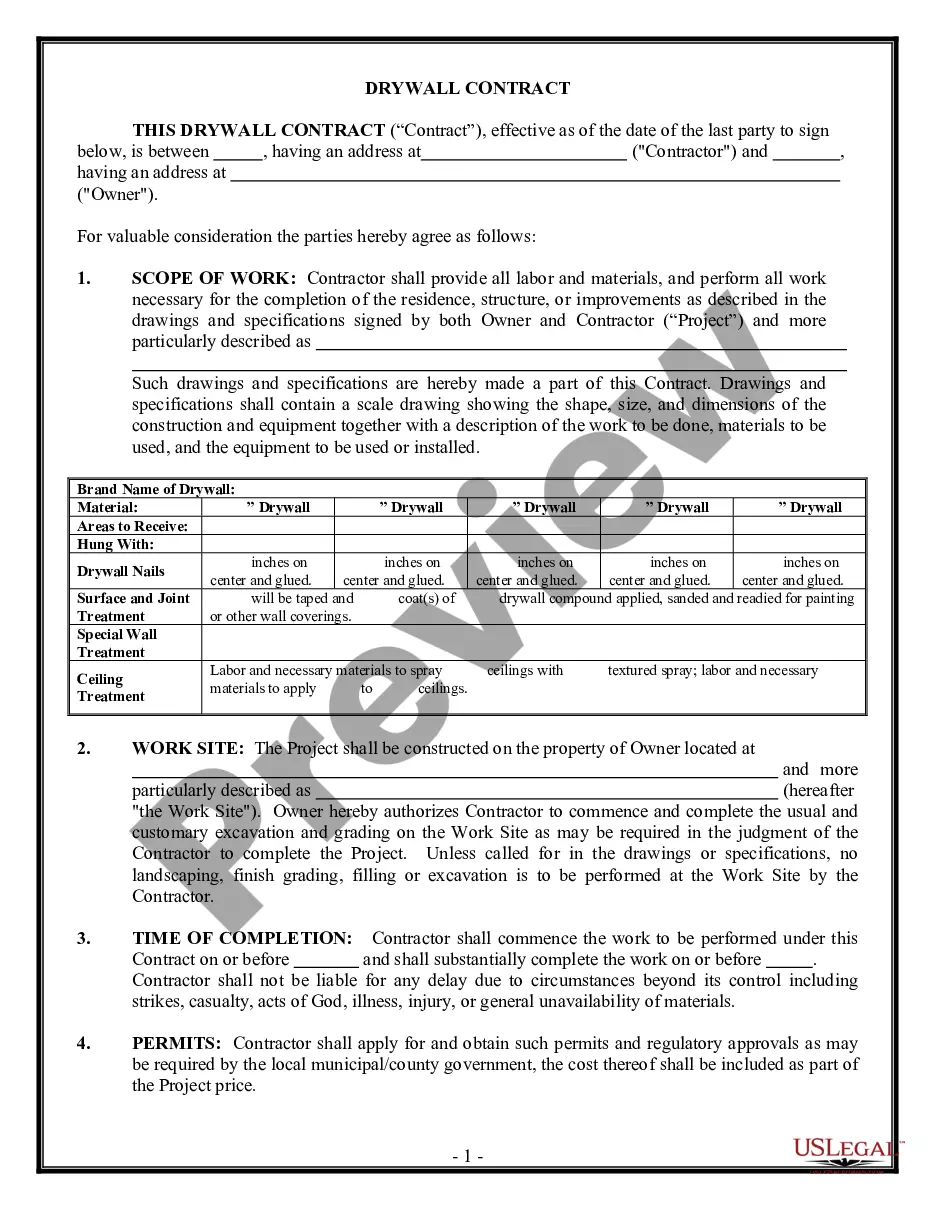

A Montana Financing Statement (sometimes referred to as a UCC-1) is a legal document created to preserve a creditor's security interest in personal or real property. It is typically used to perfect a security interest in inventory, equipment, accounts receivable, and other assets used in a business. The filing of the Montana Financing Statement provides public notice of the secured party's interest in the collateral. There are two types of Montana Financing Statements: (1) an initial financing statement and (2) a continuation statement. An initial financing statement is used to perfect a security interest in collateral that was created after the filing of the statement. A continuation statement is used to extend the duration of a financing statement on file and to amend or supplement information in a previously filed statement.

Montana Financing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Montana Financing Statement?

How much time and resources do you typically allocate for creating formal documentation.

There’s a better method to obtain such forms than employing legal experts or spending hours searching online for an appropriate template. US Legal Forms is the premier online repository that offers professionally crafted and verified state-specific legal documents for any purpose, including the Montana Financing Statement.

Another advantage of our service is that you can access previously acquired documents that you securely store in your profile in the My documents tab. Retrieve them anytime and redo your paperwork as often as necessary.

Conserve time and effort preparing official documents with US Legal Forms, one of the most reputable web solutions. Register with us today!

- Review the form content to confirm it complies with your state regulations. To do this, examine the form description or use the Preview option.

- If your legal template does not satisfy your needs, locate an alternative using the search bar at the top of the page.

- If you are already subscribed to our service, Log In and download the Montana Financing Statement. If not, continue to the following steps.

- Click Buy now once you identify the correct blank. Choose the subscription plan that fits you best to gain access to our library’s complete service.

- Register for an account and pay for your subscription. You can complete your payment using your credit card or through PayPal - our service is completely reliable for that.

- Download your Montana Financing Statement onto your device and complete it on a printed hard copy or electronically.

Form popularity

FAQ

A UCC financing statement ? also called a UCC-1 financing statement or a UCC-1 filing ? is a legal form that allows a lender to announce a lien on an asset to secure a loan. By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing.

Essentially, a UCC-1 can be described as a financing statement. In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property.

In addition to filing with the state, the UCC is filed with the County office that holds the county real estate records for the property. Filings for ownership entities are made in the state where the entity is registered. Filings for individuals are made in the state in which the individual resides.

1 should be filed with the secretary of state's office in the state where the debtor is incorporated or lives. 1 does not expire until the loan is paid in full, but in many jurisdictions including California, it must be renewed every five years.

Essentially, a UCC-1 can be described as a financing statement. In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property.

A qualified financing statement should include: Debtor and secured party's name, Collateral describing, and. A creditor or other person authorized by the debtor in their security agreement files it.

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.

A UCC financing statement ? also called a UCC-1 financing statement or a UCC-1 filing ? is a legal form that allows a lender to announce a lien on an asset to secure a loan. By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing.