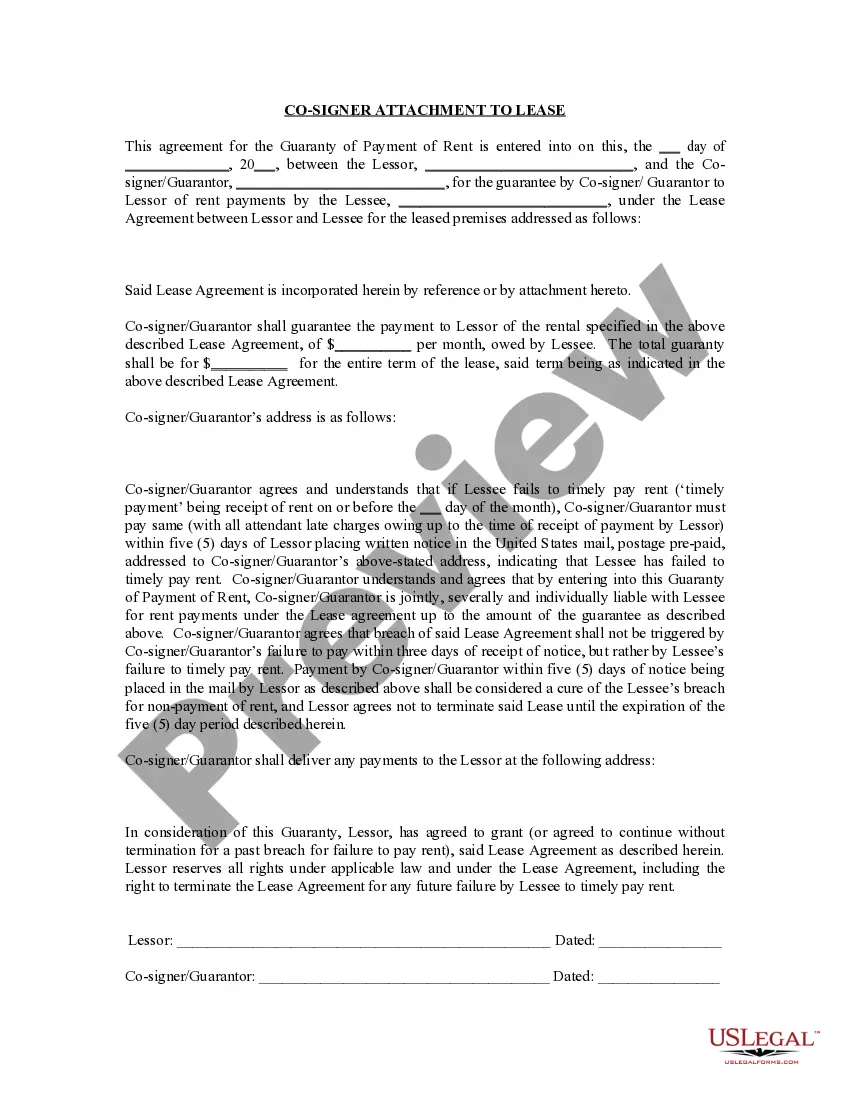

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

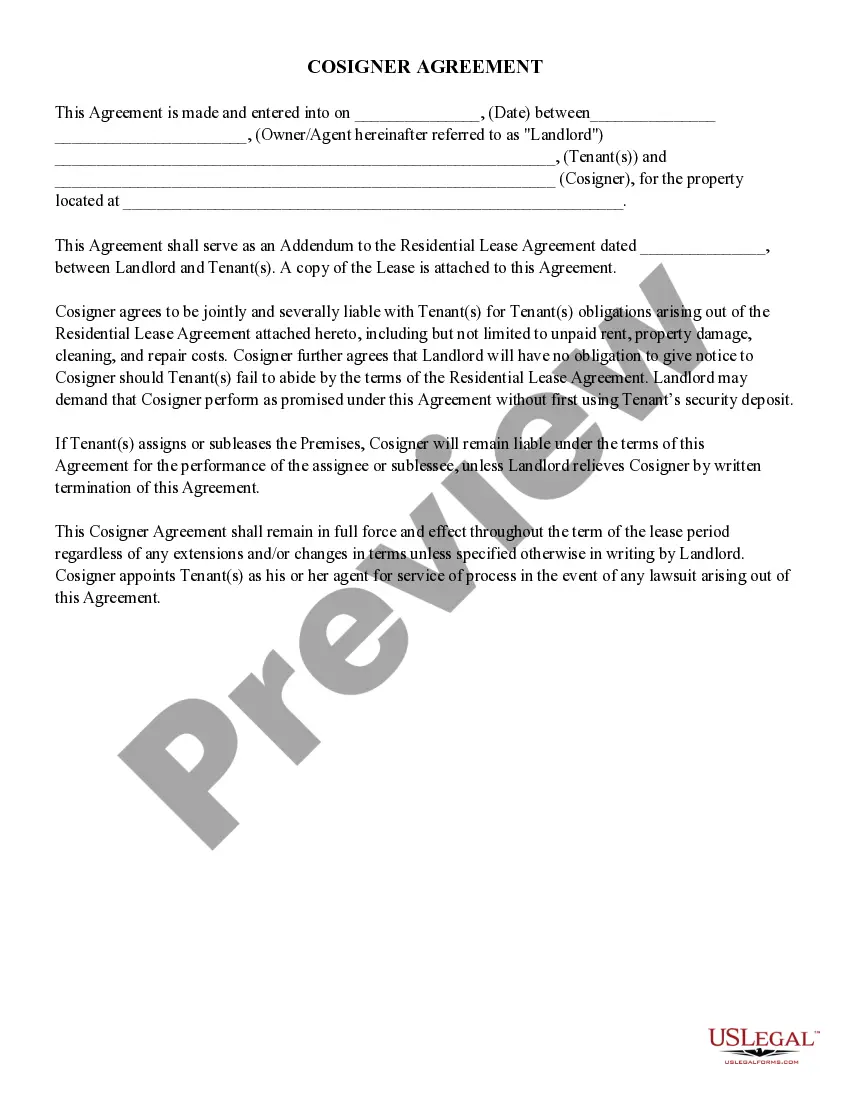

Montana Guaranty Attachment to Lease for Guarantor or Cosigner

Description

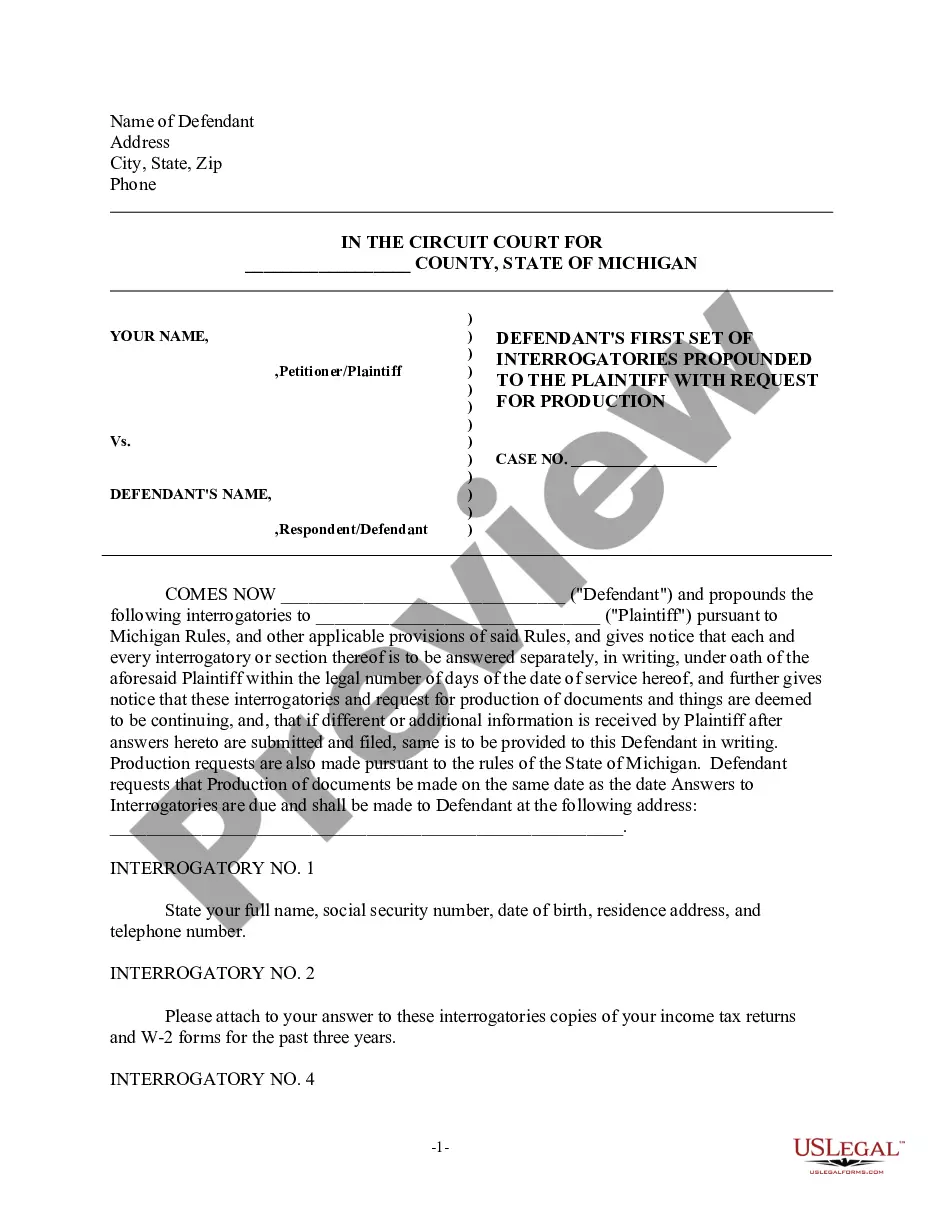

How to fill out Montana Guaranty Attachment To Lease For Guarantor Or Cosigner?

Obtain a printable Montana Guaranty Attachment to Lease for Guarantor or Cosigner with just a few clicks from the most extensive collection of legal e-documents.

Discover, download, and print expertly crafted and certified samples on the US Legal Forms website. US Legal Forms has been the leading provider of affordable legal and tax templates for US citizens and residents online since 1997.

After downloading your Montana Guaranty Attachment to Lease for Guarantor or Cosigner, you can fill it out in any online editor or print it out and complete it manually. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- Users with an existing subscription must Log In directly into their US Legal Forms account, download the Montana Guaranty Attachment to Lease for Guarantor or Cosigner, and find it stored in the My documents section.

- Individuals without a subscription must adhere to the steps outlined below.

- Confirm that your template complies with your state's regulations.

- If available, read the form’s description for additional information.

- If accessible, preview the form to learn more content.

- Once you are confident the form is suitable for you, click Buy Now.

- Create a personal account.

- Select a plan.

- Make a payment via PayPal or credit card.

- Download the template in Word or PDF format.

Form popularity

FAQ

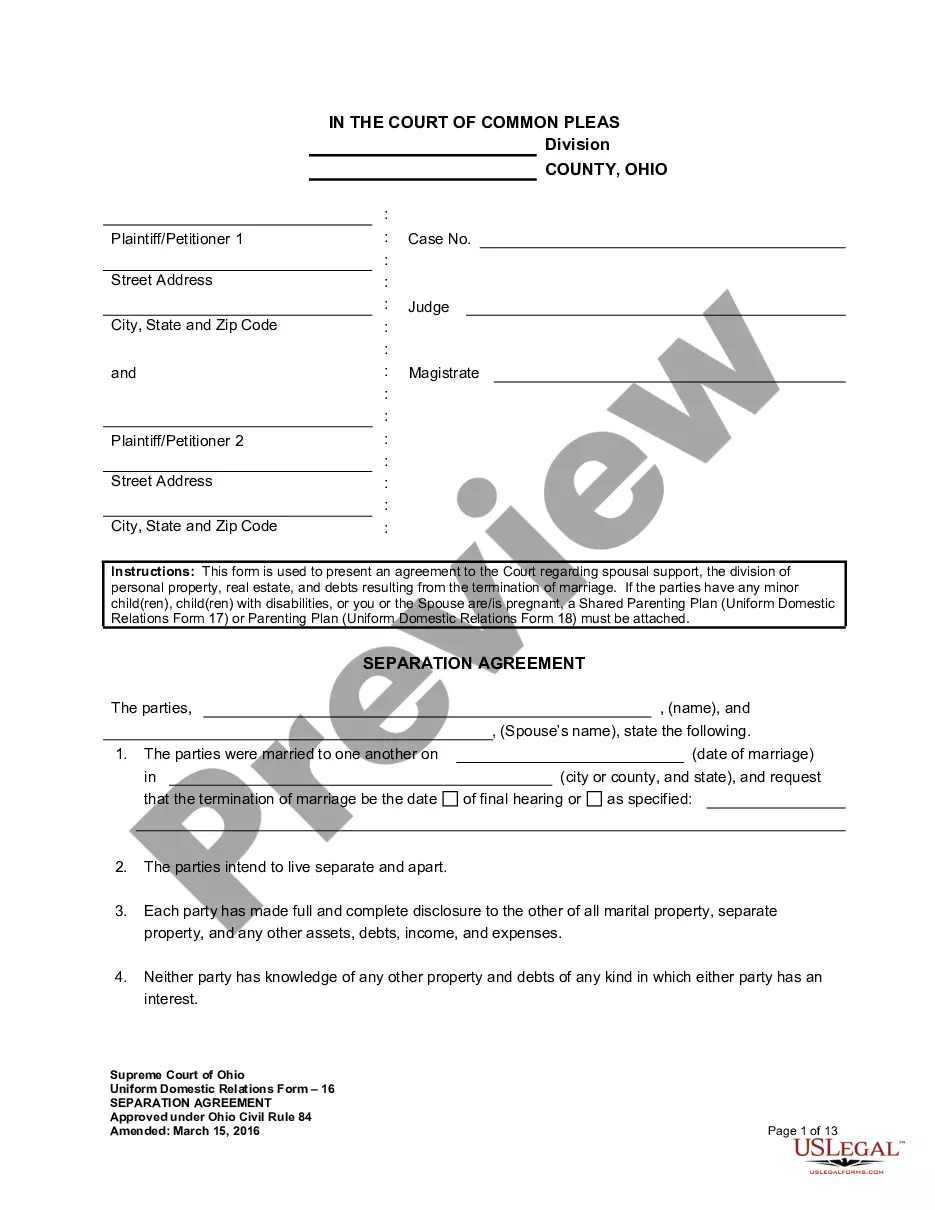

A lease guarantee is an official agreement signed by the landlord, tenant, and in addition, a third party who meets the monetary requirements of the landlord. A lease guarantor serves as a financial intermediary and is responsible for the tenant's defaults, which protects the tenant from eviction.

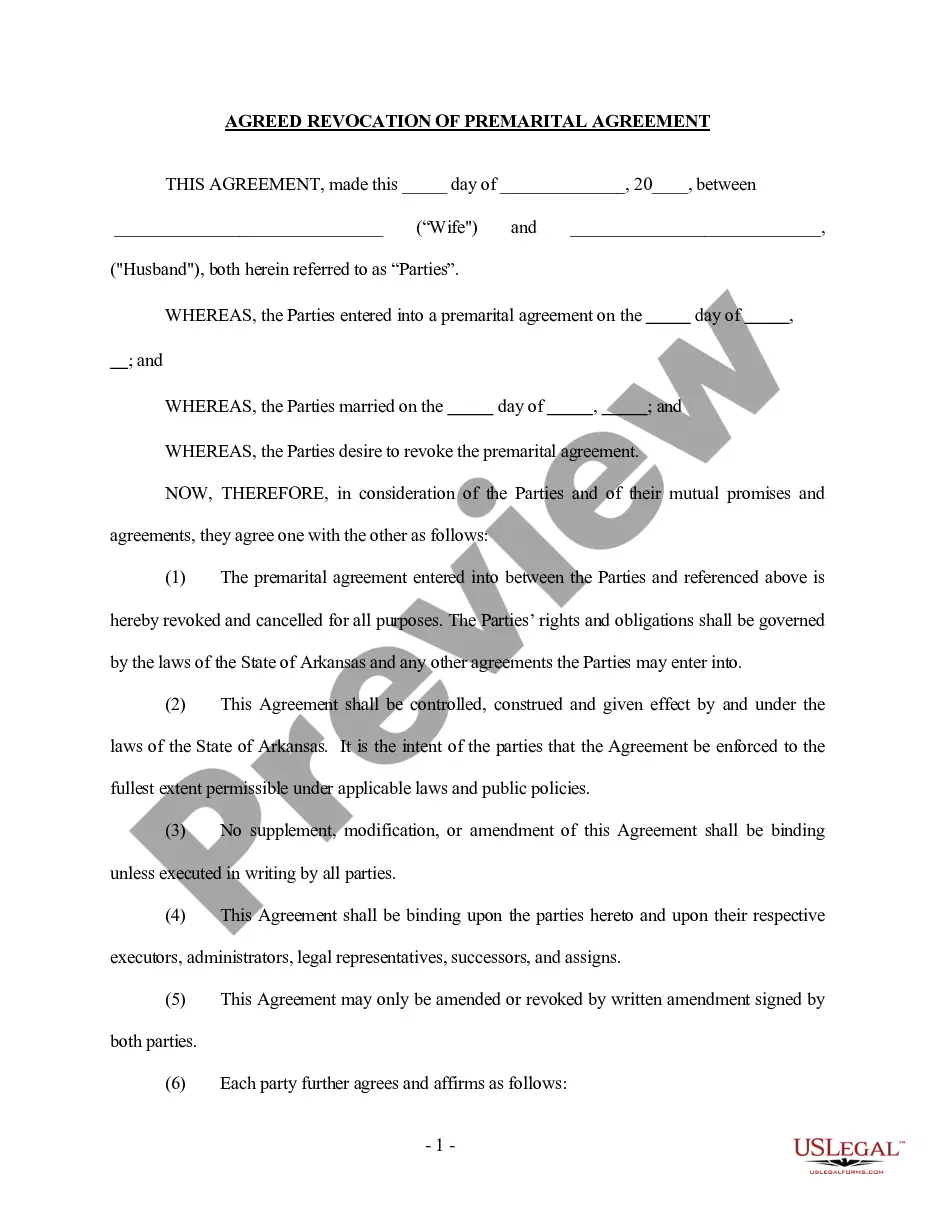

It's very common for a guarantee to last as long as the tenancy lasts. So, if the tenant remains in the property for four years, you will continue to be responsible for any arrears or damages during that entire period. Most tenancies will run for a fixed term and will then continue on a month-by-month basis.

A guaranty of lease is a covenant by the guarantor to be responsible for the obligations of the tenant.In these examples, a selective landlord would not enter into the lease without the tenant offering a creditworthy guarantor.

Does being a guarantor affect my credit rating? Providing the borrower keeps up with their repayments your credit score won't be affected. However, should they fail to make their payments and the loan/mortgage falls into default, it will be added to your credit report.

This is a short agreement to bring in a guarantor to a residential tenancy agreement. The guarantor provides a promise to pay rent unpaid by one or more of the tenants and also for any loss or damage caused by the tenant.

One approach is as follows: a landlord and tenant agree that the guarantor is to be fully responsible for the performance of all tenant obligations and payment of all charges due under the lease for the entire term; if, however, the tenant does not default under any of the terms of the lease during some initial portion

Ask for an amendment to the lease after 12-24 months. Ask for the guarantee to expire after 12-24 months as long as you have paid rent payments on time. Try to renegotiate the guarantee terms.

Business owners are often required to give a personal guarantee to get a business loan or to lease commercial space for their business. Most business advisors say you should keep business and personal financial matters separate, and the loan is for the business, not for the individual.