For use in all states except AK,FL,ME,NY,PR,VT,VA,WV,WI

Montana Multistate Promissory Note - Unsecured - Signature Loan

Description

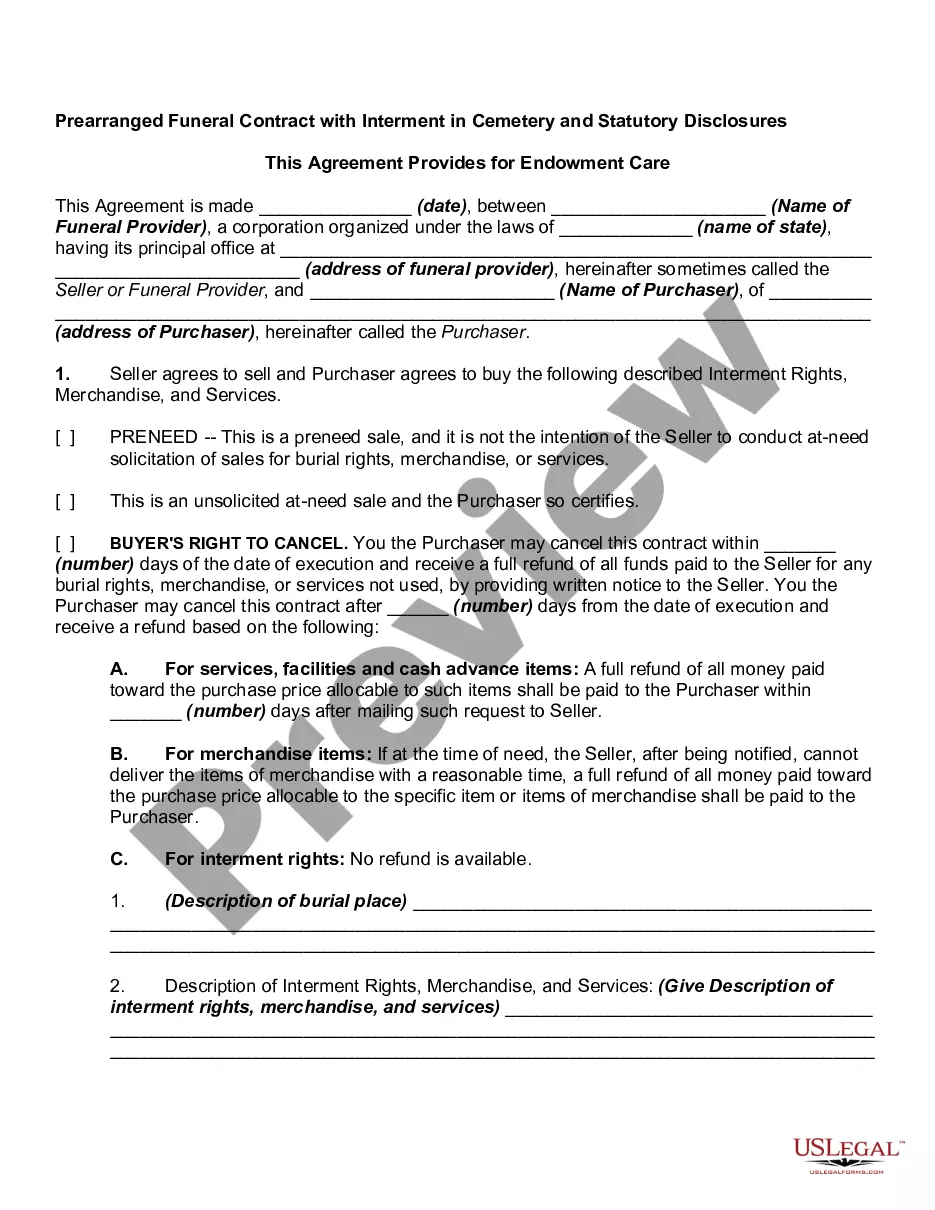

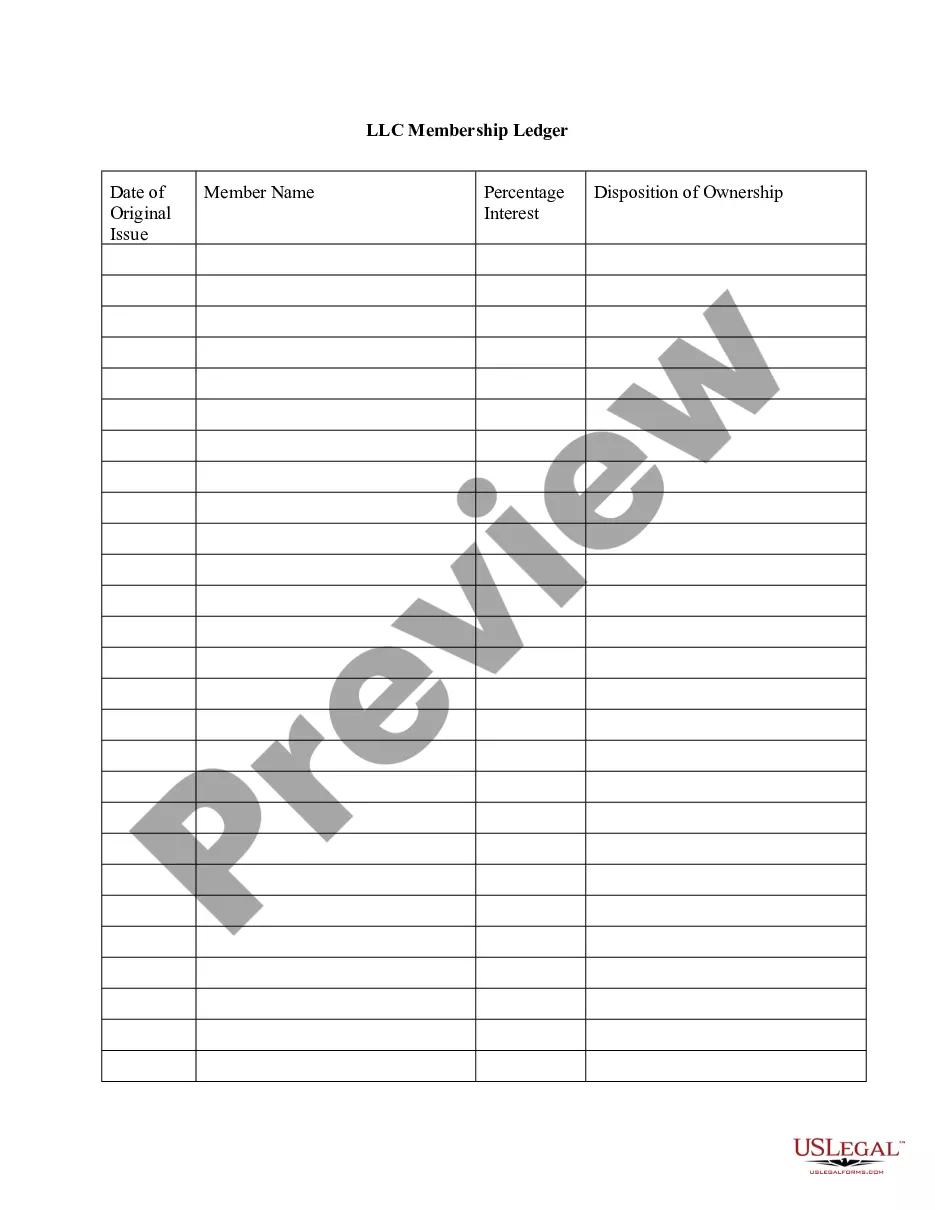

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

Are you currently in a situation where you need documents for either professional or personal reasons almost all the time.

There are many legitimate document templates accessible online, but finding forms you can trust is challenging.

US Legal Forms offers numerous template options, such as the Montana Multistate Promissory Note - Unsecured - Signature Loan, which are designed to comply with state and federal requirements.

Once you find the correct form, click Acquire now.

Select the pricing plan you want, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Montana Multistate Promissory Note - Unsecured - Signature Loan template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct state/region.

- Use the Preview button to review the form.

- Read the description to ensure that you have selected the correct form.

- If the form is not what you’re looking for, use the Lookup field to find the form that meets your needs and criteria.

Form popularity

FAQ

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

You should demand to see your original promissory note if you are facing foreclosure of your home because only the party that holds the original note is allowed to sue you. If you bought a home, you probably didn't pay cash for it unless you are wealthy or you did a great job of saving money.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Signatures. Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

Not signed by the borrowerIn order for a promissory note to be legally binding, it must include the signature of the borrower. You generally are not required by law to have the signatures witnessed or notarized.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

In other words, if the party seeking enforcement can produce other proof that the parties did have an agreement on the terms, then the agreement can be enforced unless the other side can show that the parties agreed that the contract should not be binding until it was formally signed.