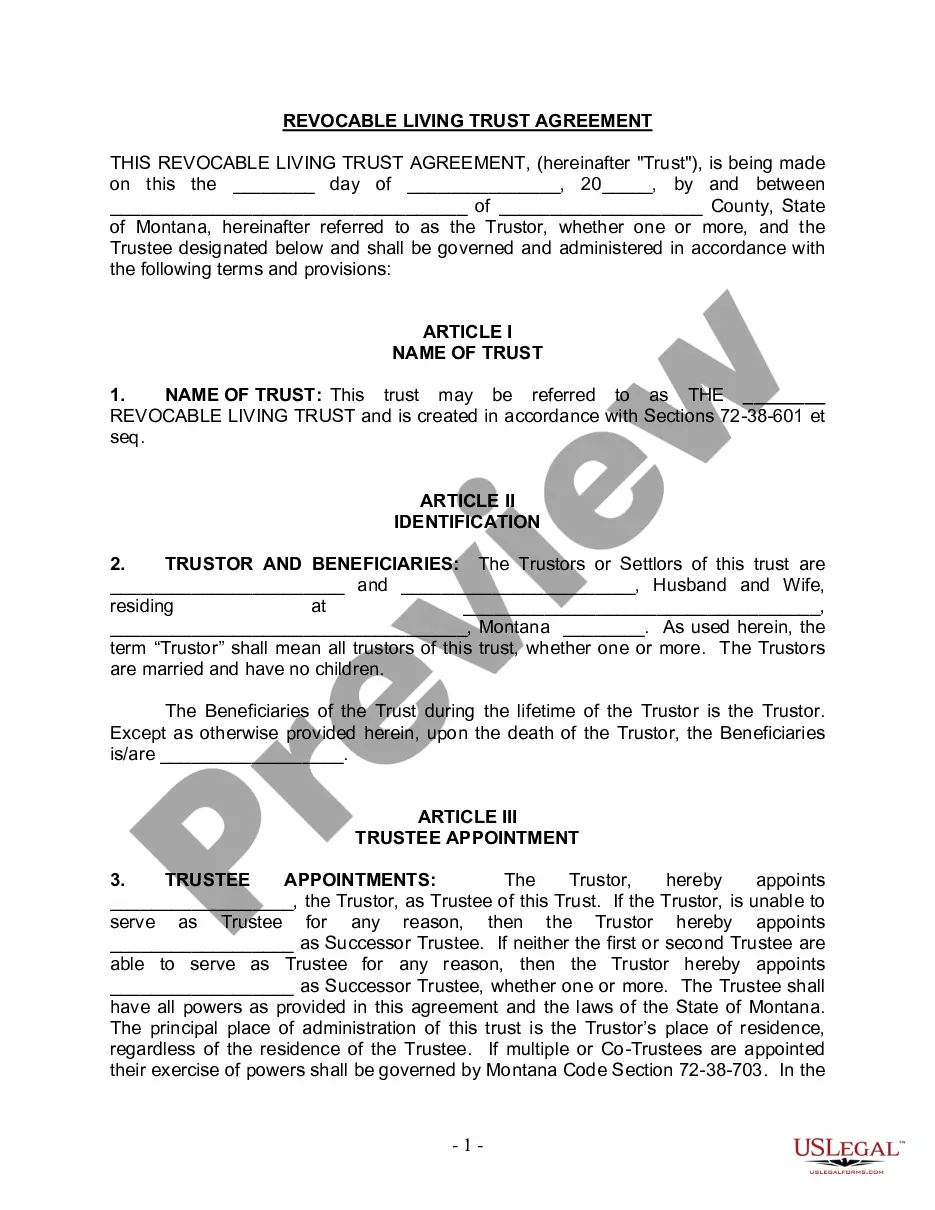

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Montana Living Trust for Husband and Wife with No Children

Description

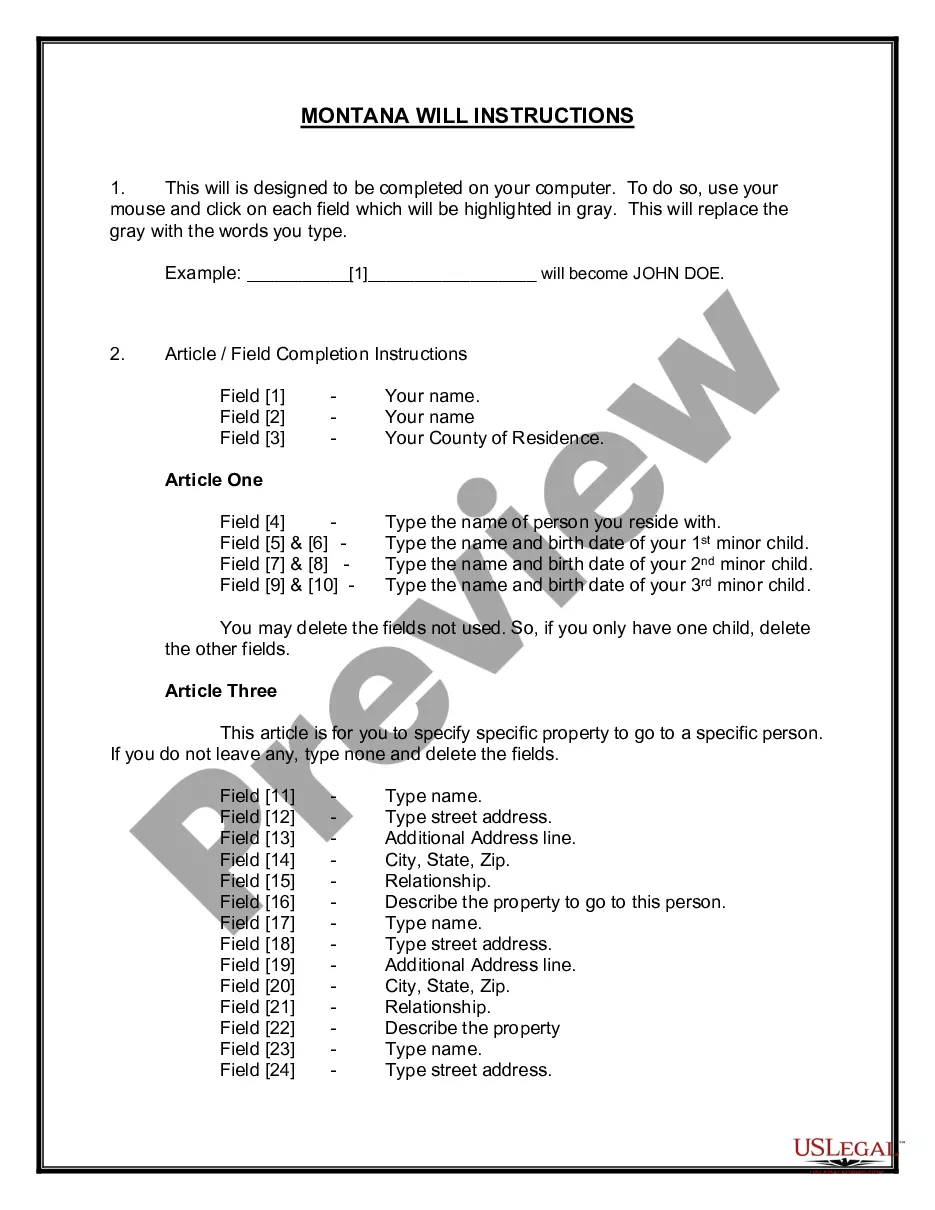

How to fill out Montana Living Trust For Husband And Wife With No Children?

Get a printable Montana Living Trust for Husband and Wife with No Children in just several mouse clicks in the most extensive library of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the Top supplier of affordable legal and tax forms for US citizens and residents online since 1997.

Users who already have a subscription, need to log in into their US Legal Forms account, download the Montana Living Trust for Husband and Wife with No Children see it saved in the My Forms tab. Users who never have a subscription are required to follow the tips below:

- Make sure your template meets your state’s requirements.

- If provided, read the form’s description to learn more.

- If readily available, preview the shape to discover more content.

- As soon as you’re confident the template is right for you, just click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay out via PayPal or visa or mastercard.

- Download the template in Word or PDF format.

Once you’ve downloaded your Montana Living Trust for Husband and Wife with No Children, you can fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

But to protect spouses from being disinherited, most of these states give a surviving spouse the right to claim one-third to one-half of the deceased spouse's estate, no matter what the will provides. (For other limitations on what a will can do, see What a Will Won't Do.)

In Montana, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

This law states that no matter what your will says, your spouse has a right to inherit one-third or one-half (depending on the state and sometimes depending on the length of the marriage) of your total estate. To exercise this right, your spouse has to petition the probate court to enforce the law.

Most married couples own most of their assets jointly. Assets owned jointly between husband and wife pass automatically to the survivor.This requires the will to be probated and an executor to be appointed in order to secure the assets. There are exceptions to the probate requirement for estates of $50,000 or less.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

If you are unmarried and die without a valid will and last testament in Montana, then your entire estate goes to any surviving children in equal shares, or grandchildren if you don't have any surviving children. If you die intestate unmarried and with no children, then by law, your parents inherit your entire estate.

The Spouse Is the Automatic Beneficiary for Married People A federal law, the Employee Retirement Income Security Act (ERISA), governs most pensions and retirement accounts.