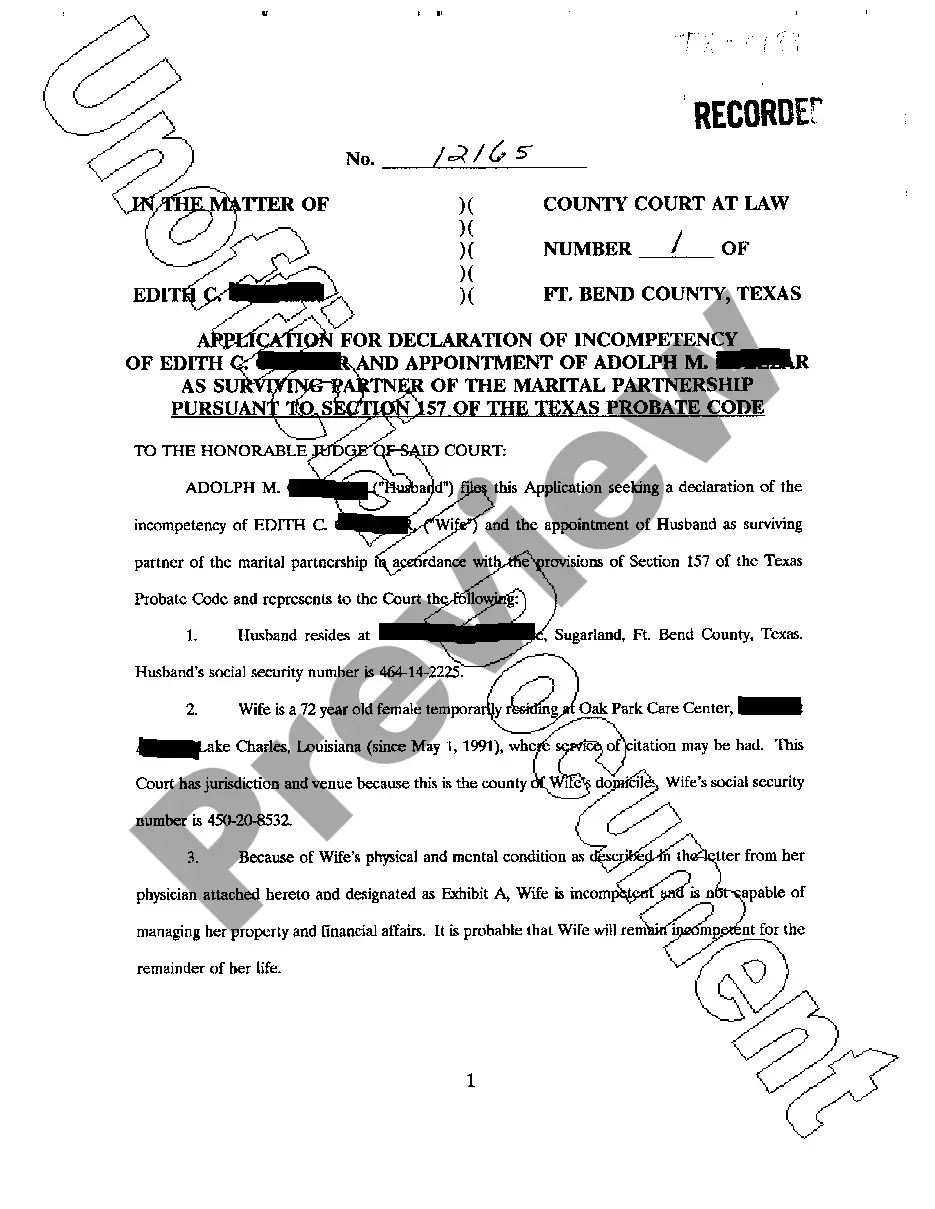

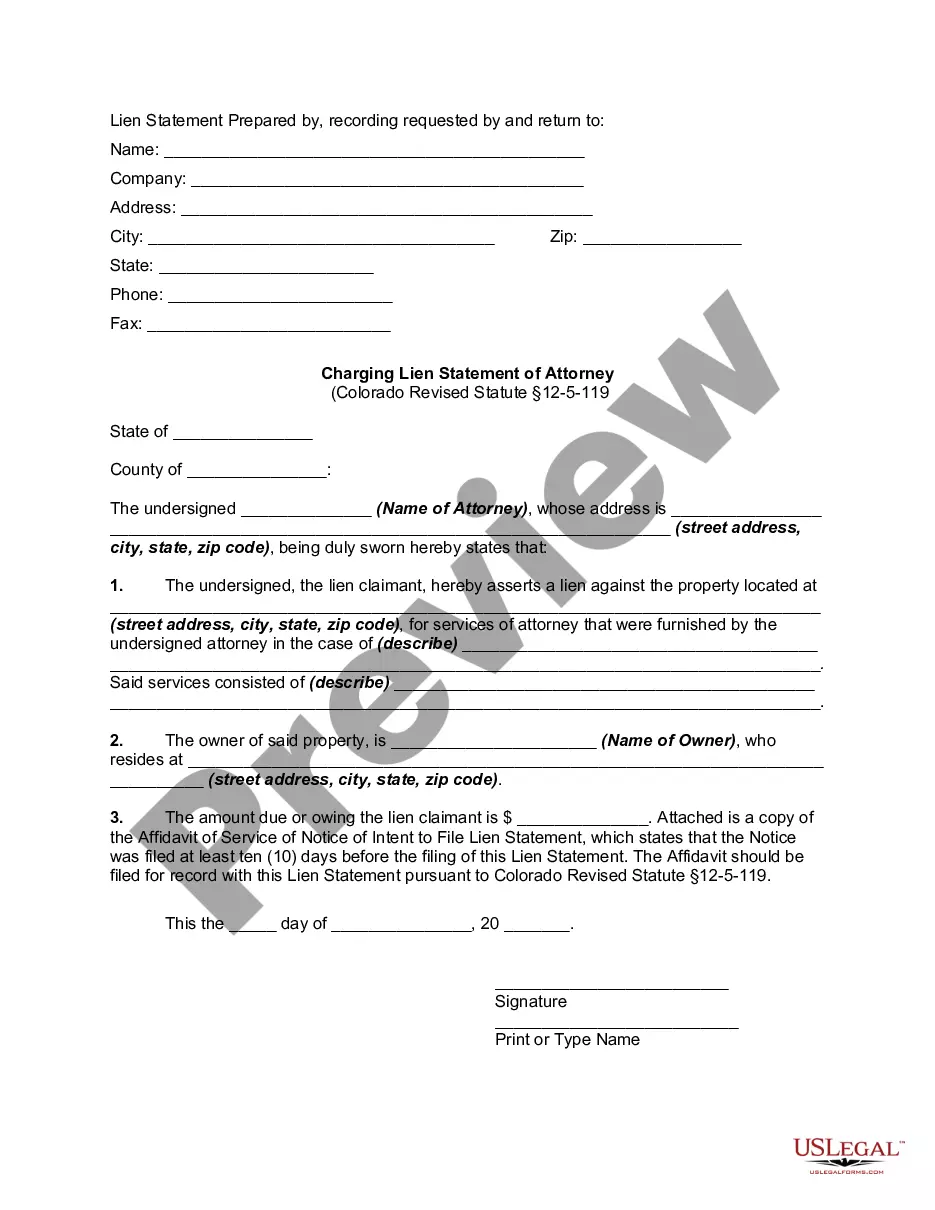

Montana Demand for Collateral by Creditor

Description

How to fill out Demand For Collateral By Creditor?

You can spend hours online looking for the proper legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast collection of legal forms that have been reviewed by professionals.

You can obtain or print the Montana Demand for Collateral by Creditor from their services.

If available, utilize the Review button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, edit, print, or sign the Montana Demand for Collateral by Creditor.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the easy instructions below.

- First, ensure that you have selected the correct document template for the area/city you choose.

- Check the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

The process by which a creditor may take possession of collateral to satisfy an unpaid debt is referred to as repossession. This legal measure allows the creditor to reclaim their secured property if the borrower defaults. Understanding your rights and obligations in this context can make a significant difference, especially during a Montana Demand for Collateral by Creditor. Carefully consider the terms of your agreements to avoid complications.

A security interest in goods refers to a legal claim a creditor has on a debtor's personal property until the debt obligation is fulfilled. This ensures that the creditor has a secured position, allowing them to take action if payments are not made. In a Montana Demand for Collateral by Creditor situation, this interest is vital because it dictates the creditor's rights in the event of default. Clear documentation of this interest is crucial for all parties involved.

The three requirements for a creditor to establish an enforceable security interest are attachment, perfection, and compliance with legal formalities. Attachment occurs when a creditor's interest becomes enforceable against the debtor, perfection ensures the creditor's interest is protected against third parties, and legal compliance varies by jurisdiction. By understanding these requirements, you can better navigate a Montana Demand for Collateral by Creditor and ensure effective protection.

The four main types of security interests are pledges, mortgages, liens, and security agreements. Each type serves a different purpose based on the nature of the transaction and the type of collateral involved. For example, a mortgage involves real estate, while a lien might pertain to personal property. Knowing these distinctions can empower borrowers and lenders in a Montana Demand for Collateral by Creditor scenario.

One of the key requirements for a creditor to have an enforceable security interest is that the debtor must have rights in the collateral. Without ownership rights to the property, the creditor cannot establish a claim. This aspect is crucial in the context of a Montana Demand for Collateral by Creditor, as proper proof of rights can facilitate the recovery process. Always ensure that documentation is handled correctly.

Yes, it is possible for someone to place a lien on your house without your immediate knowledge. Creditors may file a lien if they have a valid claim against you, typically for unpaid debts. It's important to regularly check public records to stay informed about any potential liens. The Montana Demand for Collateral by Creditor can assist you in understanding how to protect yourself and respond effectively.

A notice of lien is a formal document that informs the public of a creditor's claim against a property. This notice acts as a legal warning to anyone interested in the property, indicating that the creditor may seek payment through the property if debts remain unpaid. Understanding this concept can help you navigate potential disputes and improve your financial planning. The Montana Demand for Collateral by Creditor provides insights on how to manage such situations.

In Montana, a lien typically remains valid for a specific duration, which is generally up to three years from the date of recording. After this period, if no action is taken to enforce the lien, it may become invalid. It’s crucial to stay informed about your rights and obligations to protect your interests. The Montana Demand for Collateral by Creditor offers guidance on maintaining and managing your lien effectively.

A notice of intent to file a lien serves as a warning to property owners that a lien may be filed against their property. This notice gives the property owner an opportunity to resolve any disputes before the formal lien is recorded. Understanding this notice can help you manage your obligations and avoid complications. Utilizing resources like the Montana Demand for Collateral by Creditor can further clarify this process.

In Montana, you generally have a limited timeframe to file a lien. The law requires you to file your lien within a specific period after the claim arises, often within 90 days for most construction-related claims. If you fail to do this, you may lose your right to a lien. Protecting your rights is essential, and understanding the Montana Demand for Collateral by Creditor process is key.