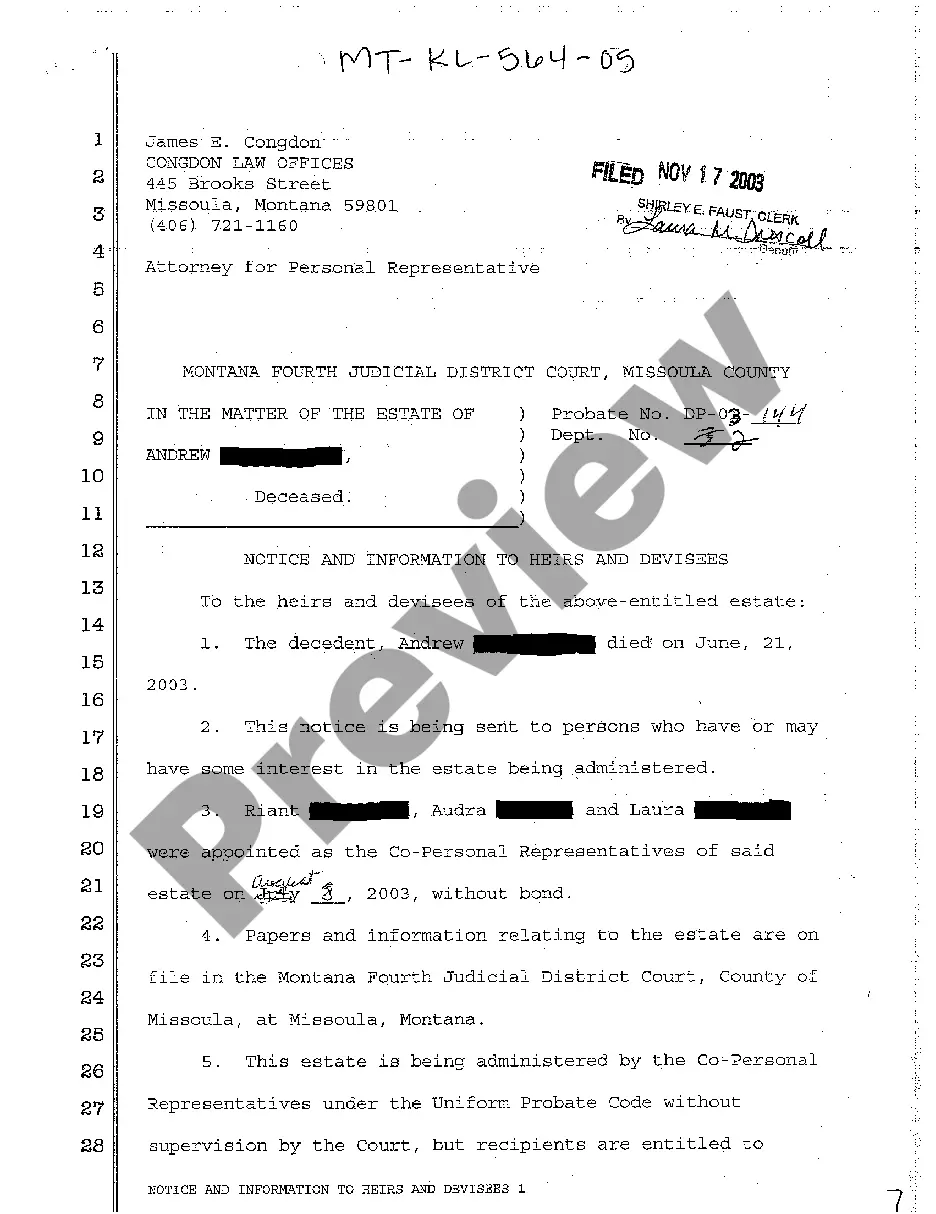

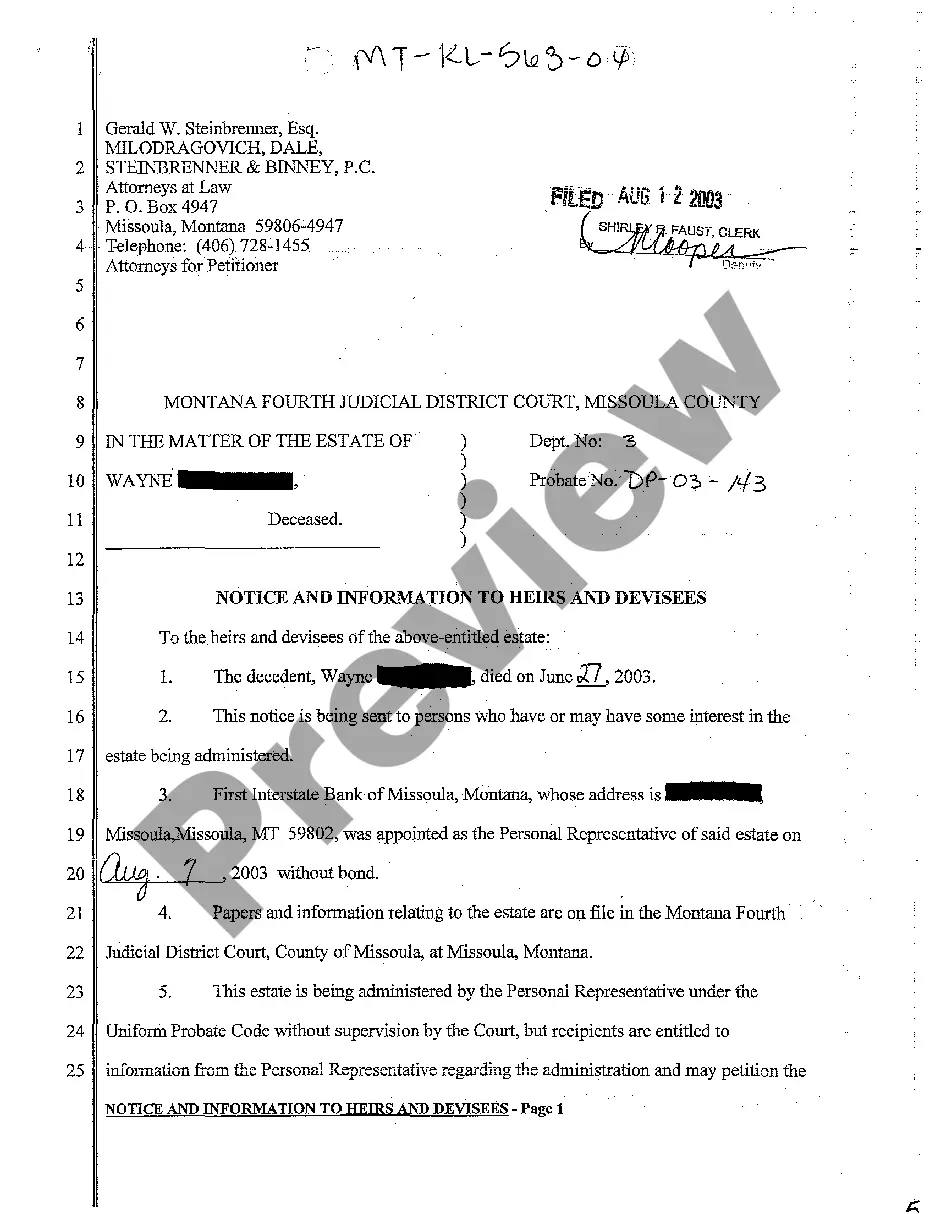

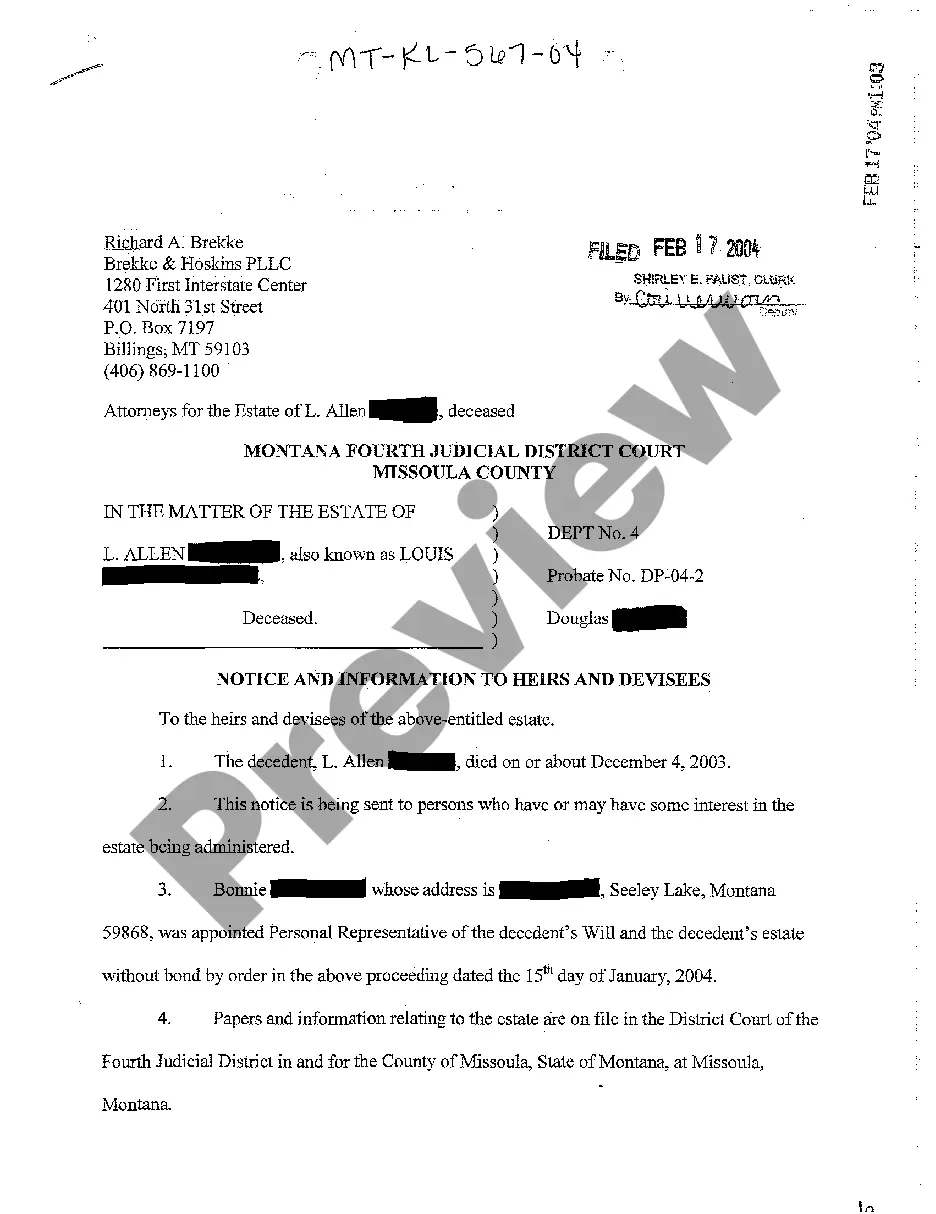

Montana Notice and Information to Heirs and Devisees

Description

How to fill out Montana Notice And Information To Heirs And Devisees?

Obtain a printable Montana Notice and Information to Heirs and Devisees in just several mouse clicks from the most comprehensive library of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 supplier of reasonably priced legal and tax templates for US citizens and residents on-line since 1997.

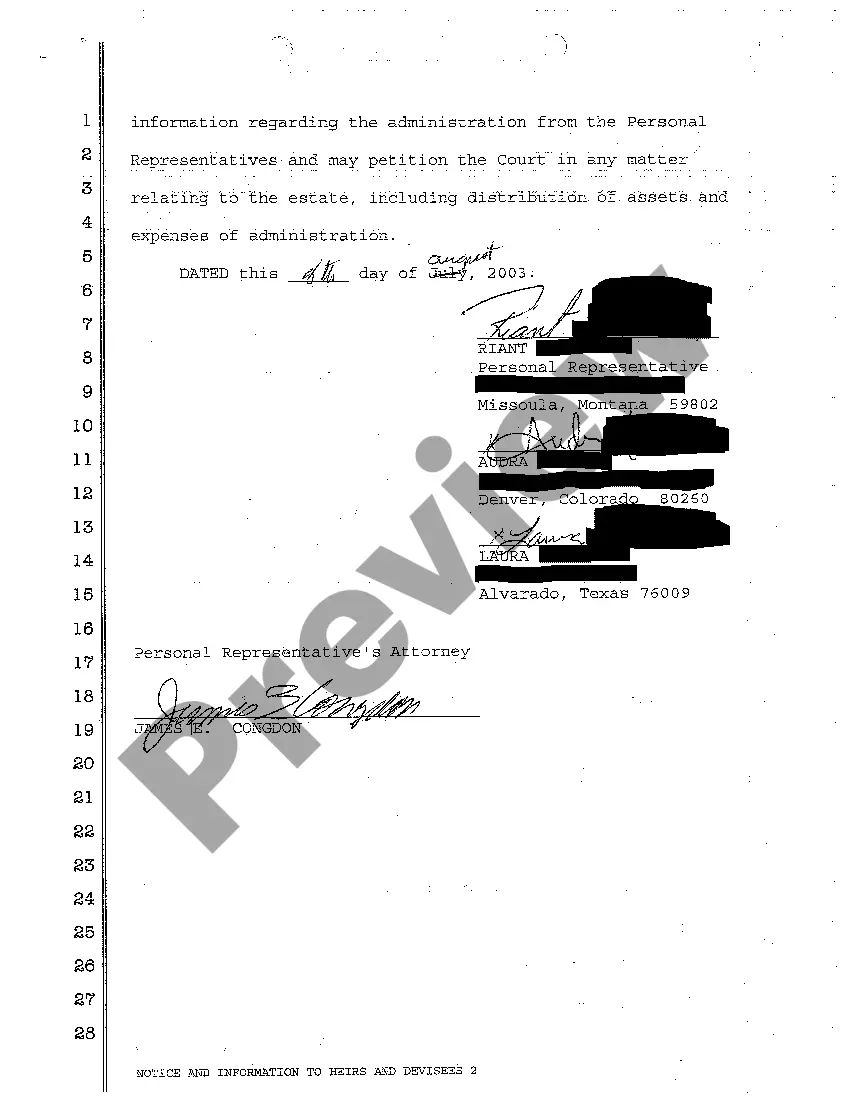

Customers who have already a subscription, must log in directly into their US Legal Forms account, down load the Montana Notice and Information to Heirs and Devisees see it saved in the My Forms tab. Customers who do not have a subscription are required to follow the steps listed below:

- Ensure your template meets your state’s requirements.

- If available, read the form’s description to find out more.

- If accessible, preview the shape to view more content.

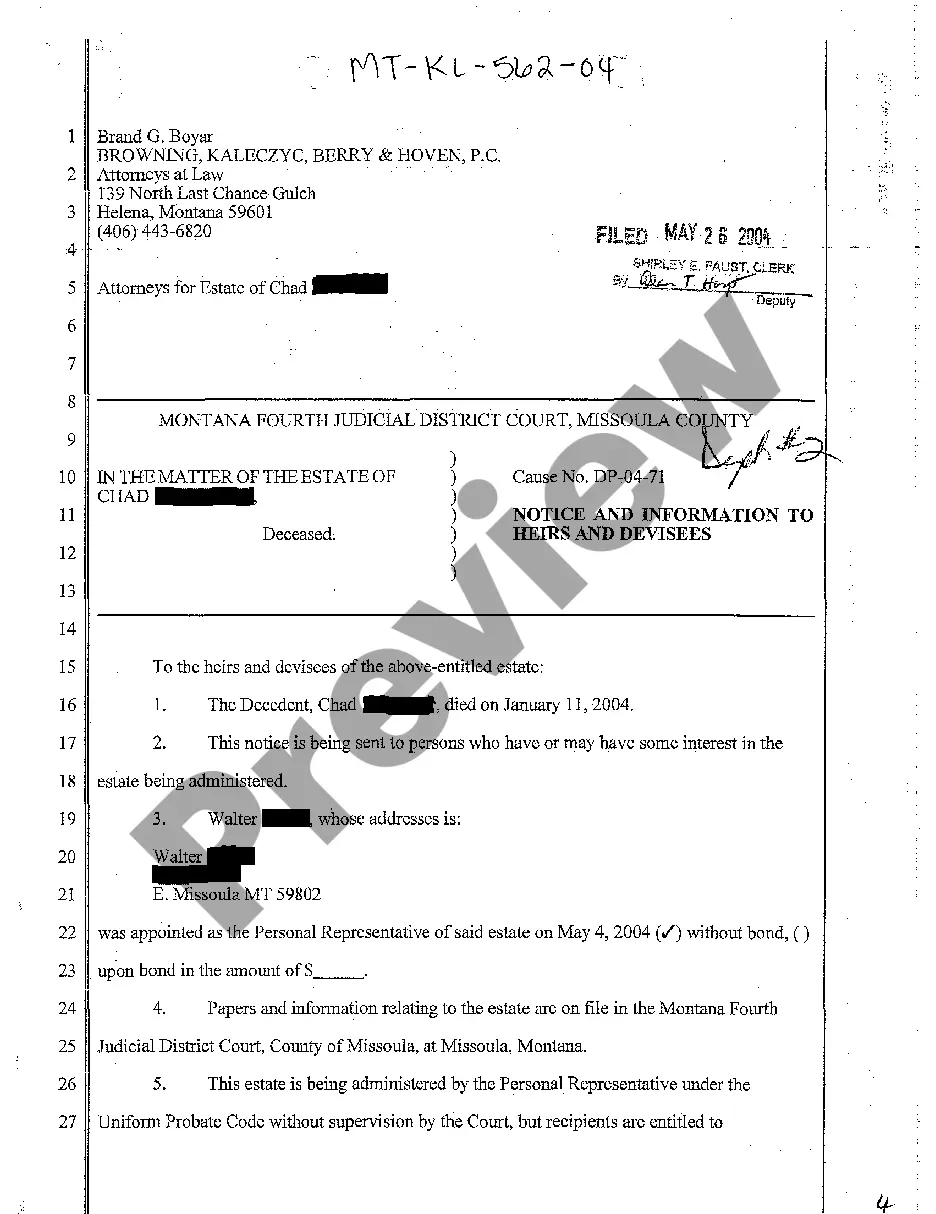

- When you’re sure the form fits your needs, just click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay via PayPal or visa or mastercard.

- Download the form in Word or PDF format.

Once you’ve downloaded your Montana Notice and Information to Heirs and Devisees, it is possible to fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

As an heir, you are entitled to a copy of the Will, whether you are named as a beneficiary or not. If there is a probate estate, then you should receive a copy of the Will. If you do not, you can always get it from the court. If there is no probate estate, then the Will is not going to do anything.

This law states that no matter what your will says, your spouse has a right to inherit one-third or one-half (depending on the state and sometimes depending on the length of the marriage) of your total estate. To exercise this right, your spouse has to petition the probate court to enforce the law.

Give the letter a personal touch and address each of your heirs and beneficiaries personally. Tell them any last wishes you may have or any hopes you have for their future. Write as clearly as possible. Use specific details and avoid using shorthand.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.

The right of inheritance is passing the titles, rights, debts, property, and obligations to another person on the death of an individual. Considering how priceless real estate assets are currently, legal heirs must safeguard the property/asset after the death of the person in whose name the property was registered.

Heirs are entitled to receive their inheritance.In legal terms, heirs are the next of kin and are the people who would normally benefit if the person died without leaving a will (died intestate.) The succession of intestate heirs is based on direct descendants, such as children or grandchildren.

An heir-at-law is anyone who's entitled to inherit from someone who dies without leaving a last will and testament or other estate plans. This status can be an important factor not only in settling an estate but in determining who might be entitled to challenge or contest a will when the deceased does leave one.

Mention the obvious and that you wish to change the current beneficiary to a new one. Provide accurate details of the new beneficiary and double check the spelling. Specify that if any documentation or details not included are needed that you may be contacted with contact information enclosed.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.