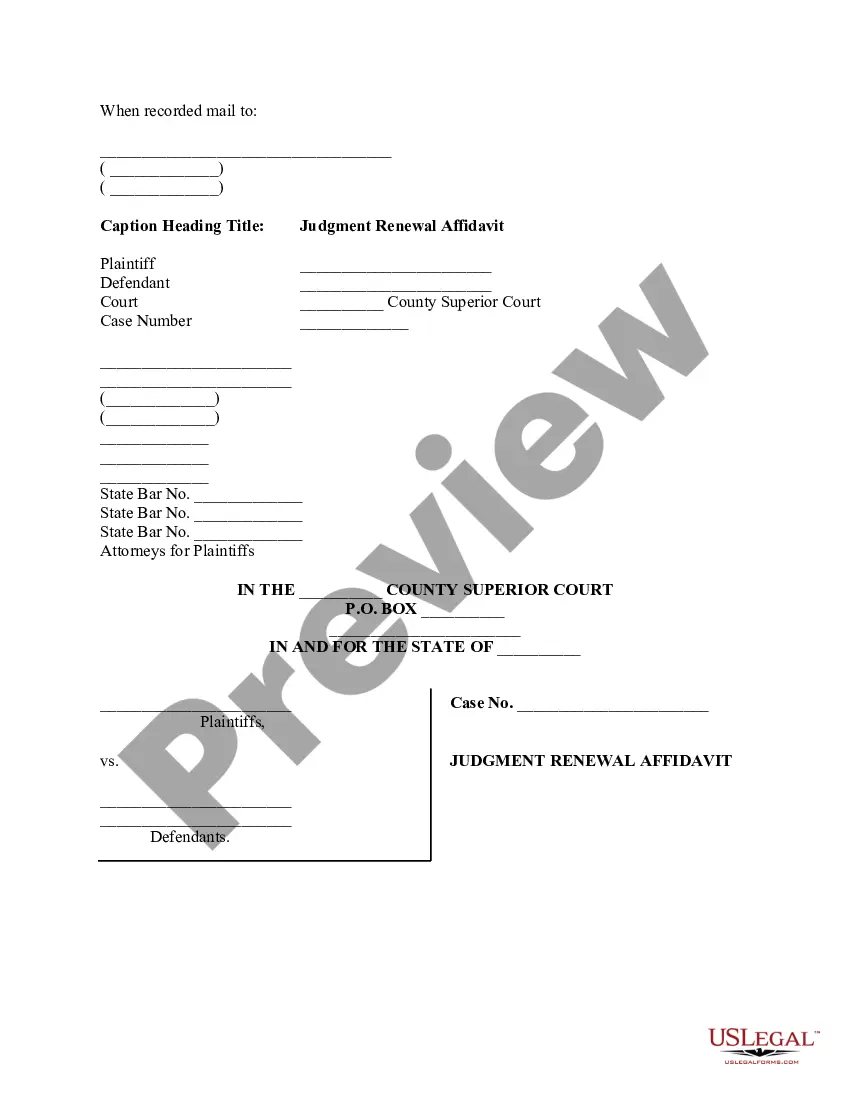

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Preview button and check the form description to ensure it is appropriate for you.

- The service offers thousands of templates, such as the Montana Privacy and Confidentiality Policy for Credit Counseling Services, suitable for business and personal needs.

- All the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to locate the Montana Privacy and Confidentiality Policy for Credit Counseling Services.

- Use your account to view the legal forms you may have ordered previously.

- Navigate to the My documents tab in your account and obtain another copy of the document you need.

Form popularity

FAQ

The invasion of privacy law in Montana outlines specific rights and protections for individuals against unauthorized access to their personal space or information. This law provides a framework for what constitutes a breach of privacy, helping protect residents' dignity. It's vital to stay informed about these regulations, especially when dealing with sensitive matters covered by the Montana Privacy and Confidentiality Policy for Credit Counseling Services.

Montana recently enacted a privacy law that enhances consumer protection regarding personal data. This law aims to give individuals more control over their information and outlines how organizations should handle such data. By adhering to the Montana Privacy and Confidentiality Policy for Credit Counseling Services, you can ensure that your practices align with these new legal standards.

In Montana, it is generally illegal to record conversations without obtaining consent from all parties involved. This law aligns with the state's commitment to upholding privacy rights. If you work with or around sensitive information, knowing the Montana Privacy and Confidentiality Policy for Credit Counseling Services is crucial for compliance.

Montana upholds specific employee privacy laws that protect workers from unwarranted surveillance and disclosures of personal information by employers. This includes laws regarding electronic communications and the right to privacy in the workplace. Familiarizing yourself with these laws is essential, especially in relation to the Montana Privacy and Confidentiality Policy for Credit Counseling Services.

A violation of invasion of privacy occurs when an individual's personal space, information, or privacy is intruded upon without consent. This can include unauthorized surveillance, sharing private information, or misleading representation. Understanding the implications of the Montana Privacy and Confidentiality Policy for Credit Counseling Services will help you navigate these complex situations effectively.

The Montana Consumer Data Privacy Act includes several exemptions, such as data collected by certain governmental bodies and information governed by specific federal laws. These exemptions help clarify which entities must comply with the act, reflecting the state's focus on consumer protection. For credit counseling services, understanding these exemptions is essential to ensure compliance with the Montana Privacy and Confidentiality Policy. This knowledge empowers you to navigate the complexities of consumer data handling effectively.

The Montana Privacy Act focuses on protecting individuals' personal information by establishing clear guidelines for data collection and usage. This act complements the Montana Privacy and Confidentiality Policy for Credit Counseling Services. Understanding its provisions helps credit counseling agencies manage client data responsibly. By adhering to these regulations, you foster a compliant and secure environment for your clients.

Similar to the Consumer Data Privacy Act, other Montana privacy laws typically grant businesses a 30-day cure period to rectify any deficiencies. This allowance underscores the state's commitment to providing businesses with the chance to comply. Adapting to these timelines enhances your credit counseling service's ability to respect clients' privacy. Utilizing resources like uslegalforms can simplify the process of aligning with these laws.

Yes, Montana explicitly recognizes a constitutional right to privacy. This foundational principle enhances the protection offered by the Montana Privacy and Confidentiality Policy for Credit Counseling Services. By respecting this right, credit counseling services can foster trust and assurance among clients. It's vital to stay abreast of privacy rights to ensure compliance and build confidence with your clientele.

The threshold for the Montana Consumer Data Privacy Act includes any entity that processes data for at least 50,000 Montana residents or derives more than 25% of its gross revenue from selling personal data. Understanding these thresholds is essential for credit counseling services to determine their obligations under the Montana Privacy and Confidentiality Policy. Being aware will enable you to tailor your data practices accordingly.