A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Montana Guaranty Attachment to Lease for Guarantor or Cosigner

Description

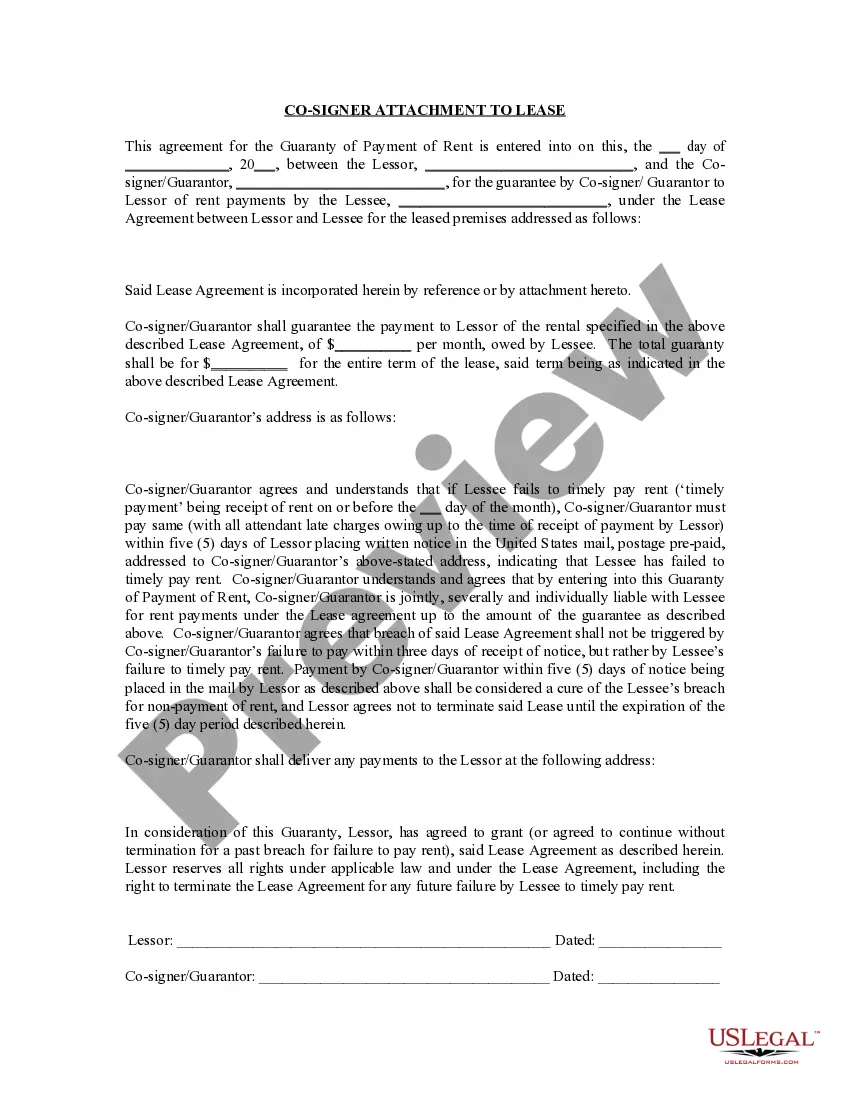

How to fill out Montana Guaranty Attachment To Lease For Guarantor Or Cosigner?

Get a printable Montana Guaranty Attachment to Lease for Guarantor or Cosigner in just several mouse clicks from the most comprehensive library of legal e-documents. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the Top supplier of reasonably priced legal and tax templates for US citizens and residents online since 1997.

Users who already have a subscription, must log in straight into their US Legal Forms account, down load the Montana Guaranty Attachment to Lease for Guarantor or Cosigner see it stored in the My Forms tab. Customers who do not have a subscription are required to follow the steps listed below:

- Ensure your template meets your state’s requirements.

- If available, read the form’s description to learn more.

- If accessible, preview the shape to find out more content.

- When you are sure the form is right for you, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

Once you’ve downloaded your Montana Guaranty Attachment to Lease for Guarantor or Cosigner, you are able to fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

A lease guarantee is an official agreement signed by the landlord, tenant, and in addition, a third party who meets the monetary requirements of the landlord. A lease guarantor serves as a financial intermediary and is responsible for the tenant's defaults, which protects the tenant from eviction.

It's very common for a guarantee to last as long as the tenancy lasts. So, if the tenant remains in the property for four years, you will continue to be responsible for any arrears or damages during that entire period. Most tenancies will run for a fixed term and will then continue on a month-by-month basis.

A guaranty of lease is a covenant by the guarantor to be responsible for the obligations of the tenant.In these examples, a selective landlord would not enter into the lease without the tenant offering a creditworthy guarantor.

Does being a guarantor affect my credit rating? Providing the borrower keeps up with their repayments your credit score won't be affected. However, should they fail to make their payments and the loan/mortgage falls into default, it will be added to your credit report.

This is a short agreement to bring in a guarantor to a residential tenancy agreement. The guarantor provides a promise to pay rent unpaid by one or more of the tenants and also for any loss or damage caused by the tenant.

One approach is as follows: a landlord and tenant agree that the guarantor is to be fully responsible for the performance of all tenant obligations and payment of all charges due under the lease for the entire term; if, however, the tenant does not default under any of the terms of the lease during some initial portion

Ask for an amendment to the lease after 12-24 months. Ask for the guarantee to expire after 12-24 months as long as you have paid rent payments on time. Try to renegotiate the guarantee terms.

Business owners are often required to give a personal guarantee to get a business loan or to lease commercial space for their business. Most business advisors say you should keep business and personal financial matters separate, and the loan is for the business, not for the individual.