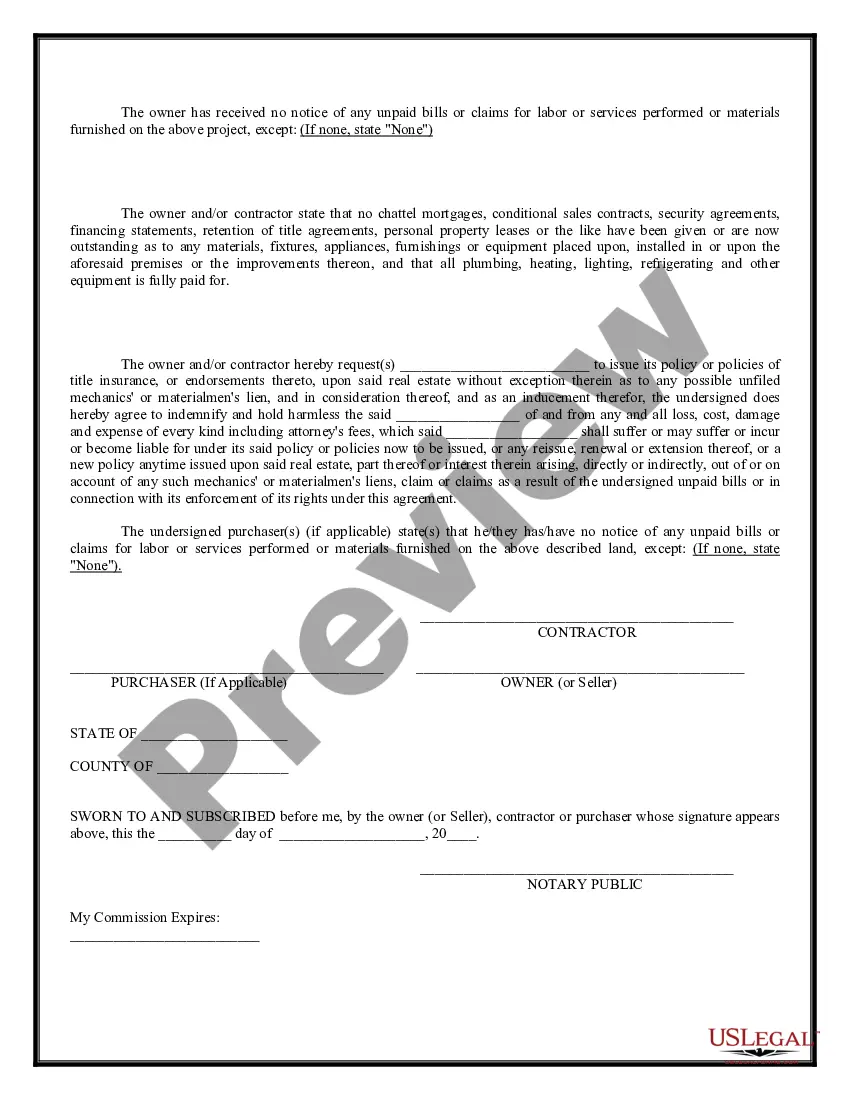

Montana Owner's and Contractor Affidavit of Completion and Payment to Subcontractors

Description

How to fill out Owner's And Contractor Affidavit Of Completion And Payment To Subcontractors?

Are you currently in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but locating reliable ones isn't easy.

US Legal Forms offers thousands of form templates, such as the Montana Owner's and Contractor Affidavit of Completion and Payment to Subcontractors, which are crafted to comply with federal and state requirements.

Once you locate the correct document, click on Buy now.

Select the pricing plan you prefer, enter the necessary information to create your account, and complete your order with your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Montana Owner's and Contractor Affidavit of Completion and Payment to Subcontractors template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is appropriate for the correct area/county.

- Utilize the Review option to examine the form.

- Check the description to confirm that you have selected the correct document.

- If the form isn't what you're seeking, use the Search field to find the document that meets your requirements.

Form popularity

FAQ

Yes, subcontractors typically need a license in Montana to work legally, especially for projects that exceed a certain monetary amount. Licensing helps ensure that they comply with local laws and possess the necessary skills to fulfill their contracts. Understanding the licensing requirements is crucial for anyone involved in the construction industry, especially when dealing with the Montana Owner's and Contractor Affidavit of Completion and Payment to Subcontractors.

To obtain an independent contractor's license in Montana, you need to complete an application through the Montana Department of Labor and Industry. This process often requires submitting proof of insurance, satisfactory financial documentation, and understanding the Montana Owner's and Contractor Affidavit of Completion and Payment to Subcontractors. Ensuring you have all necessary documents ready can lead to a smoother application process.

A contract clause for a subcontractor outlines the specific obligations and responsibilities they must adhere to while working on a project. This includes payment terms, the scope of work, and requirements for completing the Montana Owner's and Contractor Affidavit of Completion and Payment to Subcontractors. Clear clauses help protect the interests of both contractors and subcontractors, ensuring smooth project execution.

The number for contractors in Montana, specifically for licensing inquiries, can be found on the Montana Department of Labor and Industry website. They provide a helpful directory, which can guide you in finding information related to the Montana Owner's and Contractor Affidavit of Completion and Payment to Subcontractors. Understanding how to reach the right contacts can greatly facilitate your projects and ensure compliance.

To become an independent contractor in Montana, you need a clear business plan, appropriate licenses, and insurance coverage to protect your business. You should also consider setting up a system for managing your finances, including taxes. Equipping yourself with knowledge about the Montana Owner's and Contractor Affidavit of Completion and Payment to Subcontractors will streamline your operations and safeguard your payment processes.

An employee in Montana typically works under the direction and control of an employer, while a contractor operates independently. Employees receive benefits and tax withholdings from their employers, whereas contractors manage their own finances and often have flexibility in their work arrangements. When navigating these definitions, understanding the Montana Owner's and Contractor Affidavit of Completion and Payment to Subcontractors can clarify payment structures and obligations.

In Montana, a contractor generally has 90 days from the last date of work performed or materials provided to file a lien. This time frame ensures that contractors can secure their rights to payment for services rendered. It’s advisable to keep records to support your claim. Understanding the Montana Owner's and Contractor Affidavit of Completion and Payment to Subcontractors can also aid in protecting your lien rights.

To become an independent contractor in Montana, start by determining your business structure, which may involve registering your business and obtaining the necessary licenses. It’s important to understand tax obligations and insurance needs for contractors. Familiarizing yourself with the Montana Owner's and Contractor Affidavit of Completion and Payment to Subcontractors will also support your transition into independent contracting by clarifying payment processes.

Montana does require a contractor's license for various types of contracting work. Depending on the project’s scope, different licenses may apply, including residential and commercial categories. This requirement helps uphold industry standards while safeguarding homeowner interests. If you're looking to learn more, the Montana Owner's and Contractor Affidavit of Completion and Payment to Subcontractors is an essential document in this process.

Yes, you need a license to operate as a contractor in Montana. Licensing ensures that contractors meet specific educational and experience requirements. It is crucial to provide quality service and protect consumers. Additionally, understanding the Montana Owner's and Contractor Affidavit of Completion and Payment to Subcontractors can help manage contractual obligations effectively.