The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor. If the debtor tells the creditor the name of his attorney, any future contacts must be made with the attorney and not with the debtor.

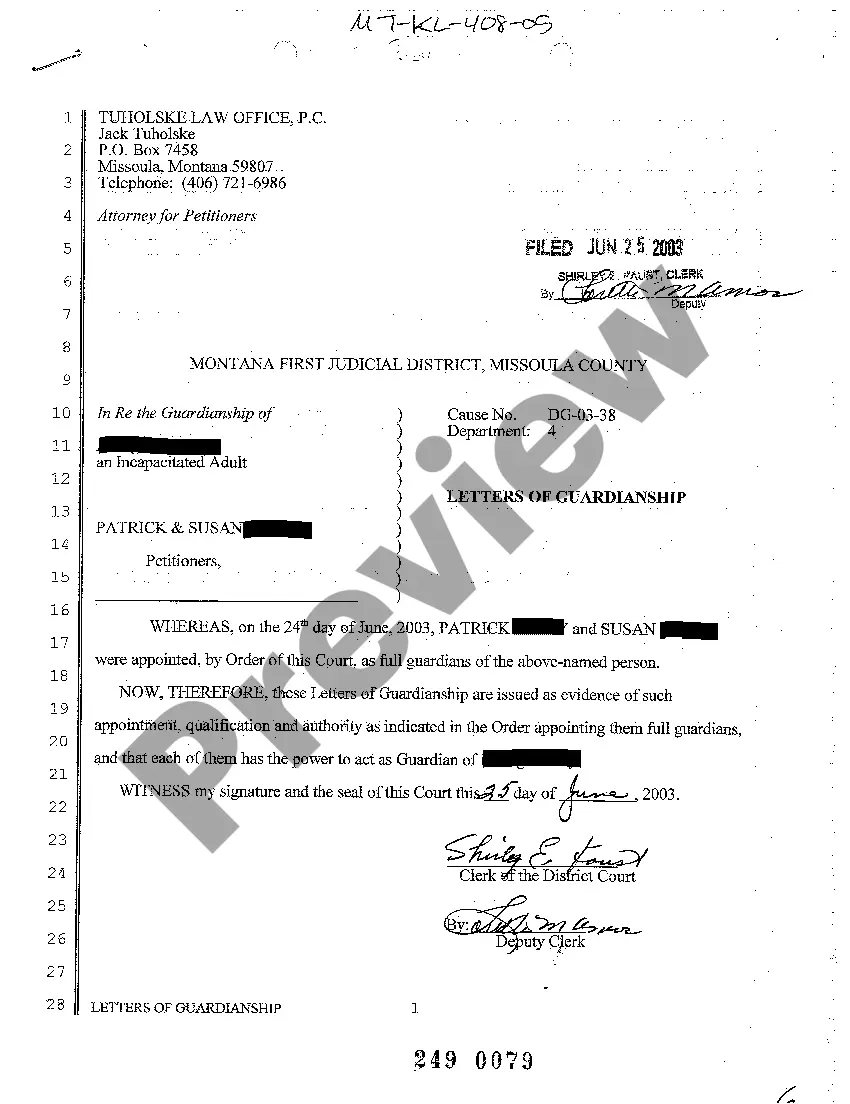

Montana Letter Informing Debt Collector that Debtor is Represented by an Attorney

Description

How to fill out Letter Informing Debt Collector That Debtor Is Represented By An Attorney?

If you wish to total, down load, or produce legal file layouts, use US Legal Forms, the largest selection of legal types, that can be found online. Take advantage of the site`s simple and easy handy look for to discover the files you will need. Numerous layouts for business and specific uses are sorted by categories and claims, or keywords and phrases. Use US Legal Forms to discover the Montana Letter Informing Debt Collector that Debtor is Represented by an Attorney with a few mouse clicks.

In case you are already a US Legal Forms consumer, log in to your accounts and click on the Acquire option to get the Montana Letter Informing Debt Collector that Debtor is Represented by an Attorney. You may also access types you earlier downloaded from the My Forms tab of the accounts.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have chosen the shape for the correct metropolis/nation.

- Step 2. Utilize the Preview solution to check out the form`s content material. Don`t overlook to learn the information.

- Step 3. In case you are not satisfied with the form, take advantage of the Lookup area near the top of the display screen to find other types of your legal form format.

- Step 4. Upon having discovered the shape you will need, go through the Get now option. Opt for the rates prepare you choose and include your references to register to have an accounts.

- Step 5. Method the transaction. You may use your bank card or PayPal accounts to complete the transaction.

- Step 6. Find the format of your legal form and down load it on your device.

- Step 7. Total, modify and produce or indicator the Montana Letter Informing Debt Collector that Debtor is Represented by an Attorney.

Each legal file format you buy is the one you have permanently. You have acces to every form you downloaded with your acccount. Click on the My Forms section and pick a form to produce or down load once again.

Contend and down load, and produce the Montana Letter Informing Debt Collector that Debtor is Represented by an Attorney with US Legal Forms. There are thousands of expert and express-specific types you can use to your business or specific requires.

Form popularity

FAQ

Collectors are required by Fair Debt Collection Practices Act (FDCPA) to send you a written debt validation notice with information about the debt they're trying to collect. It must be sent within five days of the first contact. The debt validation letter includes: The amount owed.

How to Request Debt Verification. To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

Within five days after a debt collector first contacts you, it must send you a written notice, called a "validation notice," that tells you (1) the amount it thinks you owe, (2) the name of the creditor, and (3) how to dispute the debt in writing.

A debt validation letter is a letter that debt collectors must provide that includes information about the size of your debt, when to pay it, and how to dispute it. A debt collection letter essentially proves you owe the debt collector money.

Under federal law, a debt collector must go through your attorney if they know that you have one, so it's a good idea ? if you get legal representation ? to tell the collector the name of the attorney who is representing you and how to contact them.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and to who, as well as when you need to pay the debt. If you're still uncertain about the debt you're being asked to pay, you can request a debt verification letter to get more information.