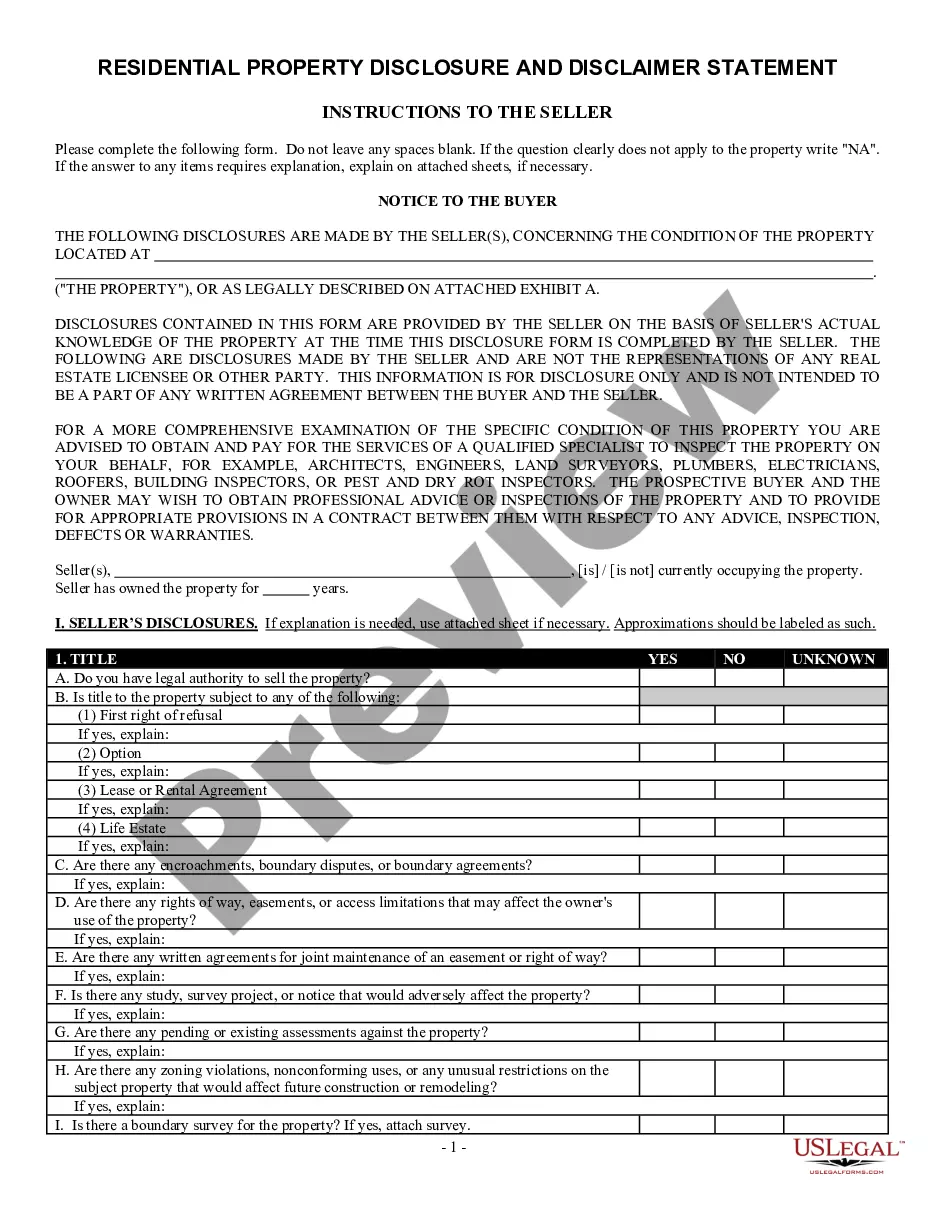

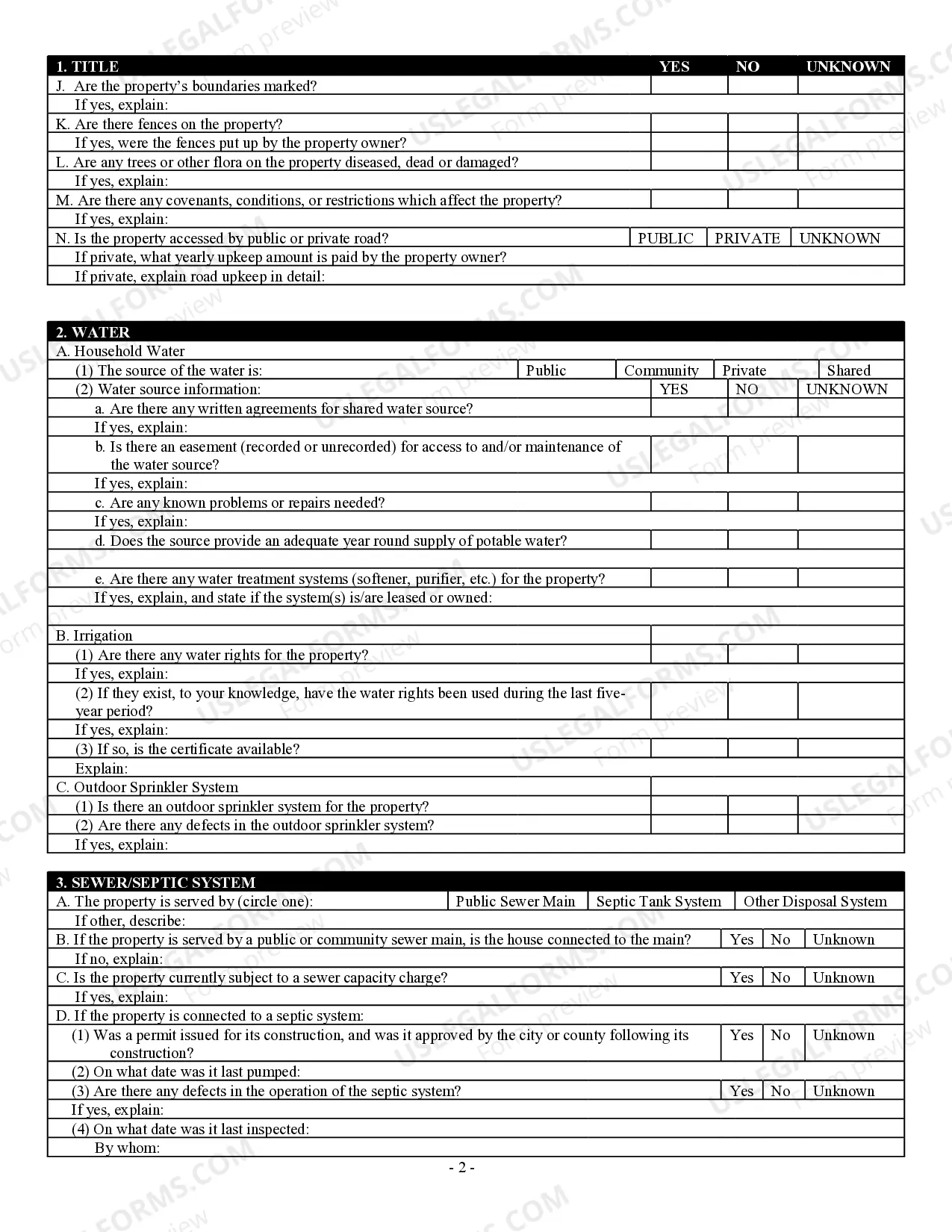

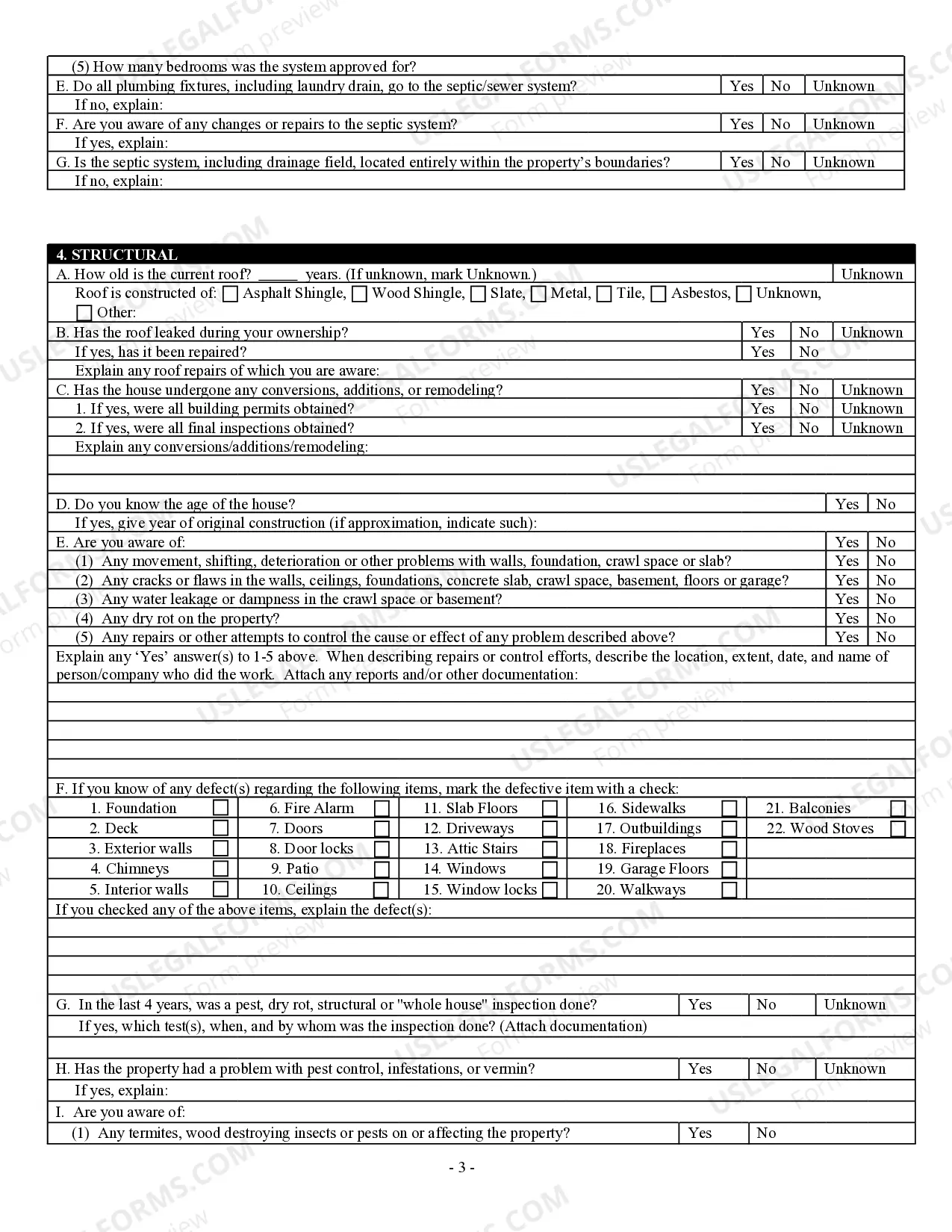

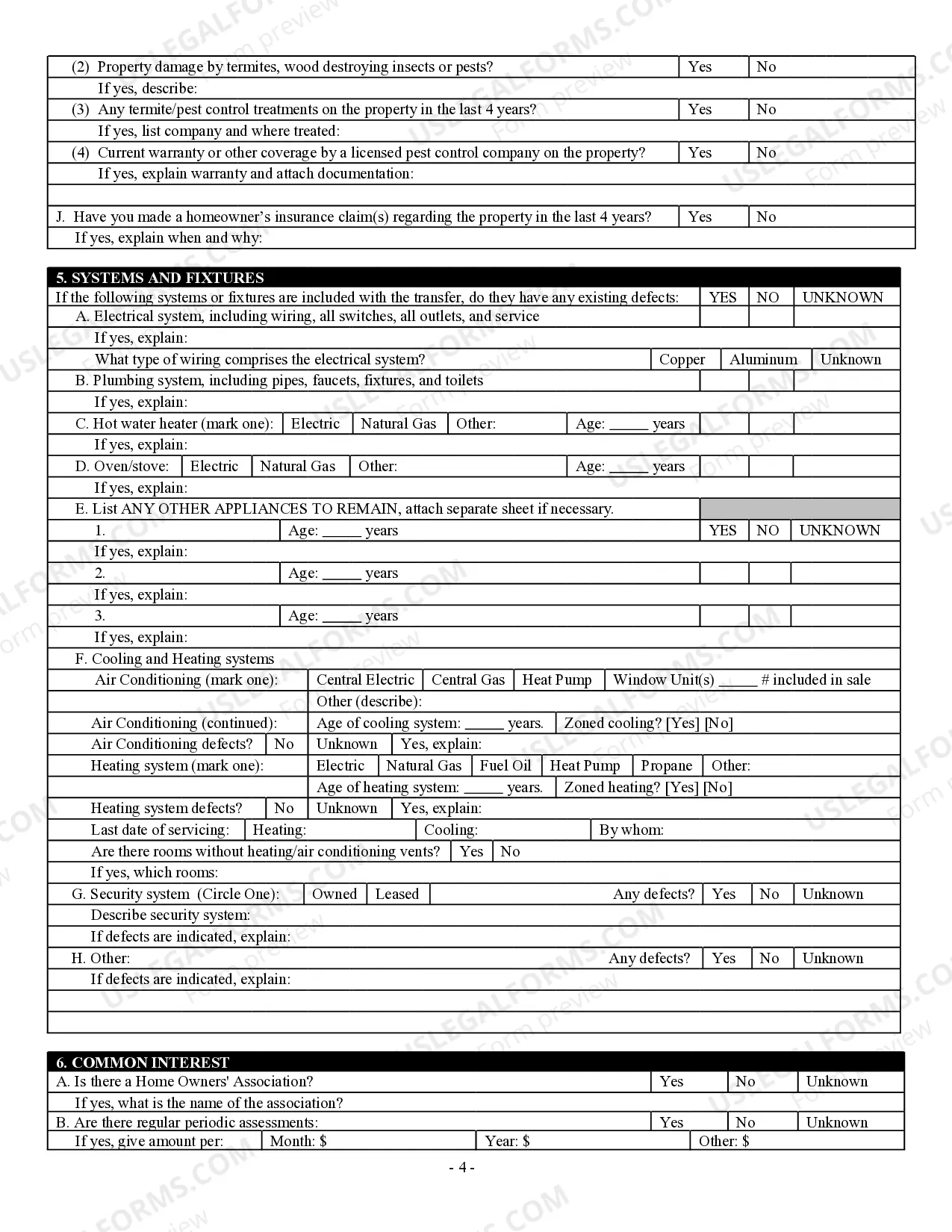

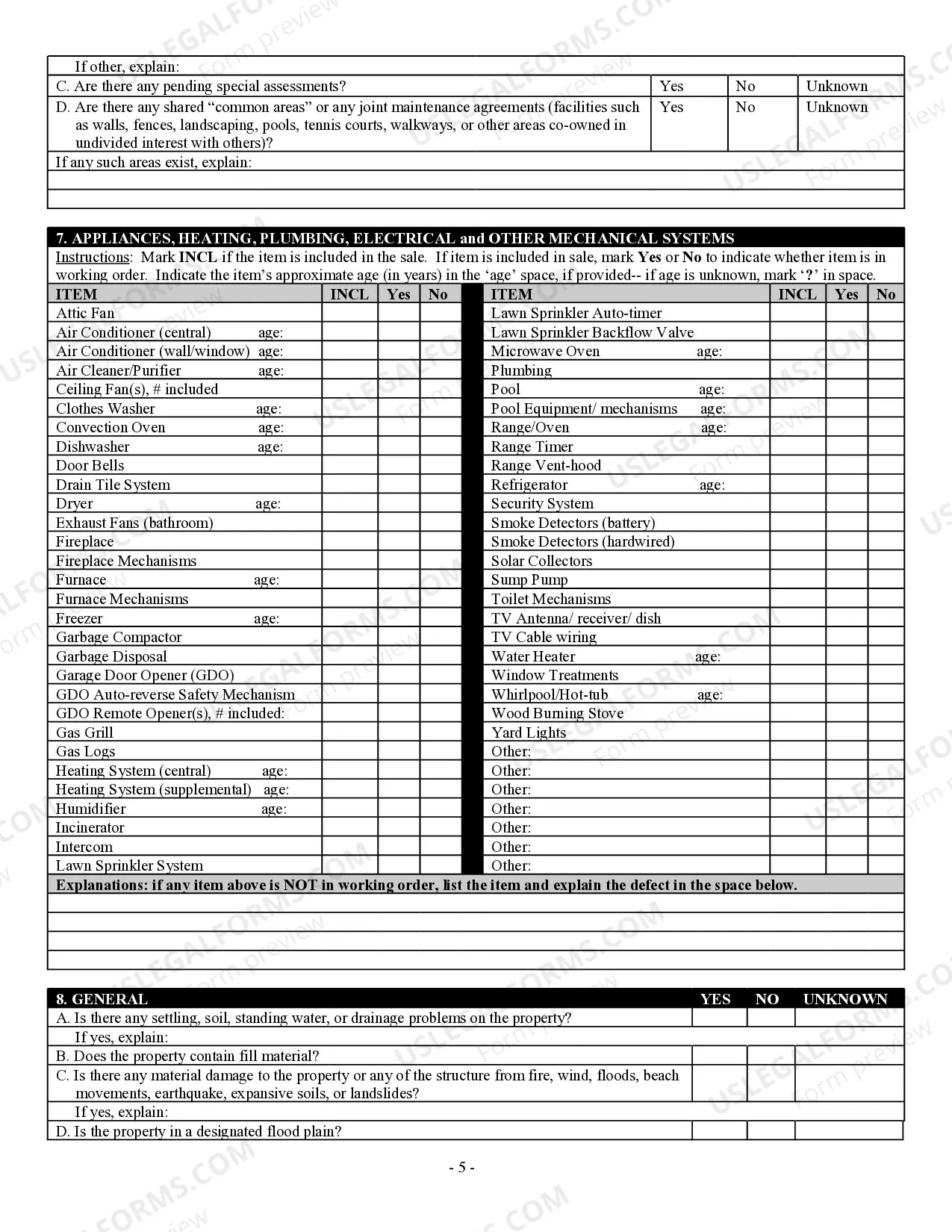

This form is a Seller's Disclosure Statement for use in a residential sales transaction in Montana. This disclosure statement concerns the condition of property and is completed by the Seller.

Montana Residential Real Estate Sales Disclosure Statement

Description

How to fill out Montana Residential Real Estate Sales Disclosure Statement?

Acquire a printable Montana Residential Real Estate Sales Disclosure Statement in just a few clicks from the most extensive collection of legal e-forms.

Locate, download, and print professionally created and certified samples on the US Legal Forms website.

After downloading your Montana Residential Real Estate Sales Disclosure Statement, you can fill it out in any online editor or print it out and complete it by hand. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- US Legal Forms has remained the premier supplier of affordably priced legal and tax templates for citizens and residents of the US online since 1997.

- Users who already possess a subscription must Log In directly to their US Legal Forms account, download the Montana Residential Real Estate Sales Disclosure Statement, and find it saved in the My documents section.

- Users who do not have a subscription need to follow the steps outlined below.

- Ensure your form complies with your state's regulations.

- If available, read the description of the form to learn more.

- If accessible, review the form to discover additional content.

- Once you’re certain the form meets your requirements, click on Buy Now.

- Create a personal account.

- Choose a plan.

- Pay using PayPal or credit card.

- Download the form in Word or PDF format.

Form popularity

FAQ

Whenever you sell real estate, you are obligated to follow local mandatory disclosure laws. This involves informing the buyer about specific hazards or problems affecting the property before the sale is completed.

But, there are 12 states that are still considered non-disclosure: Alaska, Idaho, Kansas, Louisiana, Mississippi, Missouri (some counties), Montana, New Mexico, North Dakota, Texas, Utah and Wyoming. In a non-disclosure state, transaction sale prices are not available to the public.

If a seller fails to disclose, or actively conceals, problems that affect the value of the property; they are violating the law, and may be subject to a lawsuit for recovery of damages based on claims of fraud and deceit, misrepresentation and/or breach of contract.

In general, you have an obligation to disclose potential problems and material defects that could affect the value of the property you're trying to sell. In addition, it is considered illegal in most states to deliberately conceal major defects on your property.

Under California law, all material facts that affect the value or desirability of the property must be disclosed to the buyer. There is no specific definition or rule on what is considered to be a material fact.

California's Especially Stringent Disclosure Requirements Sellers must fill out and give the buyers a disclosure form listing a broad range of defects, such as a leaky roof, deaths that occurred within three years on the property, neighborhood nuisances such as a dog that barks every night, and more.

In California there is no legal requirement that a real estate licensee, acting as a principal, must disclose his or her licensee status. It may be good business practice, but it isn't required.Bob Hunt is a director of the California Association of Realtors®.

But, there are 12 states that are still considered non-disclosure: Alaska, Idaho, Kansas, Louisiana, Mississippi, Missouri (some counties), Montana, New Mexico, North Dakota, Texas, Utah and Wyoming.The lack of property sales information in non-disclosure states can also lead to errors in property tax assessments.

If you live in a non-disclosure state, it means that sale prices in a real estate transaction are not disclosed or recorded as public record. If you want to know a sale price of a home, you'd have to ask the seller directly or work with a real estate professional who has access to the Multiple Listing Service (MLS).