This office lease clause is used to respond to various changes that might occur within the tenant's office building or shopping center.

Mississippi Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share

Description

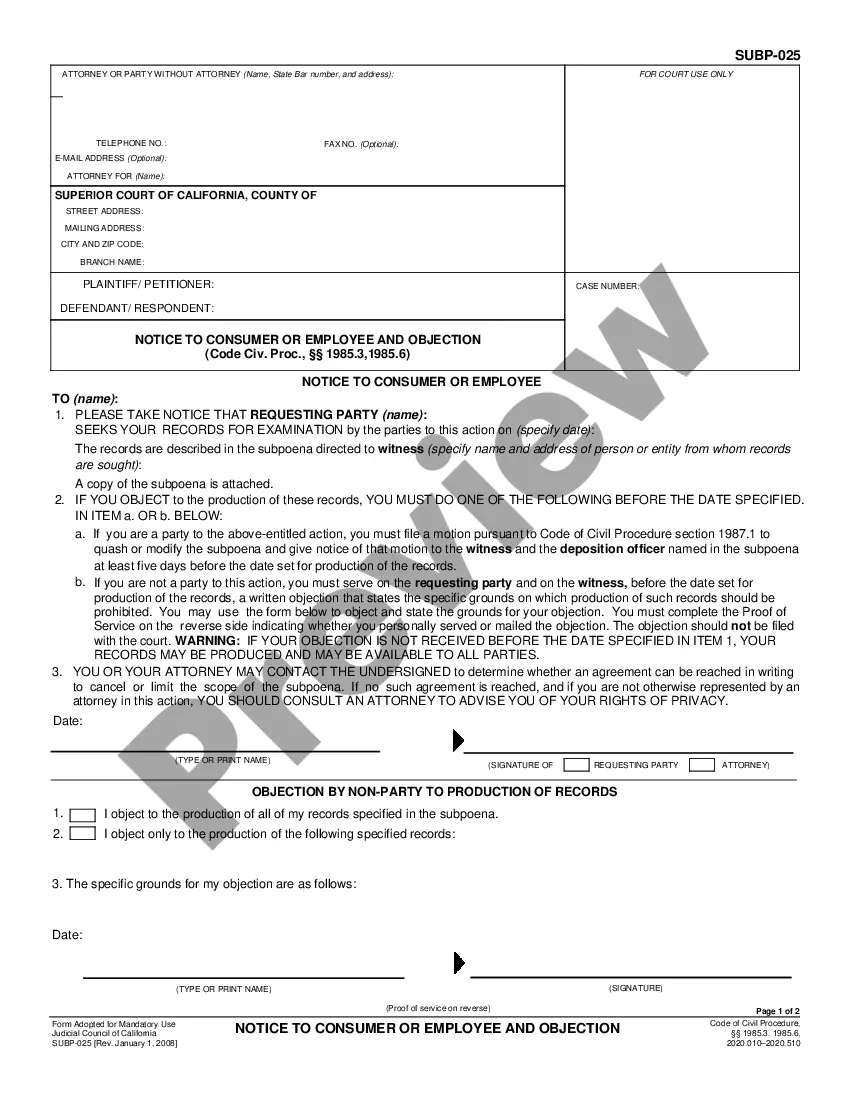

How to fill out Measurement Representations And Proportionate Share Adjustment Of Tenants Proportionate Tax Share?

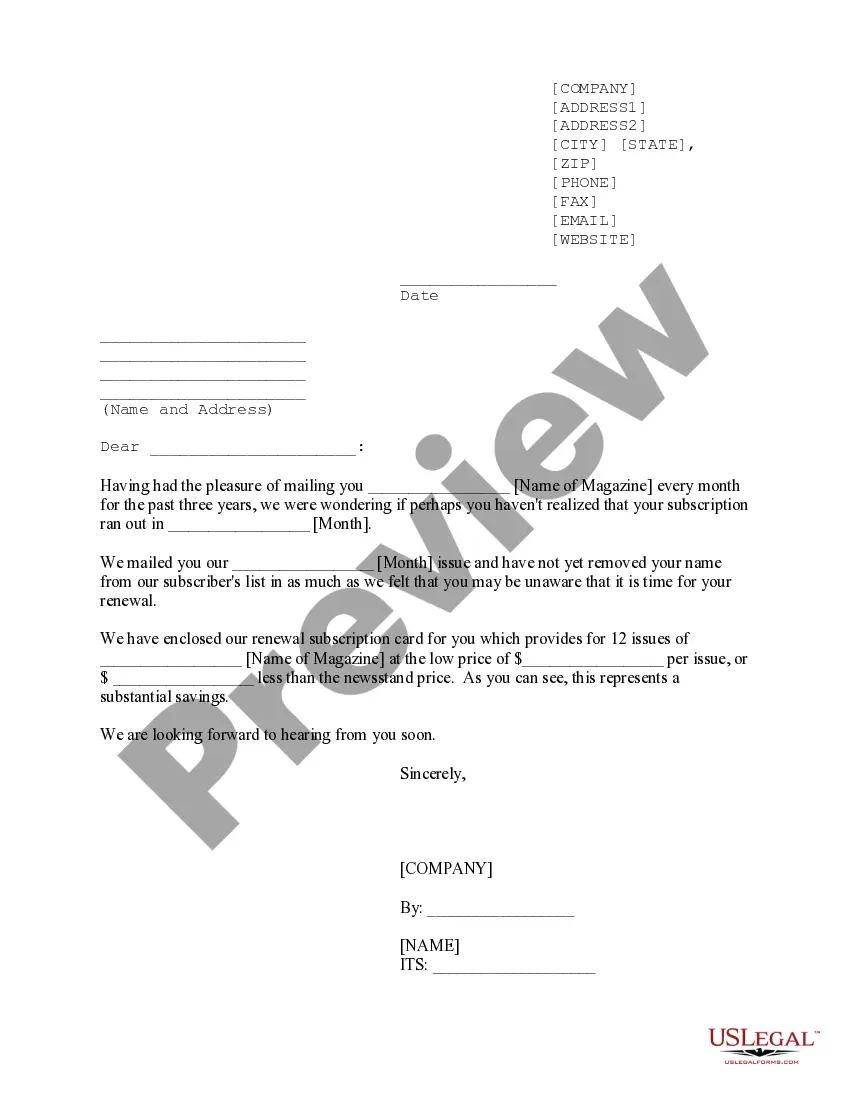

If you want to comprehensive, obtain, or printing lawful record web templates, use US Legal Forms, the largest collection of lawful kinds, which can be found on the web. Make use of the site`s easy and handy search to discover the files you require. Numerous web templates for enterprise and individual uses are sorted by types and claims, or search phrases. Use US Legal Forms to discover the Mississippi Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share within a handful of mouse clicks.

If you are presently a US Legal Forms customer, log in to your bank account and then click the Down load key to find the Mississippi Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share. You can even access kinds you earlier downloaded in the My Forms tab of your bank account.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have chosen the form to the proper metropolis/country.

- Step 2. Take advantage of the Preview choice to look over the form`s content material. Do not forget about to learn the explanation.

- Step 3. If you are not satisfied with the kind, use the Look for field on top of the screen to discover other models of your lawful kind design.

- Step 4. When you have identified the form you require, click the Buy now key. Choose the costs program you like and add your qualifications to register to have an bank account.

- Step 5. Method the financial transaction. You can use your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Choose the structure of your lawful kind and obtain it in your gadget.

- Step 7. Full, change and printing or indication the Mississippi Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share.

Every single lawful record design you buy is yours eternally. You possess acces to every kind you downloaded within your acccount. Click the My Forms section and select a kind to printing or obtain once again.

Compete and obtain, and printing the Mississippi Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share with US Legal Forms. There are thousands of specialist and condition-certain kinds you can utilize to your enterprise or individual requirements.

Form popularity

FAQ

The pro-rata share is the percentage of expenses shared by the tenant for the shopping center or office building. In most leases, the pro-rata share is calculated as a fraction of the tenant's demised square footage divided by the total square footage of the shopping center or the building.

In general, the tenant's proportionate share is determined by taking the building's rentable square footage and dividing it by the tenant's rentable square footage. Local industry customs usually provide the landlord with the guiding principles for: Measuring the building.

Tenant's Share may also be referred to as Tenant's Proportionate Share, Pro Rata Share or simply PRS. It represents the percentage of the Defined Area that is occupied by a particular tenant.

Tenant's Proportionate Share of Real Estate Taxes means a percentage factor, determined by dividing the net rentable square footage contained in the Premises by the net rentable square footage contained in the office and retail portions of the Building, or one and 58/100 percent (1.58%).

Proportionate Share of Operating Expenses means a fraction equal to the total Gross Rentable Area of the Premises divided by the total Gross Rentable Area of the Building.