Montana General Guaranty and Indemnification Agreement

Description

How to fill out General Guaranty And Indemnification Agreement?

If you need to obtain, download, or create valid document templates, utilize US Legal Forms, the largest collection of legal documents available on the web.

Take advantage of the site’s user-friendly search to find the documents you need.

Various templates for business and personal uses are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, make use of the Search field at the top of the page to find other versions of the legal form template.

Step 4. Once you have found the form you need, click the Get Now button. Choose the pricing plan you prefer and enter your credentials to register for the account.

- Utilize US Legal Forms to locate the Montana General Guaranty and Indemnification Agreement with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Montana General Guaranty and Indemnification Agreement.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

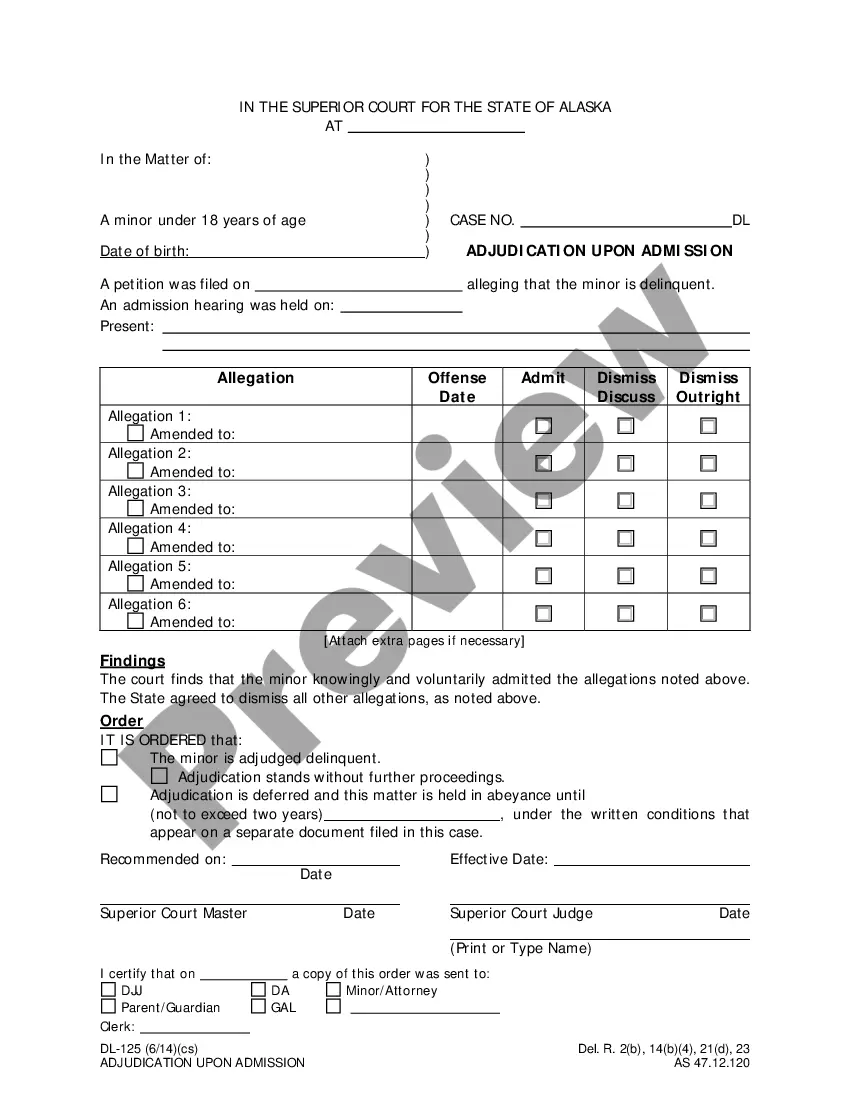

- Step 2. Use the Preview option to review the form’s content. Remember to check the details.

Form popularity

FAQ

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person, is called a contract of indemnity. Illustration.

The surety is the guarantee of the debts of one party by another. A surety is an organization or person that assumes the responsibility of paying the debt in case the debtor policy defaults or is unable to make the payments. The party that guarantees the debt is referred to as the surety, or as the guarantor.

Right to indemnity. Once the guarantor pays the beneficiary under the terms of the guarantee, it has a right to claim indemnity from the principal provided that the guarantee was given at the principal's request.

The guarantor, an insurer or a bank, promises the same performance as the principal debtor. The object of a surety is therefore the performance of the obligation towards the principal. The guarantor is only obliged to do so within the limits of the main obligation.

In order to determine the extent of the guarantor's liability, it is necessary to refer to the distinction between a guarantee that is an undertak- ing by the guarantor that the principal debtor will perform, and one which is a conditional agreement that upon the default of the principal debtor the guarantor undertakes

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

An indemnity is a contract by one party to keep the other harmless against loss, but a contract of guarantee is a contract to answer for the debt, default or miscarriage of another who is to be primarily liable to the promisee .

Indemnity is when one party promises to compensate the loss occurred to the other party, due to the act of the promisor or any other party. On the other hand, the guarantee is when a person assures the other party that he/she will perform the promise or fulfill the obligation of the third party, in case he/she default.

Differences between guarantees and indemnitiesa guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.