One principal advantage of insurance trusts is that they permit a greater flexibility in investment and distribution than may be effected under settlement options generally included in the policies themselves. Another advantage is that such trusts, like other gifts of insurance policies, may afford substantial estate tax savings.

Montana Irrevocable Trust Funded by Life Insurance

Description

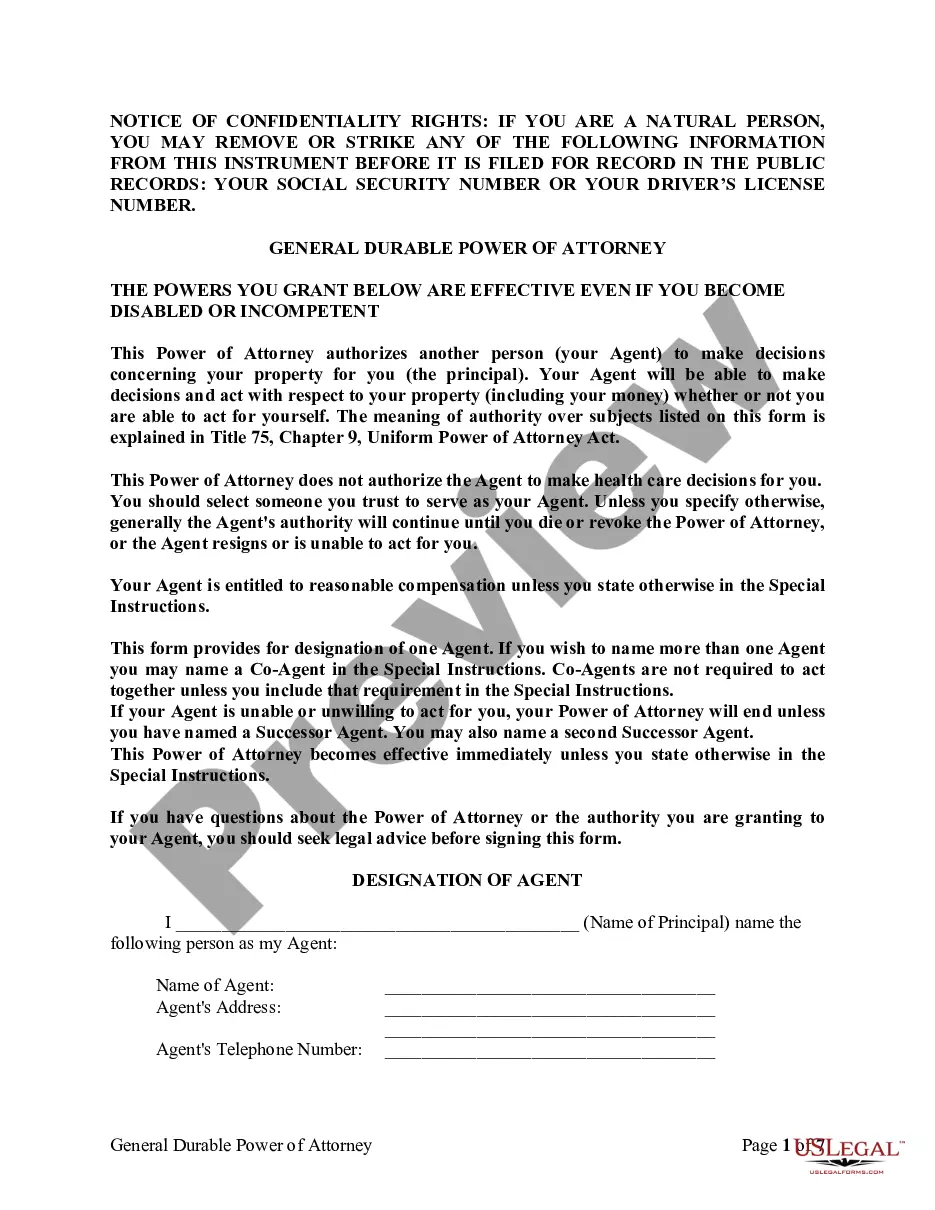

How to fill out Irrevocable Trust Funded By Life Insurance?

Selecting the optimal legitimate document template can be a challenge. Naturally, there are numerous templates available online, but how do you find the accurate version you seek? Visit the US Legal Forms website.

The service offers a multitude of templates, including the Montana Irrevocable Trust Funded by Life Insurance, which you can utilize for business and personal needs. All documents are vetted by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Montana Irrevocable Trust Funded by Life Insurance. Use your account to search through the legal documents you have acquired previously. Navigate to the My documents section of your account and download another copy of the document you require.

Select the document format and download the legal document template to your device. Complete, revise, print, and sign the obtained Montana Irrevocable Trust Funded by Life Insurance. US Legal Forms is the largest repository of legal documents where you can find various form templates. Utilize the service to acquire professionally created documents that meet state requirements.

- If you are a new client of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your locality/region. You can review the form using the Preview function and read the form description to confirm it is suitable for you.

- If the form does not meet your standards, use the Search box to find the appropriate document.

- Once you are confident that the form is correct, click on the Get now button to obtain the form.

- Choose the pricing plan you want and fill in the required information.

- Create your account and finalize the purchase using your PayPal account or credit card.

Form popularity

FAQ

The IRS considers irrevocable trusts as separate taxable entities, which means they have distinct tax rules. A Montana Irrevocable Trust Funded by Life Insurance must comply with these regulations, including filing tax returns and paying taxes on any income it generates. It’s essential to understand these rules to manage your trust wisely and avoid potential penalties. Utilizing platforms like uslegalforms can make it easier to ensure your trust adheres to IRS guidelines.

Generally, an irrevocable life insurance trust does support its own tax filing obligations when it earns income. If you've created a Montana Irrevocable Trust Funded by Life Insurance, the proceeds from the life insurance policy may not be taxable, but any income generated from the trust's assets likely would be. Consequently, the trust may require filing a tax return. Letting a tax advisor guide you can help navigate these requirements.

Yes, an irrevocable trust usually needs to file a tax return if it generates income. When you establish a Montana Irrevocable Trust Funded by Life Insurance, the trust itself is treated as a separate tax entity. This means it will require its own tax identification number and may have to report income on Form 1041, depending on the trust's earnings. Consulting a tax professional can ensure compliance with tax obligations.

The 3-year rule for an irrevocable trust pertains to the look-back period for estate taxes. If you transfer assets into a Montana Irrevocable Trust Funded by Life Insurance and die within three years, those assets may still be included in your taxable estate. This rule prevents individuals from avoiding taxes by transferring assets shortly before death. It’s important to plan wisely and consult with a professional to ensure your estate strategy is effective.

An irrevocable trust does not automatically dissolve after the death of the trust creator. Instead, a Montana Irrevocable Trust Funded by Life Insurance remains in effect until its purpose is fulfilled, such as distributing assets to beneficiaries. This ensures that the intentions behind your estate planning are upheld, providing you with peace of mind regarding your legacy.

When the individual who created a Montana Irrevocable Trust Funded by Life Insurance passes away, the trust typically continues to operate according to its terms. The assets in the trust are distributed to the beneficiaries as set forth in the trust document, often avoiding probate. This allows for a smoother transfer of wealth and can help preserve privacy regarding your estate.

The 3-year rule states that if you transfer a life insurance policy into a Montana Irrevocable Trust Funded by Life Insurance, the death benefit may be included in your estate if you pass away within three years of the transfer. This rule is crucial because it affects your estate tax liability. To avoid this, consider keeping your policy out of the trust until after the three-year mark.

A Montana Irrevocable Trust Funded by Life Insurance removes control of assets from you, making it difficult to change beneficiaries or access funds later. Additionally, the trust may incur setup and maintenance costs that some find burdensome. Furthermore, if not managed properly, you might face tax implications that can impact your estate planning.

Consider placing your life insurance in an irrevocable trust if you want to protect the policy from creditors and avoid estate taxes. The Montana Irrevocable Trust Funded by Life Insurance can provide peace of mind that your beneficiaries will receive financial support after your demise. We recommend speaking with an estate planning attorney to evaluate your goals and determine if this strategy aligns with your financial plan.

Yes, you can place life insurance in an irrevocable trust. Doing so allows the policy to be excluded from your taxable estate, thereby providing financial benefits to your beneficiaries through the Montana Irrevocable Trust Funded by Life Insurance. It is important to work with a financial professional or attorney to ensure compliance with all regulations and to structure the trust correctly.