Montana Owner Financing Contract for Land

Description

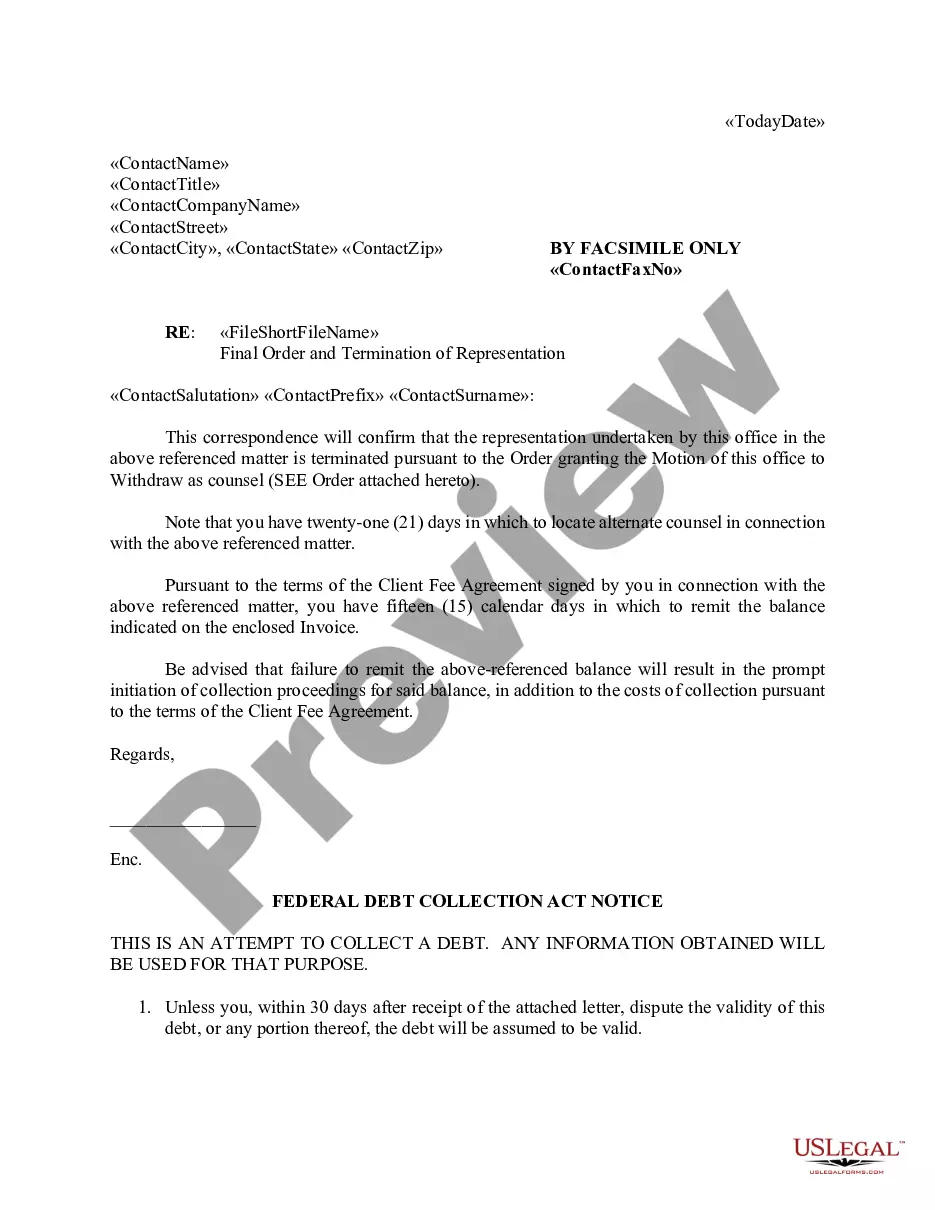

How to fill out Owner Financing Contract For Land?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a wide array of legal document templates you can download or print.

Using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Montana Owner Financing Contract for Land in just minutes.

Review the form details to confirm you have chosen the correct one.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already possess a monthly subscription, Log In and download the Montana Owner Financing Contract for Land from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the right form for your area/state.

- Click on the Preview button to examine the form's content.

Form popularity

FAQ

Writing up an owner finance contract requires clear and concise language that outlines the key terms. Include the buyer and seller details, property description, payment terms, and any contingencies. Using uslegalforms can help streamline this process by providing templates and legal language appropriate for Montana.

Typically, the seller of the land sets up the owner financing. They create the Montana Owner Financing Contract for Land, defining all terms. However, buyers can also negotiate terms, ensuring that both parties are satisfied with the agreement.

Opting for owner financing can be a smart move under the right circumstances. It allows for manageable payment structures and often accelerates the purchasing process. By utilizing a Montana Owner Financing Contract for Land, you can create terms that suit your financial situation, making land ownership more accessible without the complications of traditional financing.

Owner financing benefits both buyers and sellers in the land transaction. Buyers gain easier access to funding without stringent bank requirements, making purchasing land more attainable. Sellers can attract a larger pool of potential buyers, especially those who may struggle to secure traditional financing, ultimately leading to a quicker sale.

Owner financing can be a beneficial option when purchasing land in Montana. This arrangement allows you to bypass traditional lenders, enabling quicker access to property. With a Montana Owner Financing Contract for Land, you often face fewer restrictions and can negotiate terms directly with the seller, making it a flexible choice.

The IRS has specific guidelines regarding owner financing agreements. For a Montana Owner Financing Contract for Land, the seller must report interest income received from the financing as taxable income. Additionally, the transaction must comply with any applicable laws around installment sales. Consulting a tax advisor can provide clarity on how these rules impact your financing structure.

Typically, the seller or a legal professional prepares a land contract. In the case of a Montana Owner Financing Contract for Land, it is advisable to use a qualified attorney or an online legal service to draft the document. This ensures that it meets local laws and regulations while including all necessary terms. A properly prepared contract minimizes the chances of future disputes.

While owner financing can be beneficial, several issues may arise. For example, buyers might default on their payments, leading to potential loss for the seller. Additionally, if the Montana Owner Financing Contract for Land is not properly structured, it could lead to legal complications. To avoid these risks, ensure the contract is thorough and consider utilizing expert legal services.

Yes, owner financing can provide a way to manage capital gains taxes effectively. When you sell your land using a Montana Owner Financing Contract for Land, you might spread out your capital gains over time as you receive monthly payments. This method may enable you to manage your tax burden more conveniently. However, it’s wise to consult a tax professional to understand how this applies to your situation.

To engage in owner financing on land, you need to determine the terms of the agreement, including the down payment, interest rate, and repayment schedule. Next, draft a Montana Owner Financing Contract for Land that outlines these terms clearly. Once both parties agree, sign the contract and ensure that the agreement complies with Montana's property laws. This process allows you to facilitate a smooth transaction without involving traditional banks.