Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Bartering Contract or Exchange Agreement

Description

How to fill out Bartering Contract Or Exchange Agreement?

If you wish to obtain, download, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Employ the site’s straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to retrieve the Montana Bartering Contract or Exchange Agreement with just a few clicks.

Every legal document template you obtain is yours indefinitely. You have access to every form you saved in your account. Navigate to the My documents section and select a form to print or download again.

Complete, download, and print the Montana Bartering Contract or Exchange Agreement with US Legal Forms. There are thousands of specialized and state-specific forms available for your business or personal needs.

- If you are an existing US Legal Forms customer, Log In to your account and then click the Download button to access the Montana Bartering Contract or Exchange Agreement.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Confirm you have selected the correct form for the appropriate city/state.

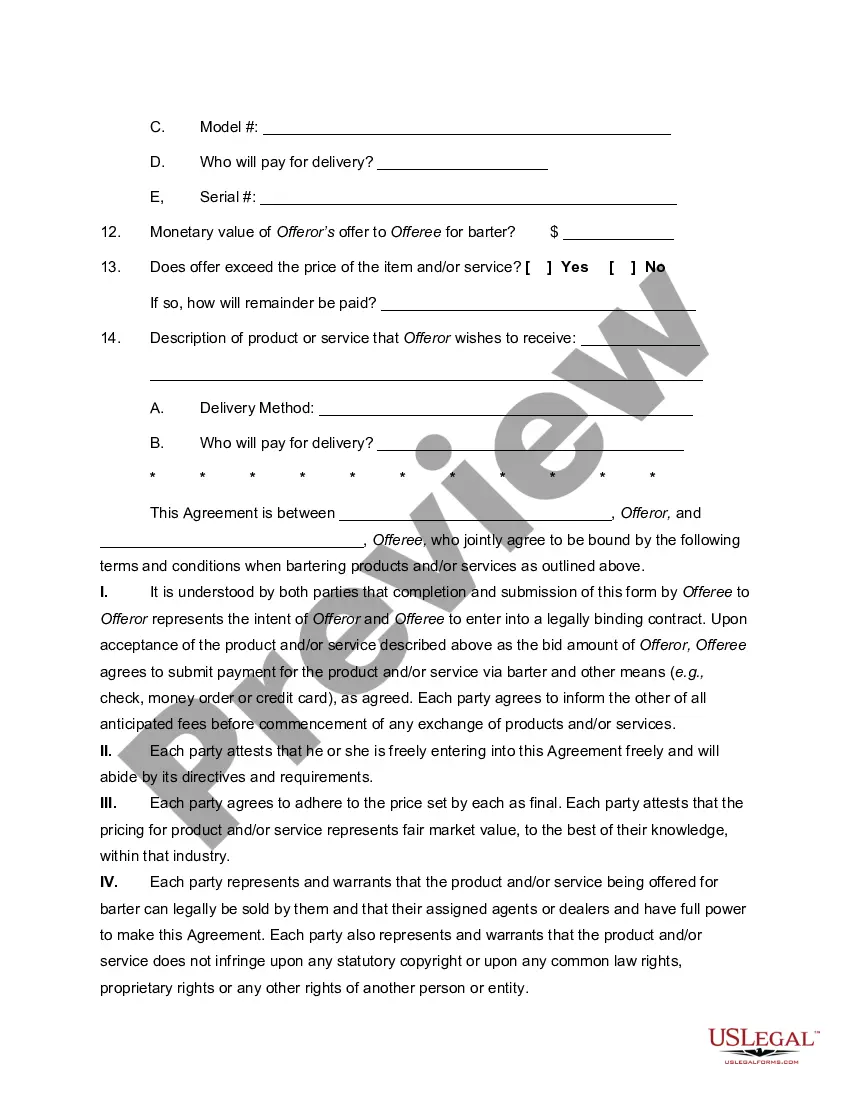

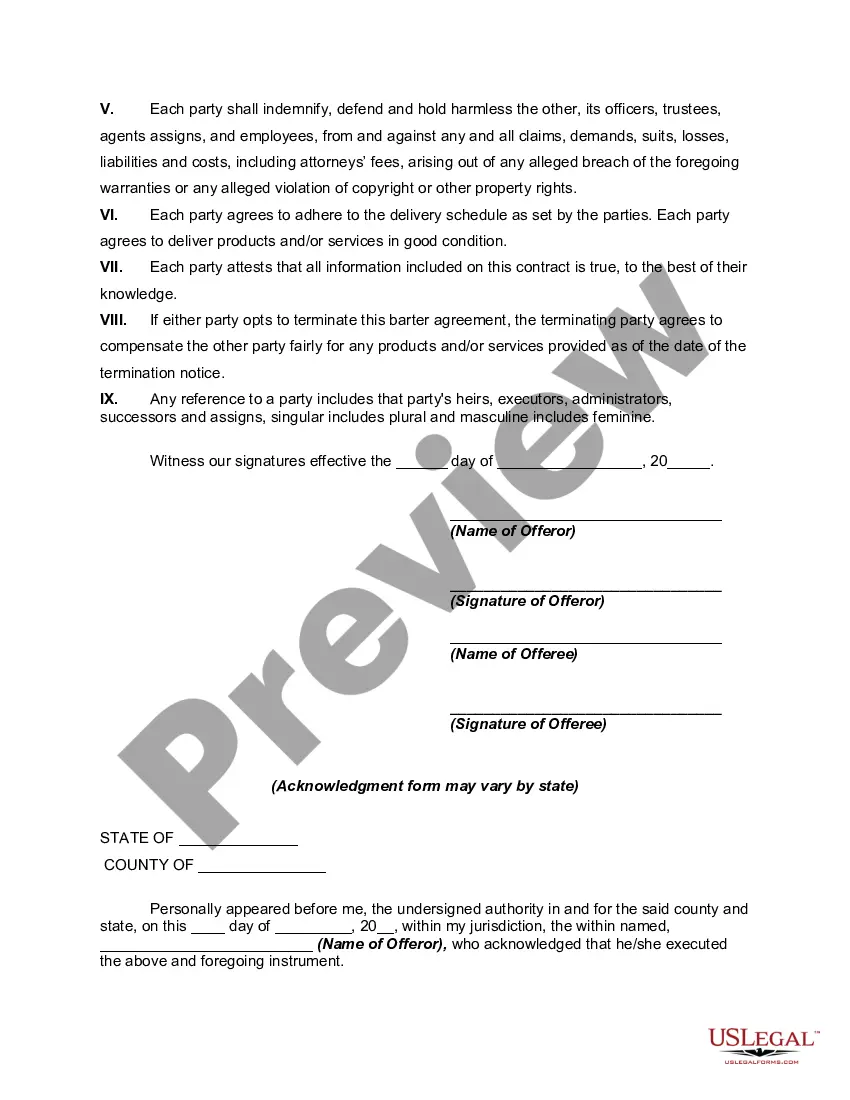

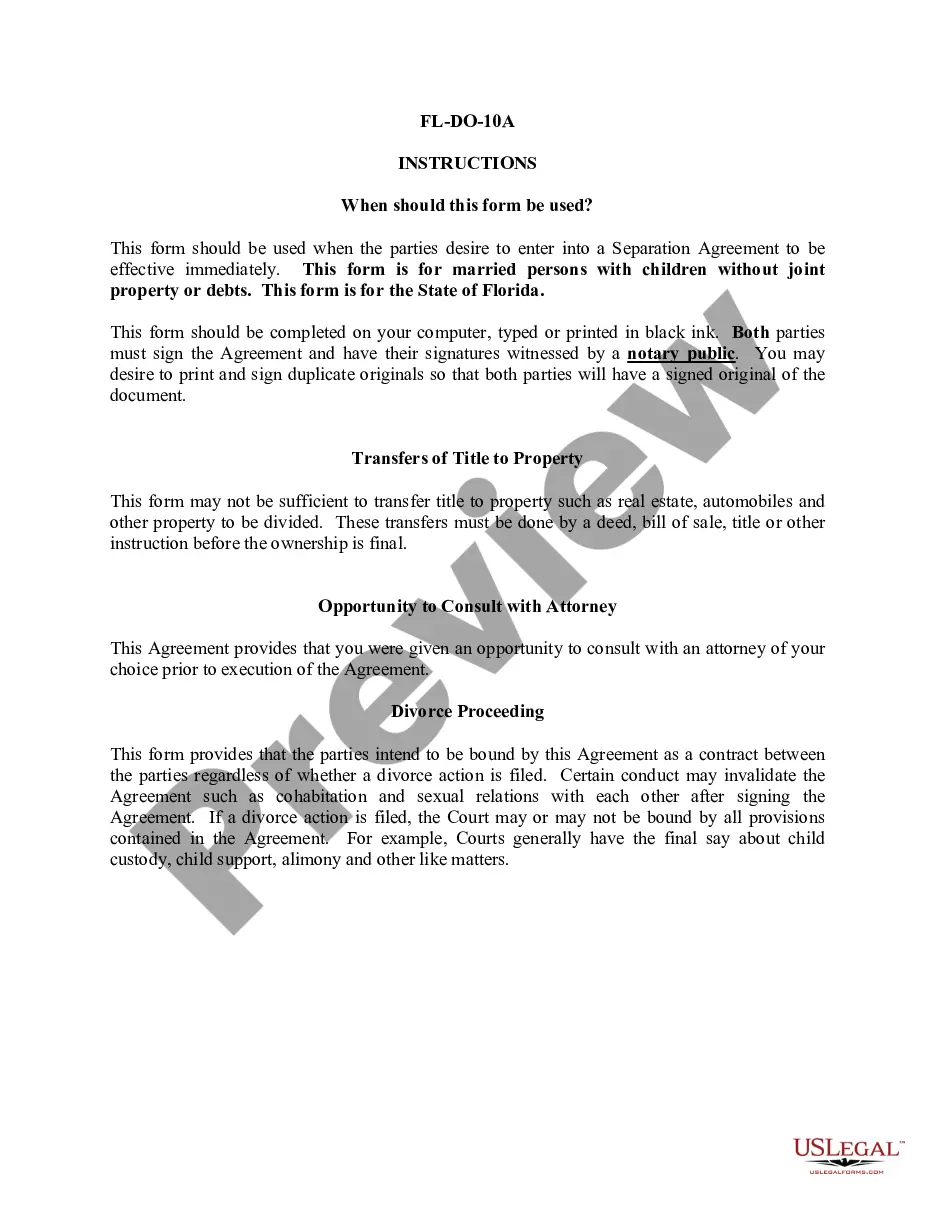

- Step 2. Utilize the Preview feature to review the content of the form. Make sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get Now button. Select the pricing plan that suits you and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Montana Bartering Contract or Exchange Agreement.

Form popularity

FAQ

To write an agreement between a buyer and a seller, begin with identifying both parties and their contact information. Outline the terms of the sale, including the goods or services offered and their prices, possibly using a Montana Bartering Contract or Exchange Agreement format if applicable. Specify payment terms, delivery details, and any warranties. Clarity in these documents prevents disputes and fosters trust.

When it comes to taxes, bartering is considered income that must be reported. You need to assign a fair market value to the goods or services exchanged in your Montana Bartering Contract or Exchange Agreement. Both parties should keep records of these transactions for accurate tax reporting. Consulting with a tax professional might help clarify your obligations.

To write an agreement deal, start by clearly stating the names and contact details of all parties involved. Then, specify the goods or services being exchanged in a Montana Bartering Contract or Exchange Agreement, along with the quantity and value. It's crucial to include terms regarding delivery and any other conditions. Lastly, ensure all parties sign the document to make it official.

An example of a barter agreement could be a situation where a graphic designer creates a website for a local bakery in exchange for baked goods. This arrangement would be documented through a Montana Bartering Contract or Exchange Agreement that specifies the services provided and the quantity of goods exchanged. Such agreements can benefit both parties in their respective businesses. Understanding these terms can simplify the trading process.

Yes, bartering is still legal in the United States and can be a valuable method for exchanging goods and services. However, it's essential to adhere to tax laws and report barter transactions properly. A Montana Bartering Contract or Exchange Agreement ensures that your exchanges are well-documented and compliant with all relevant regulations, providing peace of mind.

Yes, bartering can be considered a business activity if it is conducted as part of regular trade involving goods or services. If you frequently engage in exchanges, you may need to register your operations, and the income derived from bartering should be reported in your tax filings. A well-drafted Montana Bartering Contract or Exchange Agreement can help formalize your business transactions.

Writing a barter agreement involves outlining the details of the exchange clearly. First, ensure both parties agree on the items or services being exchanged, their estimated values, and any deadlines for the transaction. Utilizing a Montana Bartering Contract or Exchange Agreement template from uslegalforms can simplify this process by providing a clear framework for your agreement.

Yes, when you engage in bartering, it's essential to track the trades as regular business income and expenses. The IRS requires that you report the fair market value of goods and services exchanged, as stipulated in your Montana Bartering Contract or Exchange Agreement. This tracking can help you maintain accurate financial records and ensure compliance with tax regulations.

Yes, you must report bartering to the IRS. Any income received from bartering is taxable and should be included in your total income for the year. By using a Montana Bartering Contract or Exchange Agreement, you can clearly document your exchanges and streamline your reporting process to the IRS.

Yes, broker and barter exchange transactions are generally taxable. The IRS requires reporting of any income earned through bartering transactions at their fair market value. Utilizing a Montana Bartering Contract or Exchange Agreement can help you manage these transactions and ensure you comply with tax regulations.