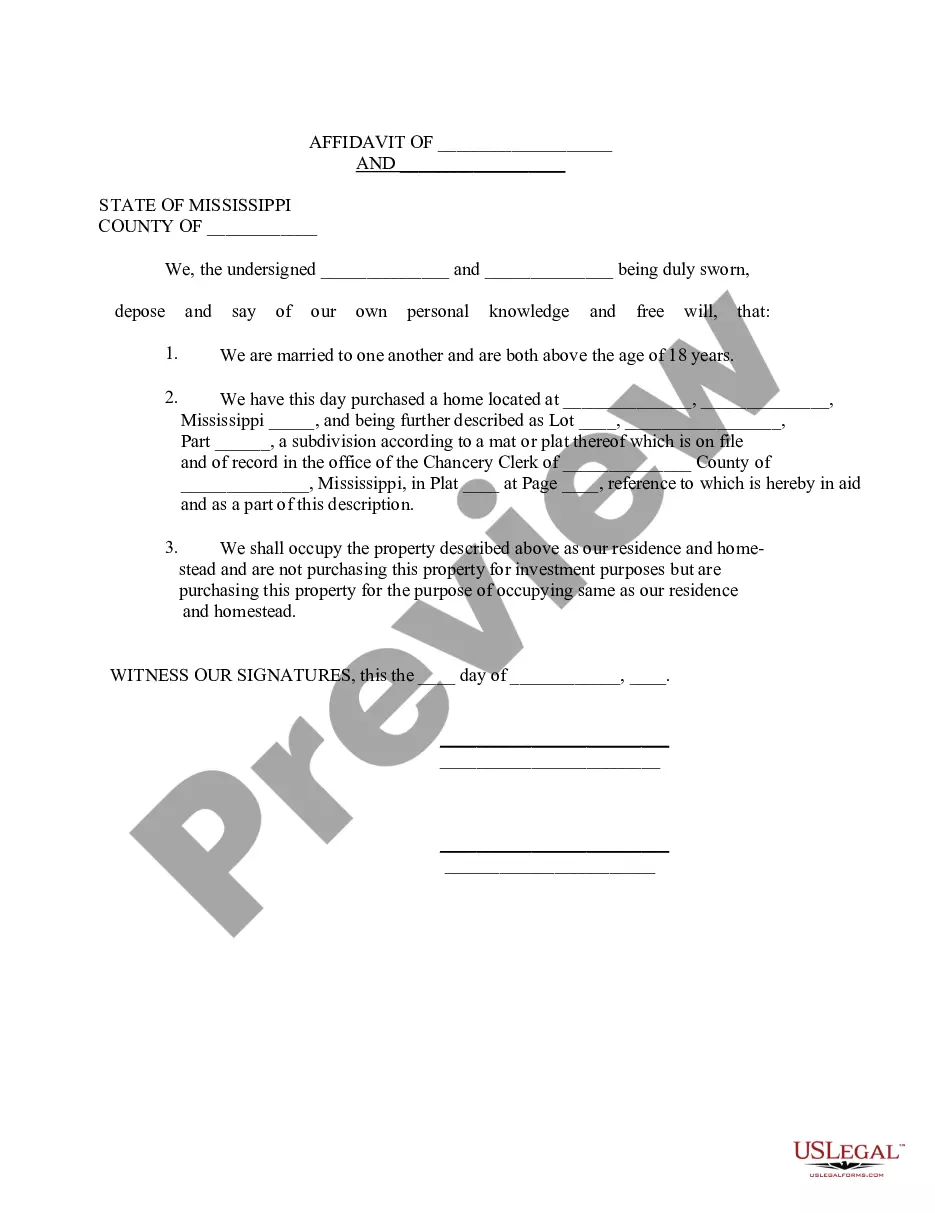

An account is an unsettled claim or demand by one person against another based on a transaction creating a debtor-creditor relationship between the parties. A verified account usually takes the form of an affidavit, in which a statement of an account is verified under oath as to the accuracy of the account. Ordinarily, where an action is based on an itemized account, the correctness of which is verified, the account is taken as true. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Verification of an Account for Services and Supplies to a Public Entity

Description

How to fill out Verification Of An Account For Services And Supplies To A Public Entity?

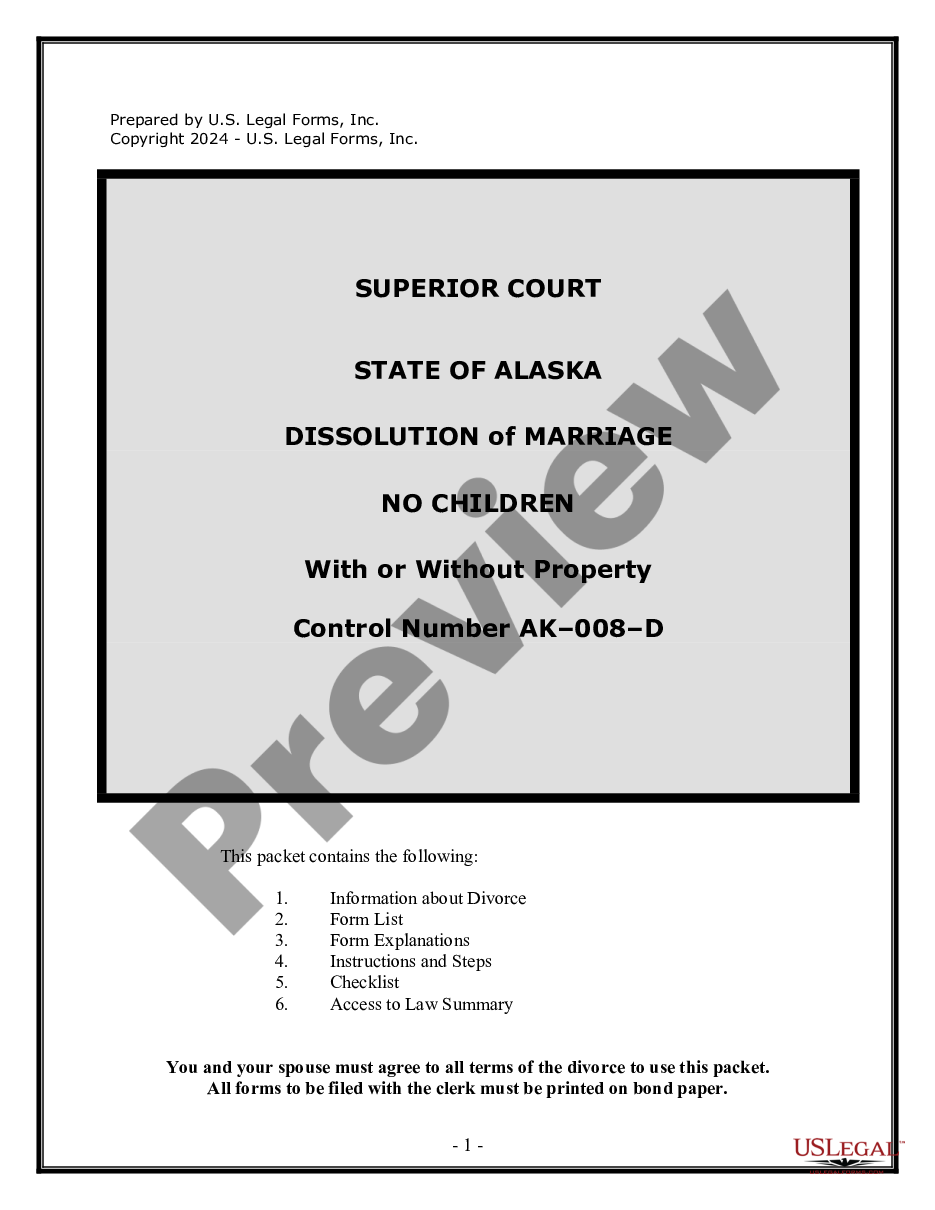

Are you currently in the situation that you need to have files for either business or personal purposes virtually every working day? There are tons of authorized document themes available online, but discovering versions you can rely isn`t simple. US Legal Forms offers a huge number of form themes, like the Montana Verification of an Account for Services and Supplies to a Public Entity, that are created to meet federal and state needs.

In case you are currently knowledgeable about US Legal Forms site and also have a merchant account, simply log in. Afterward, you can download the Montana Verification of an Account for Services and Supplies to a Public Entity web template.

Should you not have an profile and would like to begin using US Legal Forms, follow these steps:

- Discover the form you need and ensure it is for that correct metropolis/region.

- Use the Preview button to analyze the shape.

- See the description to ensure that you have selected the correct form.

- When the form isn`t what you`re trying to find, use the Search field to find the form that meets your requirements and needs.

- When you discover the correct form, just click Buy now.

- Select the prices plan you desire, fill out the desired information to make your bank account, and purchase the transaction utilizing your PayPal or charge card.

- Choose a hassle-free data file file format and download your duplicate.

Get every one of the document themes you might have bought in the My Forms food list. You can aquire a further duplicate of Montana Verification of an Account for Services and Supplies to a Public Entity whenever, if needed. Just go through the required form to download or printing the document web template.

Use US Legal Forms, the most comprehensive selection of authorized kinds, to conserve efforts and stay away from blunders. The support offers professionally made authorized document themes that you can use for a selection of purposes. Create a merchant account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

Montana CPA Exam Cost Breakdown Initial Exam Application Fee$245.00Regulation (REG)$238.15Total for all 4 CPA Exam Sections$952.60CPA License Application Fee$150.00Active License Renewal Fee$125.005 more rows

All licensed CPAs in Iowa must complete 120 hours of approved continuing education over a three-year reporting period. Many of our programs in Live and Self-Study are Approved for continuing education for Iowa CPA.

What are the MT CPE Requirements? Montana CPAs must complete 120 hours of CPE including at least 2 hours of Ethics and 60 hours in Technical courses every 3-year Rolling Reporting Cycle. How many credits can MT CPAs complete via Self Study courses? Montana CPAs can complete all 120 credits via Self Study courses.

CPE Requirements for AICPA Members From January 1, 2001 forward, and for each three-year reporting period thereafter, all AICPA members shall complete 120 hours or its equivalent of continuing professional education.

One hundred fifty (150) semester hours of education. Baccalaureate degree from an accredited institution. 24 semester hours (36 quarter hours) of accounting, auditing and tax courses. 18 semester hours (27 quarter hours) in business-related courses such as business law, management, marketing, economics and finance.

Completed 150 semester hours of college education and earned a bachelor's degree. Passed the Uniform CPA Exam. Passed the AICPA Ethics Examination. Fulfill the Board's experience requirement of one year (2000 hours) of accounting experience.